Irs Form 944 X

What is the Irs Form 944 X

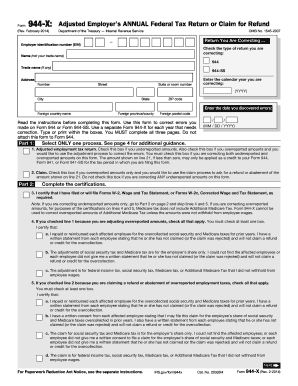

The IRS Form 944 X is a correction form used by employers to amend their annual payroll tax return, Form 944. This form is specifically designed for small businesses that report their employment taxes annually instead of quarterly. It allows employers to correct any errors made in previously filed Form 944 submissions, ensuring accurate reporting of wages, tax liabilities, and payments. Understanding the purpose of this form is crucial for maintaining compliance with federal tax regulations.

Steps to complete the Irs Form 944 X

Completing the IRS Form 944 X involves several key steps to ensure accuracy and compliance. First, gather all relevant information from the original Form 944 that needs correction. Next, clearly indicate the specific lines that require changes and provide the correct information. It's important to explain the reason for each correction in the designated section. After completing the form, review it for errors and ensure all necessary signatures are included. Finally, submit the amended form to the IRS, either electronically or by mail, depending on your filing preferences.

How to obtain the Irs Form 944 X

The IRS Form 944 X can be obtained directly from the IRS website. It is available as a downloadable PDF file, which can be printed and filled out manually. Additionally, many tax preparation software programs include this form, allowing for easier completion and submission. Ensure you are using the most current version of the form to comply with any recent updates or changes in tax regulations.

Legal use of the Irs Form 944 X

The legal use of the IRS Form 944 X is essential for ensuring that employers fulfill their tax obligations accurately. When correcting a previously filed Form 944, it is important to adhere to IRS guidelines to avoid penalties. The corrections made using Form 944 X must be supported by appropriate documentation, such as payroll records or payment confirmations. By following the legal requirements, employers can mitigate risks associated with non-compliance and maintain their good standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 944 X are critical to avoid penalties. Generally, the form must be filed within three years of the original Form 944 submission date. Employers should also be aware of the annual filing deadline for Form 944, which is typically due by January 31 of the following year. Keeping track of these important dates ensures timely corrections and compliance with IRS regulations.

Penalties for Non-Compliance

Failure to properly file the IRS Form 944 X or to correct errors on the original Form 944 can result in significant penalties. The IRS may impose fines for late filings, inaccuracies, or failure to pay owed taxes. Understanding the potential consequences of non-compliance emphasizes the importance of accurately completing and submitting the amended form. Employers should take proactive steps to ensure all tax filings are correct and submitted on time to avoid these penalties.

Quick guide on how to complete irs form 944 x

Complete Irs Form 944 X effortlessly on any gadget

Online document administration has gained traction with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Irs Form 944 X on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Irs Form 944 X without any hassle

- Find Irs Form 944 X and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Edit and eSign Irs Form 944 X and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 944 x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 944 X, and how does it relate to my business?

IRS Form 944 X is used to correct errors on a previously filed IRS Form 944, which is for small employers reporting annual payroll taxes. Understanding how to properly file Form 944 X is essential for businesses to ensure compliance and avoid penalties. Using airSlate SignNow can streamline this process by allowing you to eSign and manage all necessary documents online.

-

How can airSlate SignNow help me with IRS Form 944 X?

airSlate SignNow simplifies the process of preparing and submitting IRS Form 944 X by providing an easy-to-use platform for eSigning documents. You can quickly correct any errors and securely send the form to the IRS. This efficiency can save your business time and reduce stress during tax season.

-

Is there a cost associated with using airSlate SignNow for IRS Form 944 X?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while gaining access to all the features needed for effective document management, including IRS Form 944 X submissions. The investment is minimal compared to the time and potential penalties saved.

-

What features does airSlate SignNow offer for managing IRS Form 944 X?

airSlate SignNow offers advanced features such as customizable templates, secure document storage, and real-time tracking for IRS Form 944 X. You’ll benefit from reminders for deadlines and updates, ensuring compliant and timely submissions. Our user-friendly interface makes it easy to navigate through your document workflows.

-

How secure is airSlate SignNow when handling IRS Form 944 X?

AirSlate SignNow utilizes industry-leading security measures to protect your sensitive IRS Form 944 X data. With encryption, secure user authentication, and robust access controls in place, your documents remain confidential and secure. We prioritize your security, allowing you to focus on other aspects of your business.

-

Can I integrate airSlate SignNow with other software I use for tax purposes?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing the efficiency of managing your IRS Form 944 X. Integrations include popular platforms that allow for easy data transfer and document management. This connectivity helps streamline your workflow and minimizes the need for duplicate data entry.

-

What are the benefits of using airSlate SignNow for IRS Form 944 X compared to traditional methods?

Using airSlate SignNow for IRS Form 944 X offers signNow advantages over traditional paper methods. You can eSign documents instantly, reduce processing time, and eliminate the risk of lost paperwork. The digital solution also fosters collaboration by allowing multiple users to access and work on the same document in real-time.

Get more for Irs Form 944 X

- Sciencespot form

- Exchange student application form

- Fillable online model release form minorrev fax email print

- Uco tuition waiver form

- Concurrent enrollment permission request form uiwedu 380582509

- Equipment transfer form template

- Language declaration form

- Transferring to vet tech application veterinary technology form

Find out other Irs Form 944 X

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe