Vantagen Fsa Form

What is the Vantagen FSA

The Vantagen Flexible Spending Account (FSA) is a financial tool that allows employees to set aside pre-tax dollars for eligible medical expenses. This account is designed to help individuals manage healthcare costs by reducing their taxable income. Contributions to the Vantagen FSA can be used for a variety of expenses, including copayments, deductibles, and certain over-the-counter medications. Understanding the specifics of the Vantagen FSA can empower employees to make informed decisions regarding their healthcare spending.

How to Use the Vantagen FSA

Using the Vantagen FSA involves several straightforward steps. First, employees need to enroll in the program through their employer during the open enrollment period. Once enrolled, they can contribute a portion of their paycheck to the account. To access funds, employees can submit claims for eligible expenses. This can often be done through an online portal or mobile app, where users can upload receipts and track their spending. It is essential to keep records of all transactions to ensure compliance and facilitate reimbursements.

Steps to Complete the Vantagen FSA

Completing the Vantagen FSA involves a few key steps:

- Enroll in the Vantagen FSA during the designated enrollment period.

- Determine the amount to contribute based on anticipated medical expenses.

- Submit claims for eligible expenses through the online portal or mobile app.

- Provide necessary documentation, such as receipts, to validate claims.

- Monitor account balances and ensure funds are used within the plan year.

Legal Use of the Vantagen FSA

The legal use of the Vantagen FSA is governed by IRS regulations. To maintain compliance, funds must be used for qualified medical expenses as defined by the IRS. This includes expenses such as medical, dental, and vision care. Misuse of funds can lead to penalties, including taxes on non-qualified withdrawals. It is important for account holders to be aware of the rules surrounding eligible expenses to avoid any legal complications.

Eligibility Criteria

To be eligible for the Vantagen FSA, employees typically must be enrolled in a qualifying health plan offered by their employer. Eligibility may also depend on factors such as employment status and participation in other health-related programs. Employers may set specific guidelines regarding who can participate, so it is advisable for employees to check with their HR department for detailed eligibility requirements.

Required Documents

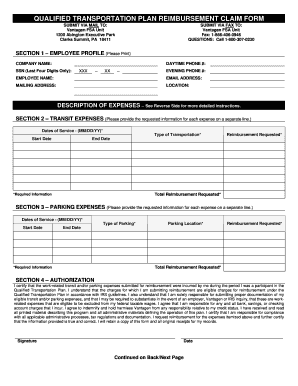

When submitting claims for reimbursement from the Vantagen FSA, employees must provide certain documentation. Required documents generally include:

- Receipts for eligible medical expenses, clearly showing the date and amount.

- Explanation of Benefits (EOB) statements from insurance providers, if applicable.

- Any additional forms required by the employer's FSA plan.

Having these documents ready can streamline the claims process and ensure timely reimbursements.

Filing Deadlines / Important Dates

Filing deadlines for the Vantagen FSA are crucial for ensuring that funds are used appropriately. Typically, employees must submit claims for eligible expenses by a specified date, often at the end of the plan year. Some plans may offer a grace period or allow for a carryover of funds into the next year. It is important to review the specific deadlines set by the employer to avoid losing any contributions.

Quick guide on how to complete vantagen fsa

Effortlessly prepare Vantagen Fsa on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Vantagen Fsa on any platform with the airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to edit and eSign Vantagen Fsa with ease

- Find Vantagen Fsa and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form navigation, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Vantagen Fsa while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vantagen fsa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Vantagen FSA and how does it work?

Vantagen FSA is a flexible spending account solution designed to help employees manage their healthcare expenditures. It allows users to set aside pre-tax dollars for eligible medical expenses, ultimately saving money on their taxes. With Vantagen FSA, managing these funds is straightforward, providing tools to track spending and submission of claims efficiently.

-

What are the key features of Vantagen FSA?

Vantagen FSA offers a variety of features including a simple online claims submission process, mobile app accessibility, and automated eligibility checks. Additionally, it provides detailed account history and reporting tools that empower users to effectively manage their healthcare spending. This makes Vantagen FSA a user-friendly choice for both employers and employees.

-

How much does Vantagen FSA cost for businesses?

The pricing for Vantagen FSA can vary depending on the number of participants and the specific services required. Typically, employers pay a nominal fee per participant, making it a cost-effective solution for managing employee benefits. When compared to the potential tax savings for employees, the overall value of Vantagen FSA is signNow.

-

What are the benefits of using Vantagen FSA for employees?

Employees who use Vantagen FSA can benefit from signNow tax savings, as contributions to the account are made with pre-tax dollars. This not only reduces their taxable income but also increases their purchasing power for eligible medical expenses. Moreover, Vantagen FSA enhances financial wellness, allowing employees to budget more effectively for healthcare costs.

-

How does Vantagen FSA integrate with other payroll systems?

Vantagen FSA is designed to seamlessly integrate with various payroll and HR management systems. This integration simplifies the process of managing contributions and deductions, ensuring that employees' healthcare expenses are smoothly handled alongside their regular payroll. By utilizing Vantagen FSA, organizations can streamline their benefits administration, reducing overhead and errors.

-

Can employees use Vantagen FSA funds for over-the-counter medications?

Yes, employees can use Vantagen FSA funds for a wide range of eligible expenses, including over-the-counter medications. Recent changes to FSA regulations have made it easier for participants to make these purchases without a prescription, broadening the scope of what can be covered. This feature empowers employees to utilize their Vantagen FSA funds flexibly and effectively.

-

Is there a limit to how much I can contribute to my Vantagen FSA?

Yes, there are annual contribution limits set by the IRS for Vantagen FSA accounts. For the current tax year, the limit is generally $2,850, but this can vary based on employer policies. Staying within these limits helps ensure that employees maximize their tax advantages while managing their healthcare expenses efficiently.

Get more for Vantagen Fsa

- Form llp 2 amendment to registration of a limited liability partnership

- Online california architects business entity report form

- Dsa 291 form

- Dtsc form 1478

- Form llc 12 llc statement of information

- Warehousemans lien california mobilehome form

- Articles of incorporation montana secretary of state sos mt form

- Professional limited liability company form

Find out other Vantagen Fsa

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later