Donations Form

What is the donations form?

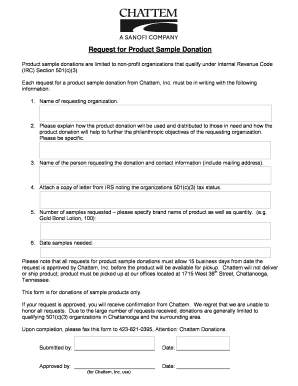

The donations form is a legal document used to record contributions made to charitable organizations. This form serves as a record for both the donor and the recipient organization, ensuring transparency and compliance with tax regulations. It typically includes details such as the donor's name, address, the amount donated, and the date of the contribution. By completing this form, donors can track their charitable giving for personal records and for tax deduction purposes.

How to complete the donations form

Completing the donations form is a straightforward process. First, gather all necessary information, including your personal details and the specifics of your donation. Next, accurately fill in the required fields on the form, ensuring that all information is correct and legible. After completing the form, review it for accuracy before submitting it. This step is crucial to avoid any issues with record-keeping or tax deductions.

Legal use of the donations form

The donations form must comply with relevant legal standards to be considered valid. In the United States, it is essential to follow guidelines set forth by the IRS, which include maintaining proper documentation for tax purposes. The form should be signed by both the donor and the recipient organization to establish a clear record of the transaction. Adhering to these legal requirements ensures that your donation is recognized and can be used for tax deductions.

IRS guidelines for donations

The IRS provides specific guidelines regarding charitable contributions, which are essential for donors to understand. Donations may be tax-deductible if made to qualified organizations. Donors should keep records of their contributions, including the donations form, to substantiate their claims during tax filing. Additionally, the IRS requires that donations exceeding a certain amount be substantiated with written acknowledgment from the charitable organization.

Steps to submit the donations form

Submitting the donations form can be done through various methods. Donors can choose to submit the form online, by mail, or in person, depending on the organization's preferences. If submitting online, ensure that you follow the organization's submission guidelines. For mail submissions, keep a copy of the form for your records. In-person submissions may require a signature from an authorized representative of the organization to confirm receipt.

Key elements of the donations form

Several key elements must be included in the donations form to ensure its effectiveness. These elements typically include:

- Donor's full name and contact information

- Recipient organization's name and address

- Amount donated

- Date of the donation

- Purpose of the donation, if applicable

- Signature of the donor and an authorized representative of the organization

Examples of using the donations form

There are various scenarios in which the donations form can be utilized. For instance, an individual may fill out the form after making a monetary donation to a local charity. Alternatively, a business may use the form to document a significant contribution to a nonprofit organization. In both cases, having a completed donations form ensures that the transaction is officially recognized and can be referenced for tax purposes.

Quick guide on how to complete donations

Effortlessly Prepare Donations on Any Device

Digital document management has become widely embraced by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Donations on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Alter and Electronically Sign Donations with Ease

- Find Donations and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select important portions of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Donations and maintain excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the donations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How does airSlate SignNow facilitate donations?

airSlate SignNow simplifies the process of managing donations by allowing organizations to create, send, and eSign donation agreements quickly. With our user-friendly platform, nonprofits can streamline their workflows, making it easier to collect essential donor information while ensuring compliance and security.

-

What pricing plans are available for using airSlate SignNow for donations?

airSlate SignNow offers various pricing plans designed to cater to different organizational needs, including nonprofits focused on donations. Our flexible plans ensure that you can choose a subscription that fits your budget while gaining access to essential features that enhance your donation process.

-

What features does airSlate SignNow provide that support donation collection?

Key features of airSlate SignNow that support donations include document templates specific to donation agreements, automated notification systems, and secure cloud storage. These features help organizations expedite the donation process and keep track of contributions without any hassle.

-

Can airSlate SignNow integrate with other tools for managing donations?

Yes, airSlate SignNow integrates seamlessly with a variety of third-party applications used for managing donations, such as payment processors and customer relationship management (CRM) systems. This integration ensures that organizations can automate workflows and manage donor information more effectively.

-

What benefits do nonprofits gain by using airSlate SignNow for donations?

Nonprofits benefit from using airSlate SignNow for donations through increased efficiency and streamlined document processes. By reducing paperwork and automating eSignature workflows, organizations can focus more on their mission and less on administrative tasks.

-

How secure is the donation process when using airSlate SignNow?

The security of the donation process is a top priority for airSlate SignNow. Our platform employs advanced encryption protocols and secure cloud storage to protect sensitive donor information, making it safe for organizations and their contributors.

-

Can airSlate SignNow help track the status of donations?

Absolutely! airSlate SignNow offers tracking features that allow organizations to monitor the status of donation agreements and eSigned documents in real-time. This transparency helps ensure that both the organization and its donors stay informed throughout the donation process.

Get more for Donations

Find out other Donations

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later