Form Cg 20 2004-2026

What is the Form CG 20?

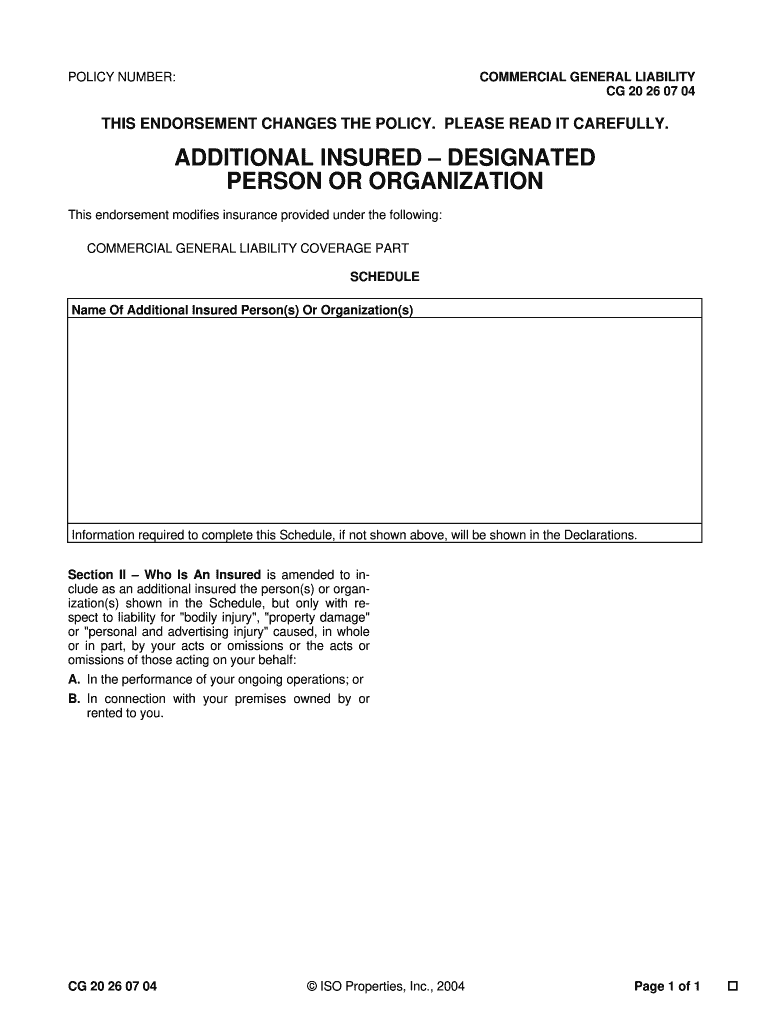

The Form CG 20 is a specific type of insurance endorsement used primarily in the United States. It serves to modify an existing insurance policy by adding or changing coverage details. This form is essential for policyholders who need to include additional insured parties, which is common in various business transactions and contractual agreements. Understanding the purpose and implications of the CG 20 endorsement can help businesses ensure they are adequately protected under their insurance policies.

Steps to Complete the Form CG 20

Completing the Form CG 20 involves several key steps to ensure accuracy and compliance with legal standards. First, gather all necessary information, including the names and addresses of the additional insured parties. Next, clearly specify the coverage being added or modified, ensuring it aligns with the existing policy terms. After filling out the required fields, review the form for any errors or omissions. Finally, submit the completed form to your insurance provider, either electronically or via traditional mail, depending on their submission guidelines.

Legal Use of the Form CG 20

The legal use of the Form CG 20 is governed by specific regulations and guidelines. It is crucial that the form is filled out correctly to ensure that the endorsement is valid and enforceable. The endorsement must be signed by an authorized representative of the insurance company to be legally binding. Additionally, the coverage provided by the CG 20 should comply with state laws and insurance regulations to avoid any potential disputes or claims issues in the future.

Key Elements of the Form CG 20

Understanding the key elements of the Form CG 20 is vital for effective use. The form typically includes sections for the policyholder's information, the additional insured's details, and the specific coverage being endorsed. It may also require the inclusion of the policy number and effective dates for the endorsement. Ensuring that all required information is complete and accurate will facilitate a smoother approval process with the insurance provider.

Examples of Using the Form CG 20

There are various scenarios in which the Form CG 20 is utilized. For instance, a contractor may need to add a property owner as an additional insured while working on a construction project. This endorsement protects the property owner from potential liabilities arising from the contractor's operations. Another example is in lease agreements, where landlords often require tenants to list them as additional insured parties on their liability policies to mitigate risks associated with property damage or injuries.

Form Submission Methods

Submitting the Form CG 20 can be done through various methods, depending on the insurance provider's preferences. Many companies now offer online submission options, allowing for quicker processing times. Alternatively, the form can be mailed directly to the insurer or delivered in person at their office. It is advisable to confirm the preferred submission method with the insurance provider to ensure timely and accurate processing of the endorsement.

