6 75 Tax Us 64 Bonds Redemption Form

What is the 6 75 Tax Us 64 Bonds Redemption

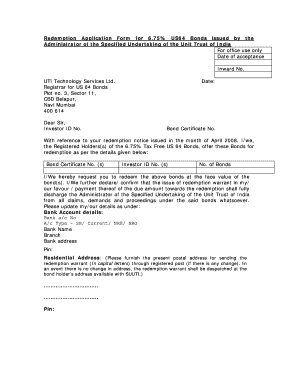

The 6 75 tax us 64 bonds redemption refers to the process by which holders of specific U.S. government bonds can redeem their bonds for cash or other forms of payment. These bonds are typically issued by the U.S. Treasury and may include various features that affect their redemption, such as interest rates and maturity dates. Understanding the details of this redemption process is crucial for bondholders to ensure they receive the correct amounts and comply with any necessary regulations.

How to use the 6 75 Tax Us 64 Bonds Redemption

Using the 6 75 tax us 64 bonds redemption involves a series of steps that bondholders must follow to successfully redeem their bonds. First, bondholders should gather all relevant documentation, including the bonds themselves and any identification required by the U.S. Treasury. Next, they need to determine the method of redemption, which can include online submission, mailing the bonds, or visiting a financial institution. Each method may have specific requirements and timelines that must be adhered to for a successful redemption.

Steps to complete the 6 75 Tax Us 64 Bonds Redemption

Completing the 6 75 tax us 64 bonds redemption involves several key steps:

- Gather necessary documents, including the bonds and identification.

- Choose a redemption method: online, by mail, or in-person.

- If redeeming online, access the appropriate U.S. Treasury website and follow the instructions.

- For mail-in redemptions, fill out any required forms and send them along with the bonds to the specified address.

- For in-person redemptions, visit a financial institution that handles U.S. Treasury bonds and present the necessary documents.

- Keep records of the redemption transaction for future reference and tax purposes.

Legal use of the 6 75 Tax Us 64 Bonds Redemption

The legal use of the 6 75 tax us 64 bonds redemption is governed by U.S. Treasury regulations and federal laws. Bondholders must ensure that they follow these regulations to avoid any legal issues. This includes providing accurate information during the redemption process and adhering to any tax obligations that may arise from the redemption. Misuse of the redemption process can lead to penalties or loss of funds, so it is essential to understand the legal framework surrounding these transactions.

Required Documents

To successfully redeem the 6 75 tax us 64 bonds, bondholders must prepare specific documents. These typically include:

- The original bonds being redeemed.

- Government-issued identification, such as a driver's license or passport.

- Any forms required by the U.S. Treasury for the redemption process.

- Proof of ownership, if applicable.

IRS Guidelines

IRS guidelines play a significant role in the redemption of the 6 75 tax us 64 bonds. Bondholders must be aware of how the redemption affects their tax situation, including any interest income that must be reported on their tax returns. The IRS provides specific instructions on how to report this income and any potential deductions that may apply. It is advisable for bondholders to consult IRS publications or a tax professional to ensure compliance with all tax regulations.

Quick guide on how to complete 6 75 tax us 64 bonds redemption

Complete 6 75 Tax Us 64 Bonds Redemption effortlessly on any device

Managing documents online has gained traction among companies and individuals. It serves as a suitable eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly and without delays. Handle 6 75 Tax Us 64 Bonds Redemption on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign 6 75 Tax Us 64 Bonds Redemption with ease

- Locate 6 75 Tax Us 64 Bonds Redemption and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 6 75 Tax Us 64 Bonds Redemption to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 6 75 tax us 64 bonds redemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for redeeming 6 75 tax us 64 bonds?

The process for redeeming 6 75 tax us 64 bonds involves submitting your bonds to the appropriate financial institution. You'll need to provide identification and fill out a redemption form to facilitate the transaction. Once processed, you will receive your funds directly.

-

What are the tax implications of redeeming 6 75 tax us 64 bonds?

When redeeming 6 75 tax us 64 bonds, it's essential to consider any potential tax implications. Interest earned on these bonds may be subject to federal tax, so we recommend consulting a tax advisor to understand your specific situation. Properly addressing these tax concerns can help you maximize your benefits.

-

Are there fees associated with redeeming 6 75 tax us 64 bonds?

Typically, there are no fees directly related to the redemption of 6 75 tax us 64 bonds if you go through the issuer. However, banks or institutions you use might charge minor processing fees. It's important to check with your financial institution for any applicable charges.

-

How can I track the status of my 6 75 tax us 64 bonds redemption?

You can usually track the status of your 6 75 tax us 64 bonds redemption through the financial institution where you submitted your bonds. They typically provide updates via email or through their online banking platform. Contacting customer service can also provide you with information on the status of your redemption.

-

What alternatives are available if I don't want to redeem my 6 75 tax us 64 bonds?

If you choose not to redeem your 6 75 tax us 64 bonds, you can hold them until maturity or transfer them to another holder. Depending on the bonds' terms, they might continue to accrue interest until they're sold or redeemed. This option allows your investment to grow as long as you meet the necessary conditions.

-

What benefits do 6 75 tax us 64 bonds offer?

6 75 tax us 64 bonds provide a reliable source of income through interest payments, making them an attractive investment. They are often considered low-risk due to their backing by the U.S. government. Additionally, redeeming these bonds can be a straightforward process, ensuring access to your funds when needed.

-

Can I redeem multiple 6 75 tax us 64 bonds at once?

Yes, you can redeem multiple 6 75 tax us 64 bonds at the same time. Simply consolidate your bonds and submit them together to your financial institution. This can streamline the process and may lead to faster transactions.

Get more for 6 75 Tax Us 64 Bonds Redemption

Find out other 6 75 Tax Us 64 Bonds Redemption

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document