Cra Schedule 8 Form

What is the CRA Schedule 8?

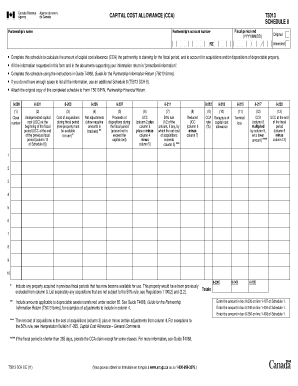

The CRA Schedule 8 is a tax form used by individuals and businesses in Canada to claim capital cost allowance (CCA) on depreciable property. This form allows taxpayers to deduct the cost of certain assets over time, thereby reducing taxable income. The Schedule 8 is essential for those who own depreciable property, such as buildings, machinery, and equipment, as it helps in calculating the amount of CCA that can be claimed in a given tax year.

Steps to Complete the CRA Schedule 8

Completing the CRA Schedule 8 involves several key steps:

- Gather necessary information about your depreciable assets, including purchase dates and costs.

- Determine the appropriate CCA class for each asset, as different classes have different rates.

- Calculate the CCA for each asset based on the formula provided by the CRA, considering the declining balance method.

- Fill out the Schedule 8 form, entering the calculated amounts for each asset class.

- Ensure all calculations are accurate and double-check your entries before submission.

Legal Use of the CRA Schedule 8

The CRA Schedule 8 is legally recognized for tax purposes, provided it is completed accurately and submitted in accordance with Canadian tax laws. It is important to maintain proper documentation for all assets claimed on the form, as the CRA may request proof of purchase and usage. Compliance with tax regulations ensures that the deductions claimed are valid and helps avoid potential penalties.

How to Obtain the CRA Schedule 8

The CRA Schedule 8 can be obtained directly from the Canada Revenue Agency's website or through tax preparation software that includes CRA forms. Taxpayers can also request a physical copy by contacting the CRA directly. It is advisable to ensure you have the most current version of the form to comply with any updates in tax regulations.

Examples of Using the CRA Schedule 8

Common scenarios for using the CRA Schedule 8 include:

- A business claiming CCA on a new piece of machinery purchased for production.

- An individual deducting the cost of a rental property renovation over several years.

- A corporation writing off the cost of office equipment as it depreciates over time.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the CRA Schedule 8. Generally, the form must be submitted along with the annual tax return by April 30 for individuals or June 15 for self-employed individuals. However, any taxes owed must be paid by April 30 to avoid interest charges. Keeping track of these dates ensures compliance and helps in effective tax planning.

Quick guide on how to complete cra schedule 8

Complete Cra Schedule 8 effortlessly on any device

Digital document management has become widely accepted among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely retain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Cra Schedule 8 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Cra Schedule 8 effortlessly

- Obtain Cra Schedule 8 and select Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Produce your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Modify and electronically sign Cra Schedule 8 to guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cra schedule 8

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a schedule 8 form and why is it important?

A schedule 8 form is a crucial document for managing controlled substances in Australia. It ensures compliance with legal regulations when prescribing or dispensing these medications. Understanding how to effectively use the schedule 8 form can benefit healthcare professionals and enhance patient safety.

-

How does airSlate SignNow simplify the process of filling out a schedule 8 form?

airSlate SignNow streamlines the completion of the schedule 8 form by providing easy-to-use templates and electronic signatures. This reduces the likelihood of errors and ensures that all necessary fields are completed accurately. Additionally, our platform saves time and enhances the efficiency of document management.

-

What are the pricing options for using airSlate SignNow for schedule 8 forms?

airSlate SignNow offers flexible pricing plans designed to meet different business needs, including affordable rates for processing schedule 8 forms. Our pricing scales with the number of users and features, allowing you to choose the appropriate plan without overspending. Check our website for the latest offers and subscription details.

-

Does airSlate SignNow provide any integrations with other software for schedule 8 forms?

Yes, airSlate SignNow seamlessly integrates with various software solutions, making it easier to manage your schedule 8 forms alongside your existing tools. Whether you use CRM platforms, billing software, or other document management systems, our integrations ensure a smooth workflow. Enhance your productivity by combining airSlate SignNow with your favorite apps.

-

Can I access my schedule 8 forms on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to access your schedule 8 forms on-the-go. Whether you’re in the office or out in the field, you can easily view, fill out, and sign your documents securely from your smartphone or tablet. This flexibility supports your workflow and improves efficiency.

-

What security measures does airSlate SignNow have for managing schedule 8 forms?

Security is a top priority at airSlate SignNow, especially for sensitive documents like schedule 8 forms. Our platform employs advanced encryption standards and complies with industry regulations to protect your data. You can trust that your documents are safe, secure, and accessible only to authorized users.

-

Can I customize the schedule 8 form template in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the schedule 8 form template according to their specific requirements. This flexibility enables you to add or modify fields, logos, and signatures to tailor documents to your organization's needs. Personalizing your forms enhances both branding and user experience.

Get more for Cra Schedule 8

Find out other Cra Schedule 8

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now