Quick guide on how to complete form cg 20

Discover how to effortlessly navigate the Form Cg 20 completion with this simple guide

Online filing and signNowing of documents is becoming increasingly popular and the preferred choice for numerous users. It presents various advantages over outdated printed materials, including convenience, time savings, enhanced accuracy, and security.

With tools like airSlate SignNow, you can access, modify, signNow, enhance, and send your Form Cg 20 without being bogged down by unending printing and scanning tasks. Follow this brief guide to get started and complete your document.

Follow these steps to access and fill out Form Cg 20

- Initiate the process by clicking the Get Form button to open your document in our editor.

- Pay attention to the green label on the left indicating required fields to ensure you don’t miss any.

- Utilize our advanced features to annotate, edit, sign, protect, and enhance your document.

- Secure your file or convert it into a fillable form using the appropriate tab options.

- Review the document and look for errors or inconsistencies.

- Select DONE to complete your editing.

- Optionally rename your document or leave it as is.

- Choose the storage service where you’d like to save your document, send it via USPS, or click the Download Now button to get your form.

If Form Cg 20 isn’t what you were looking for, you can explore our extensive library of pre-imported templates that you can complete with ease. Visit our platform now!

Create this form in 5 minutes or less

FAQs

-

Can I fill out the CGL 2017 form twice?

As per notice, you can't. Here is screenshot of relevant notice-

-

How can I fill out the SSC CGL form again?

The SSC CGL 2018 online application form has been closed. But, don’t worry, you can apply for the SSC CGL 2019 exams. The Staff Selection Commission will release the SSC CGL 2019 notification on 31st Oct 2019. You can apply between 31st October till 28th Nov 2019. Check out- SSC CGL 2018-2019: Exam Date, Admit Card, Notification for further information.

-

How many posts can one apply for when filling out the SSC CGL 2017 application form?

Hello,While applying SSC cgl2017 form be careful to fill this PREFERENCE ORDER.YOU NEED TO FILL GROUP CODE NOT POST CODE.Let me explain you,•Group code means (A,B,C,D) categories•Post code means (A,C,E,H,%,@,$,..)For suppose if you don't want AAO post or don't have a degree in accounts you must skip Group code:A. Then Your order can be b,c,d or like this…After successfully qualifying tier 1,2,3 you are asked to give POST order according to group that you have given in application form.Hope it helps :-)

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

Create this form in 5 minutes!

How to create an eSignature for the form cg 20

How to generate an electronic signature for your Form Cg 20 in the online mode

How to make an eSignature for your Form Cg 20 in Google Chrome

How to create an electronic signature for signing the Form Cg 20 in Gmail

How to generate an electronic signature for the Form Cg 20 from your smart phone

How to make an eSignature for the Form Cg 20 on iOS devices

How to generate an electronic signature for the Form Cg 20 on Android OS

People also ask

-

What is the Form Cg 20 and how is it used?

The Form Cg 20 is a crucial document used by businesses to comply with specific regulatory requirements. With airSlate SignNow, you can easily prepare, send, and eSign the Form Cg 20, ensuring that your submissions are both efficient and legally binding. Our platform streamlines the process, making it simple for users to manage their documentation.

-

How much does it cost to use airSlate SignNow for Form Cg 20?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including those who need to manage the Form Cg 20. You can choose from various subscription options, which provide access to all features necessary for managing and eSigning documents, including the Form Cg 20, at a cost-effective rate.

-

What features does airSlate SignNow offer for managing Form Cg 20?

airSlate SignNow provides robust features for managing the Form Cg 20, including customizable templates, secure eSignature options, and easy document tracking. These features enhance your workflow, ensuring that you can prepare and send the Form Cg 20 quickly while maintaining compliance with all necessary regulations.

-

Can I integrate airSlate SignNow with other software to manage the Form Cg 20?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the Form Cg 20 alongside your existing tools. Whether you're using CRM systems, cloud storage solutions, or project management tools, our platform can easily connect, enhancing your overall efficiency.

-

How does eSigning the Form Cg 20 with airSlate SignNow work?

eSigning the Form Cg 20 with airSlate SignNow is straightforward. Once the document is prepared, you can invite signers via email, and they can sign electronically from anywhere, on any device. This process not only saves time but also ensures that your Form Cg 20 is executed securely and efficiently.

-

Is airSlate SignNow secure for handling the Form Cg 20?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your Form Cg 20 and other sensitive documents. Our platform complies with industry standards, ensuring that your data remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for the Form Cg 20?

Using airSlate SignNow for the Form Cg 20 offers numerous benefits, including reduced turnaround time, improved accuracy, and enhanced compliance. The intuitive interface allows users to easily navigate the document management process, making it an ideal solution for businesses looking to streamline their operations.

Get more for Form Cg 20

Find out other Form Cg 20

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure