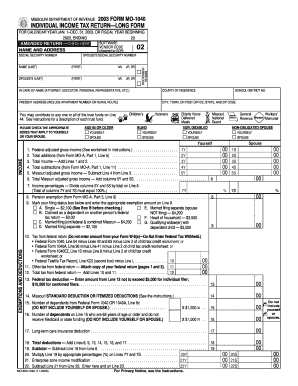

MISSOURI DEPARTMENT of REVENUE FORM MO 1040 INDIVIDUAL INCOME TAX RETURN LONG FORM for CALENDAR YEAR JAN Dor Mo

Understanding the Missouri Department of Revenue Form MO-1040 Individual Income Tax Return

The Missouri Department of Revenue Form MO-1040 is the official document used for filing individual income tax returns in Missouri. This form is essential for residents who need to report their income, claim deductions, and calculate their state income tax liability. It is specifically designed for individuals who meet the criteria for filing taxes in Missouri, ensuring compliance with state tax laws.

Steps to Complete the Missouri Department of Revenue Form MO-1040

Completing the MO-1040 form involves several key steps that taxpayers should follow to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any relevant receipts for deductions. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income on the appropriate lines, ensuring you include all sources of income. After calculating your total income, apply any deductions or credits you are eligible for. Finally, review your completed form for accuracy before submitting it.

Legal Use of the Missouri Department of Revenue Form MO-1040

The MO-1040 form is legally binding when completed and submitted according to Missouri tax regulations. It is crucial that taxpayers understand the legal implications of providing accurate information on this form. Misrepresentation or errors can lead to penalties or legal action. Therefore, using a reliable eSignature solution can enhance the legal validity of the document, ensuring that it meets all necessary compliance standards.

Filing Deadlines and Important Dates for Missouri Income Tax

Taxpayers should be aware of the key deadlines associated with filing the MO-1040. Typically, the deadline for filing individual income tax returns in Missouri is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should note that extensions can be requested, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods for the Missouri Department of Revenue Form MO-1040

There are several methods available for submitting the MO-1040 form. Taxpayers can file their returns electronically using approved e-filing software, which often simplifies the process and reduces the likelihood of errors. Alternatively, individuals can print the completed form and mail it to the appropriate address provided by the Missouri Department of Revenue. In-person submissions are also accepted at designated locations, allowing for direct interaction with tax officials if needed.

Required Documents for Filing the Missouri Income Tax Return

When preparing to file the MO-1040, taxpayers must gather several documents to ensure a complete and accurate submission. Essential documents include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income received. Additionally, receipts for deductible expenses, such as medical costs, educational expenses, and charitable contributions, should be collected to support claims made on the return.

Quick guide on how to complete missouri department of revenue form mo 1040 individual income tax return long form for calendar year jan dor mo

Complete MISSOURI DEPARTMENT OF REVENUE FORM MO 1040 INDIVIDUAL INCOME TAX RETURN LONG FORM FOR CALENDAR YEAR JAN Dor Mo effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your files rapidly without delays. Manage MISSOURI DEPARTMENT OF REVENUE FORM MO 1040 INDIVIDUAL INCOME TAX RETURN LONG FORM FOR CALENDAR YEAR JAN Dor Mo across all platforms with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign MISSOURI DEPARTMENT OF REVENUE FORM MO 1040 INDIVIDUAL INCOME TAX RETURN LONG FORM FOR CALENDAR YEAR JAN Dor Mo with ease

- Locate MISSOURI DEPARTMENT OF REVENUE FORM MO 1040 INDIVIDUAL INCOME TAX RETURN LONG FORM FOR CALENDAR YEAR JAN Dor Mo and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you wish to share your form - via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious search for forms, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Modify and eSign MISSOURI DEPARTMENT OF REVENUE FORM MO 1040 INDIVIDUAL INCOME TAX RETURN LONG FORM FOR CALENDAR YEAR JAN Dor Mo and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri department of revenue form mo 1040 individual income tax return long form for calendar year jan dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Missouri income tax and how is it calculated?

Missouri income tax is a state tax imposed on the income of individuals and businesses. It is calculated based on your total taxable income, with rates ranging from 1.5% to 5.4% depending on your income bracket. Understanding your obligations for Missouri income tax is essential for accurately reporting and filing your taxes.

-

How does airSlate SignNow help with managing Missouri income tax forms?

airSlate SignNow provides an efficient solution for electronically signing and sending your Missouri income tax forms. With its user-friendly interface, you can easily upload documents, collect signatures, and ensure that all your tax forms are properly completed and submitted on time. This streamlines your tax preparation process, reducing the hassle of paper forms.

-

What are the costs associated with using airSlate SignNow for Missouri income tax preparation?

The pricing for airSlate SignNow is designed to be cost-effective, making it accessible for small businesses and individuals alike. Our plans vary based on features, but you can find options that cater to your specific needs, helping you manage your Missouri income tax documents without breaking the bank.

-

Can airSlate SignNow integrate with accounting software I use for Missouri income tax?

Yes, airSlate SignNow offers integrations with various accounting and tax software, enhancing your workflow for handling Missouri income tax documents. By linking your existing tools, you can streamline processes, reduce errors, and ensure compliance with tax regulations more effectively.

-

What features does airSlate SignNow offer for Missouri income tax document management?

airSlate SignNow provides critical features such as customizable templates, secure document storage, and real-time tracking for your Missouri income tax documents. These features ensure that your tax forms are completed accurately and submitted efficiently, simplifying the entire process.

-

Is airSlate SignNow compliant with Missouri tax regulations?

Absolutely! airSlate SignNow is designed to comply with various state regulations, including those governing Missouri income tax. Our secure platform ensures that all eSignatures are legally binding, helping you meet all requirements when filing your Missouri tax documents.

-

What benefits can I expect from using airSlate SignNow for Missouri income tax eSigning?

Using airSlate SignNow for your Missouri income tax eSigning comes with numerous benefits, such as increased efficiency, reduced time spent on paperwork, and enhanced security for your sensitive financial data. The platform allows for easy collaboration and faster turnaround times on document approvals.

Get more for MISSOURI DEPARTMENT OF REVENUE FORM MO 1040 INDIVIDUAL INCOME TAX RETURN LONG FORM FOR CALENDAR YEAR JAN Dor Mo

Find out other MISSOURI DEPARTMENT OF REVENUE FORM MO 1040 INDIVIDUAL INCOME TAX RETURN LONG FORM FOR CALENDAR YEAR JAN Dor Mo

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free