Ifta 100 Mn on Pdfiller Form

What is the Ifta 100 Mn On Pdfiller

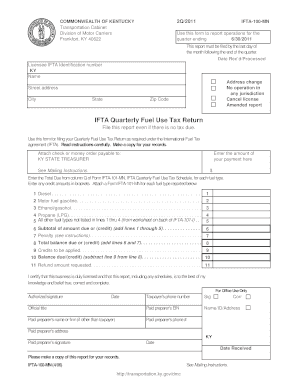

The IFTA 100 MN on Pdfiller is a specific form used for reporting fuel consumption and mileage by motor carriers operating in multiple jurisdictions within the United States and Canada. This form is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting of fuel taxes for interstate carriers. The IFTA 100 MN form allows carriers to report their fuel usage and calculate the taxes owed to each jurisdiction based on their travel. It is essential for compliance with state regulations and ensures that fuel taxes are distributed fairly among the states where the fuel was consumed.

Steps to complete the Ifta 100 Mn On Pdfiller

Completing the IFTA 100 MN on Pdfiller involves several key steps that ensure accurate reporting and compliance. First, gather all necessary data, including total miles traveled in each jurisdiction and total gallons of fuel purchased. Next, access the form on Pdfiller, where you can fill it out electronically. Input the gathered data into the appropriate fields, ensuring accuracy to avoid penalties. After completing the form, review all entries for correctness. Once verified, you can eSign the document using a trusted platform, ensuring its legal validity. Finally, submit the form according to your state’s submission guidelines, whether online or via mail.

Legal use of the Ifta 100 Mn On Pdfiller

The legal use of the IFTA 100 MN on Pdfiller is governed by regulations set forth under the International Fuel Tax Agreement. To be considered legally binding, the form must be completed accurately and submitted within the designated deadlines. Using an electronic signature through a compliant platform like airSlate SignNow ensures that the form meets legal standards established by the ESIGN Act and UETA. This compliance is crucial for the form to be accepted by state authorities and for the carrier to avoid any legal issues related to fuel tax reporting.

Key elements of the Ifta 100 Mn On Pdfiller

Several key elements are essential when completing the IFTA 100 MN on Pdfiller. These include:

- Total miles traveled: This includes all miles driven in each jurisdiction.

- Total gallons of fuel purchased: Accurate fuel purchase records are critical for tax calculations.

- Tax rates: Each jurisdiction has different fuel tax rates that must be applied to the gallons purchased.

- Carrier information: This includes the name, address, and IFTA account number of the carrier.

- Signature: An electronic signature is required to validate the form upon completion.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 100 MN on Pdfiller are typically set quarterly. Carriers must submit their reports by the last day of the month following the end of each quarter. Important dates include:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31

It is crucial for carriers to adhere to these deadlines to avoid penalties and maintain compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The IFTA 100 MN on Pdfiller can be submitted through various methods, ensuring flexibility for carriers. Common submission methods include:

- Online: Many states allow electronic submission through their official websites or authorized platforms.

- Mail: Carriers can print the completed form and send it via postal service to the appropriate state agency.

- In-Person: Some jurisdictions may accept in-person submissions at designated offices.

Choosing the right submission method can streamline the filing process and help ensure timely compliance.

Quick guide on how to complete kentucky quarterly tax form

Complete kentucky quarterly tax form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to generate, modify, and electronically sign your documents swiftly without delays. Manage ifta 100 mn on pdfiller on any gadget using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign kentucky quarterly tax form effortlessly

- Find nys ifta 100 mn on pdfiller and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal confidential information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from your preferred device. Edit and eSign ifta 100 mn on pdfiller to ensure effective communication at any stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta 100 mn on pdfiller

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask nys ifta 100 mn on pdfiller

-

What is IFTA 100 MN on PDFiller?

IFTA 100 MN on PDFiller refers to the International Fuel Tax Agreement form that allows Minnesota-based carriers to report fuel use and distance traveled. Using airSlate SignNow, businesses can easily fill out and electronically sign this form, streamlining the reporting process. This makes compliance simpler and more efficient for your trucking operations.

-

How does airSlate SignNow help with IFTA 100 MN on PDFiller?

AirSlate SignNow offers a user-friendly interface that enables users to quickly fill out the IFTA 100 MN on PDFiller form. The platform allows for easy editing, signing, and saving of documents, helping businesses stay organized and compliant with fuel tax regulations. Its cloud-based features ensure you can access your forms anytime, anywhere.

-

Is there a cost associated with using airSlate SignNow for IFTA 100 MN on PDFiller?

Yes, airSlate SignNow provides various pricing plans to suit different business needs, including options for occasional users and larger enterprises. By leveraging this platform, you can signNowly reduce costs related to paper and postage while ensuring your IFTA 100 MN on PDFiller documents are easily accessible and securely stored.

-

Can I integrate other software with airSlate SignNow for handling IFTA 100 MN on PDFiller?

Absolutely! AirSlate SignNow offers various integrations with popular business applications such as CRM systems, cloud storage, and accounting software. This allows for a seamless workflow when managing the IFTA 100 MN on PDFiller form, enhancing efficiency and minimizing manual data entry.

-

What are the benefits of using airSlate SignNow for IFTA 100 MN on PDFiller?

The primary benefits include an easy-to-use interface, electronic signature capabilities, and secure storage for all your documents. With airSlate SignNow, you can simplify the process of submitting the IFTA 100 MN on PDFiller form, which saves you time and reduces the risk of errors in your fuel tax reporting.

-

How secure is airSlate SignNow for my IFTA 100 MN on PDFiller documents?

AirSlate SignNow prioritizes security, employing encryption and authentication protocols to protect your documents. When you use airSlate SignNow for IFTA 100 MN on PDFiller, you can have peace of mind knowing that your sensitive information is safe and compliant with industry standards.

-

Can multiple users collaborate on the IFTA 100 MN on PDFiller using airSlate SignNow?

Yes! AirSlate SignNow allows multiple users to collaborate on the IFTA 100 MN on PDFiller form simultaneously. This feature is particularly useful for teams, as it enables efficient workflows and ensures all relevant parties can contribute to and review the document in real-time.

Get more for ifta 100 mn on pdfiller

Find out other kentucky quarterly tax form

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now