St28a Form

What is the ST28A?

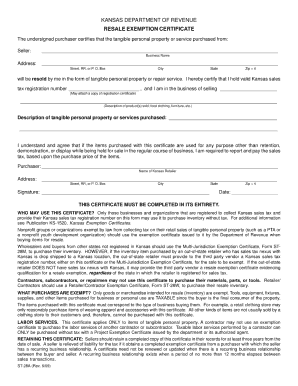

The ST28A form is a specific document used in certain legal and administrative contexts within the United States. It serves as a declaration or statement that may be required by various agencies or institutions. Understanding the purpose of this form is crucial for individuals and businesses that need to comply with specific regulations or requirements. The ST28A is often linked to compliance with tax obligations, legal declarations, or other formal processes that necessitate a clear and documented statement from the signer.

How to Use the ST28A

Using the ST28A form involves several steps to ensure it is completed accurately and submitted correctly. First, identify the specific requirements for your situation, as the form may vary depending on the context in which it is used. Next, gather all necessary information and documentation that will support your declaration on the form. Once you have filled out the form, review it for accuracy and completeness before submitting it to the appropriate agency or institution. Utilizing electronic tools can streamline this process, allowing for easier completion and submission.

Steps to Complete the ST28A

Completing the ST28A form requires careful attention to detail. Here are the essential steps:

- Read the instructions provided with the form carefully to understand the requirements.

- Gather all relevant documents and information needed to fill out the form.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring your signature meets the necessary legal standards.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal Use of the ST28A

The ST28A form holds legal significance, particularly when it is executed correctly. It must comply with relevant laws and regulations to be considered valid. This includes ensuring that the signature is authentic and that the form is filled out in accordance with the specific requirements set forth by the governing body requesting it. Understanding the legal implications of the ST28A is essential for individuals and businesses to avoid potential disputes or penalties.

Key Elements of the ST28A

Several key elements are critical to the ST28A form, which include:

- Identification of the signer: This includes full name and contact information.

- Purpose of the form: A clear statement of why the form is being submitted.

- Signature: An authentic signature that may need to be notarized, depending on the requirements.

- Date of signing: The date when the form is completed and signed.

Who Issues the ST28A?

The ST28A form is typically issued by specific governmental agencies or organizations that require this declaration for compliance purposes. The exact issuing body may vary depending on the context in which the form is used, such as tax authorities or regulatory agencies. It is important to verify the source of the form to ensure it meets the necessary legal standards and requirements.

Quick guide on how to complete st28a

Finalize St28a effortlessly on any gadget

Digital document organization has become increasingly preferred by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the required form and securely keep it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage St28a on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign St28a effortlessly

- Obtain St28a and then click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages your document organization needs in just a few clicks from any device of your choice. Modify and eSign St28a and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st28a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st28a feature in airSlate SignNow?

The st28a feature in airSlate SignNow offers an efficient way to manage and automate document signing processes. It streamlines workflows by allowing users to create, send, and eSign documents with minimal effort. This feature enhances productivity and reduces turnaround time for crucial business documents.

-

How does pricing for airSlate SignNow with st28a work?

airSlate SignNow provides competitive pricing plans that include access to the st28a feature. Customers can choose from various tiers based on their needs, ensuring a cost-effective solution for businesses of all sizes. Each plan offers distinct benefits and functionalities, including the powerful st28a capabilities.

-

What are the benefits of using st28a for my business?

Using the st28a feature in airSlate SignNow can signNowly enhance your business operations. It allows for faster document processing and improved client experiences with eSigning capabilities. Additionally, the feature supports better compliance and security for your important documents.

-

Can I integrate st28a with other software applications?

Yes, airSlate SignNow’s st28a feature is designed for seamless integration with numerous software applications. This makes it easier for businesses to incorporate eSigning into their existing workflows. Enhanced productivity and efficiency are achieved when st28a works in conjunction with other tools.

-

Is airSlate SignNow suitable for small businesses using st28a?

Absolutely! airSlate SignNow with the st28a feature is specifically tailored to support small businesses looking for affordable eSigning solutions. The user-friendly interface and cost-efficient pricing make it an ideal choice for managing document workflows effectively without breaking the bank.

-

What types of documents can I sign with st28a in airSlate SignNow?

With the st28a feature in airSlate SignNow, you can sign various types of documents, including contracts, agreements, and forms. The versatility of this feature makes it applicable for numerous industries and use cases. This flexibility allows businesses to streamline their signing processes across different document types.

-

How secure is the st28a feature for document signing?

The st28a feature in airSlate SignNow prioritizes security, providing robust encryption and compliance with industry standards. This ensures that your documents are protected during the signing process. With airSlate SignNow, you can confidently manage sensitive information while benefiting from its advanced security protocols.

Get more for St28a

Find out other St28a

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA