1041 Schedule B PDF 2013

What is the 1041 Schedule B PDF

The 1041 Schedule B PDF is a crucial tax form used by estates and trusts to report income distributions to beneficiaries. This form is part of the IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. Schedule B specifically details the income that is distributed to beneficiaries, ensuring that the correct amounts are reported and taxed appropriately. Understanding the purpose of this form is essential for fiduciaries managing estates or trusts, as it helps maintain compliance with tax regulations.

How to Use the 1041 Schedule B PDF

To effectively use the 1041 Schedule B PDF, start by gathering all necessary financial information regarding the estate or trust's income and distributions. This includes details on interest, dividends, and other income sources. Fill out the form accurately, ensuring that each beneficiary's share of income is clearly reported. Once completed, the form must be attached to the main Form 1041 when submitting your tax return. Utilizing digital tools can simplify the process, allowing for easy editing and secure eSigning.

Steps to Complete the 1041 Schedule B PDF

Completing the 1041 Schedule B PDF involves several key steps:

- Gather all relevant financial documents, including income statements and distribution records.

- Identify each beneficiary and the amount of income they will receive.

- Fill out the form by entering the income amounts allocated to each beneficiary.

- Review the completed form for accuracy and ensure all necessary information is included.

- Attach the Schedule B to the Form 1041 and prepare for submission.

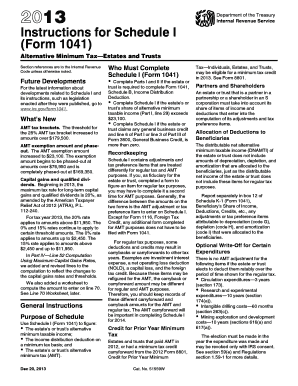

IRS Guidelines for the 1041 Schedule B PDF

The IRS provides specific guidelines for completing the 1041 Schedule B PDF. It is essential to follow these instructions closely to avoid errors that could lead to penalties. The IRS outlines how to report various types of income and the requirements for distributions to beneficiaries. Familiarizing oneself with these guidelines can help ensure compliance and facilitate a smoother filing process.

Filing Deadlines for the 1041 Schedule B PDF

Filing deadlines for the 1041 Schedule B PDF align with the due date for Form 1041. Generally, the form is due on the fifteenth day of the fourth month after the end of the tax year. For estates, this typically means April 15 for calendar year filers. Trusts may have different deadlines depending on their fiscal year. It is important to mark these dates on your calendar to avoid late filing penalties.

Legal Use of the 1041 Schedule B PDF

The legal use of the 1041 Schedule B PDF is vital for ensuring that distributions to beneficiaries are reported correctly and in compliance with tax laws. The form must be filled out truthfully and accurately to avoid legal repercussions. Using a reliable digital solution can help maintain compliance by providing secure storage and an audit trail for all documents related to the estate or trust.

Quick guide on how to complete 1041 schedule b pdf

Effortlessly Prepare 1041 Schedule B Pdf on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 1041 Schedule B Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign 1041 Schedule B Pdf with Ease

- Find 1041 Schedule B Pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and eSign 1041 Schedule B Pdf and ensure outstanding communication at every step of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1041 schedule b pdf

Create this form in 5 minutes!

How to create an eSignature for the 1041 schedule b pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule B tax form?

The Schedule B tax form is a supplemental form used by taxpayers to report interest and dividend income on their federal tax return. This form is crucial for accurately declaring various sources of income, ensuring compliance with tax regulations. If you need help filling it out, airSlate SignNow can streamline the process for you.

-

How can airSlate SignNow assist with the Schedule B tax form?

airSlate SignNow provides an efficient solution to send, receive, and eSign documents, including the Schedule B tax form. With its user-friendly interface, you can easily fill out and manage your tax documents without hassle. This ultimately saves you time and improves document management during tax season.

-

Is there a cost associated with using airSlate SignNow for the Schedule B tax form?

airSlate SignNow offers competitive pricing plans that cater to different needs, including individuals and businesses needing assistance with forms like the Schedule B tax form. The investment in this eSigning solution can help you save money in the long run by minimizing errors and minimizing the risks of tax compliance issues.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow includes several features that facilitate the smooth handling of tax forms, including the Schedule B tax form. Users can eSign documents, track their status, and manage templates effectively. These features make it easier to collect signatures and ensure that your documents are processed efficiently.

-

Can I integrate airSlate SignNow with other accounting software for managing the Schedule B tax form?

Yes, airSlate SignNow supports integrations with various accounting software, making it easier to manage your Schedule B tax form. By connecting with platforms such as QuickBooks or Xero, you can streamline your data entry, reducing the risk of errors. This integration is essential for keeping your finances organized and compliant.

-

Is airSlate SignNow secure for handling sensitive tax documents like the Schedule B tax form?

Absolutely! airSlate SignNow prioritizes the security of your sensitive information, utilizing advanced encryption and security protocols. Your Schedule B tax form and other tax documents will be protected from unauthorized access, giving you peace of mind while managing your filings.

-

What benefits does using airSlate SignNow provide when preparing the Schedule B tax form?

Using airSlate SignNow for your Schedule B tax form preparation comes with numerous benefits, such as increased efficiency and ease of use. The platform allows you to quickly complete and eSign your forms online, reducing the time spent on paperwork. Additionally, you'll have access to reliable customer support to assist with any queries.

Get more for 1041 Schedule B Pdf

Find out other 1041 Schedule B Pdf

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure