401k Beneficiary Form Template

What is the 401k Beneficiary Form Template

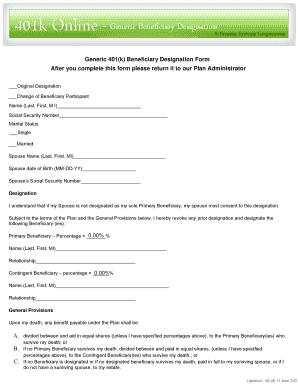

The 401k beneficiary form template is a crucial document that designates who will receive the benefits from a 401k retirement account upon the account holder's death. This form ensures that the account holder's wishes are clearly communicated and legally recognized. By filling out this template, individuals can specify primary and contingent beneficiaries, ensuring that their assets are distributed according to their preferences. It is essential for anyone with a 401k plan to complete this form to avoid complications for their heirs.

How to use the 401k Beneficiary Form Template

Using the 401k beneficiary form template involves several straightforward steps. First, download the template from a trusted source. Next, fill in your personal information, including your name, address, and account details. After that, designate your primary and contingent beneficiaries by providing their names, relationships, and contact information. It is also important to review the form for accuracy before signing. Once completed, the form should be submitted to your 401k plan administrator, who will process the changes accordingly.

Steps to complete the 401k Beneficiary Form Template

Completing the 401k beneficiary form template requires careful attention to detail. Follow these steps:

- Download the 401k beneficiary form template from a reliable source.

- Enter your personal information, including your full name, address, and Social Security number.

- Identify and list your primary beneficiaries, including their names, relationships to you, and contact information.

- If desired, include contingent beneficiaries who will receive benefits if the primary beneficiaries are unable to do so.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your choices.

- Submit the completed form to your 401k plan administrator.

Legal use of the 401k Beneficiary Form Template

The legal use of the 401k beneficiary form template is essential for ensuring that the document meets all necessary requirements. To be legally binding, the form must be signed by the account holder and submitted to the plan administrator. It is advisable to keep a copy of the completed form for personal records. Additionally, the form should comply with state laws regarding beneficiary designations, which may vary. Consulting with a legal professional can provide further assurance that the form is executed correctly.

Key elements of the 401k Beneficiary Form Template

Several key elements are essential in the 401k beneficiary form template. These include:

- Account Holder Information: Full name, address, and Social Security number.

- Beneficiary Designations: Names, relationships, and contact details of primary and contingent beneficiaries.

- Signature: The account holder's signature and date to validate the form.

- Plan Administrator Information: Details on where to submit the form.

Form Submission Methods

The 401k beneficiary form template can typically be submitted through various methods, depending on the plan administrator's preferences. Common submission methods include:

- Online Submission: Many plan administrators offer secure online portals for submitting forms electronically.

- Mail: The completed form can be printed and sent via postal mail to the plan administrator's designated address.

- In-Person: Some individuals may choose to deliver the form in person to ensure it is received and processed promptly.

Quick guide on how to complete 401k beneficiary form template

Prepare 401k Beneficiary Form Template effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage 401k Beneficiary Form Template on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign 401k Beneficiary Form Template without hassle

- Obtain 401k Beneficiary Form Template and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to share your form, whether via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 401k Beneficiary Form Template and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 401k beneficiary form template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 401k beneficiary form template?

A 401k beneficiary form template is a standardized document that allows individuals to designate beneficiaries for their 401k retirement accounts. Using this template ensures that your assets are distributed according to your wishes upon your passing. It simplifies the process of managing your beneficiaries and is crucial for estate planning.

-

How do I create a 401k beneficiary form template using airSlate SignNow?

Creating a 401k beneficiary form template with airSlate SignNow is straightforward. Simply access our user-friendly platform, select the 401k beneficiary form template option, and customize it as per your requirements. The intuitive interface allows for easy modifications and e-signing, making it a fast process.

-

Is there a cost associated with using the 401k beneficiary form template on airSlate SignNow?

Yes, there are subscription plans available for using airSlate SignNow, which includes access to the 401k beneficiary form template. Our pricing is designed to be cost-effective, catering to various business sizes and needs. You can choose from several plans to find the one that fits your budget and requirements.

-

What features are included with the 401k beneficiary form template from airSlate SignNow?

The 401k beneficiary form template from airSlate SignNow includes features such as customizable fields, eSignatures, and the ability to track document status. Additionally, it offers secure cloud storage for easy access and management of your documents. These features enhance compliance and streamline the signing process.

-

Can I integrate the 401k beneficiary form template with other software tools?

Yes, airSlate SignNow allows for easy integration with various software tools commonly used in business. This means you can seamlessly use the 401k beneficiary form template alongside your existing applications, improving efficiency and document management. Our API makes it simple to connect with other platforms.

-

How does using a 401k beneficiary form template benefit my business?

Utilizing a 401k beneficiary form template helps ensure that your retirement plans are organized and up-to-date. It minimizes the risk of errors in beneficiary designations, which can lead to complications in the future. This efficiency not only saves time but also enhances the professionalism of your business practices.

-

Is the 401k beneficiary form template secure?

Absolutely! The 401k beneficiary form template on airSlate SignNow is designed with strong security measures in place. Your documents are encrypted and securely stored, ensuring that sensitive information is protected. Compliance with data protection regulations further enhances the security of your signing process.

Get more for 401k Beneficiary Form Template

Find out other 401k Beneficiary Form Template

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement