Trust Certification Lutheran Church Extension Fund LCEF Lcef Form

Understanding the Trust Certification Lutheran Church Extension Fund LCEF

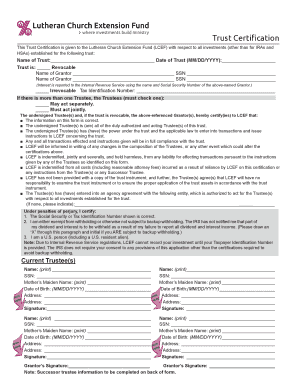

The Trust Certification from the Lutheran Church Extension Fund (LCEF) is a vital document for individuals and organizations involved in trust management. This certification serves to validate the existence and terms of a trust, ensuring that all parties are aware of their rights and responsibilities. It is particularly important for institutions that require proof of trust to facilitate financial transactions or manage assets effectively.

Steps to Complete the Trust Certification Lutheran Church Extension Fund LCEF

Completing the Trust Certification involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the trust, including the names of trustees and beneficiaries, the trust's purpose, and relevant dates. Next, fill out the certification form, ensuring all details are correct. After completing the form, it is essential to review it for accuracy before submitting. Finally, sign the document in the presence of a notary public to validate the certification.

Legal Use of the Trust Certification Lutheran Church Extension Fund LCEF

The legal use of the Trust Certification is crucial for its acceptance in various financial and legal contexts. To be considered valid, the certification must comply with state laws governing trusts. This includes proper execution, which often requires notarization and adherence to specific guidelines outlined by the LCEF. Understanding these legal requirements helps ensure that the certification holds up in court and is recognized by financial institutions.

Key Elements of the Trust Certification Lutheran Church Extension Fund LCEF

Several key elements must be included in the Trust Certification to ensure its validity. These elements typically include the full name of the trust, the names of the trustees, the date the trust was established, and a clear statement of the trust's purpose. Additionally, it should outline the powers granted to the trustees and any specific instructions regarding the management of trust assets. Including these details helps provide clarity and prevents disputes among involved parties.

Who Issues the Trust Certification Lutheran Church Extension Fund LCEF

The Trust Certification is issued by the Lutheran Church Extension Fund, which serves as a financial institution supporting the mission of the Lutheran Church. The LCEF is responsible for ensuring that the certification meets all legal requirements and accurately reflects the trust's details. This oversight helps maintain the integrity of the certification process and provides assurance to all parties involved.

Examples of Using the Trust Certification Lutheran Church Extension Fund LCEF

There are various scenarios in which the Trust Certification may be utilized. For instance, when a trustee needs to access funds held in a trust for the benefit of a beneficiary, the certification serves as proof of their authority. Additionally, financial institutions may require the certification to process loans or investments related to the trust. Understanding these examples can help clarify the importance of the certification in practical applications.

Quick guide on how to complete trust certification lutheran church extension fund lcef lcef

Complete Trust Certification Lutheran Church Extension Fund LCEF Lcef effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers a suitable environmentally-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Trust Certification Lutheran Church Extension Fund LCEF Lcef on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and electronically sign Trust Certification Lutheran Church Extension Fund LCEF Lcef with ease

- Find Trust Certification Lutheran Church Extension Fund LCEF Lcef and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form finding, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Trust Certification Lutheran Church Extension Fund LCEF Lcef and guarantee effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trust certification lutheran church extension fund lcef lcef

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are LCEF CD rates and how do they work?

LCEF CD rates refer to the interest rates offered on certificates of deposit (CDs) by LCEF. These rates vary based on the term length and amount deposited. Generally, higher CD rates are offered for longer-term commitments, allowing you to earn more interest on your investment over time.

-

How can I find the best LCEF CD rates available?

To find the best LCEF CD rates, it's advisable to compare offers from multiple banks and financial institutions. Factors to compare include interest rates, terms, and any penalties for early withdrawal. Additionally, you can visit financial websites that aggregate current rates for a comprehensive view.

-

Are LCEF CD rates fixed or variable?

LCEF CD rates are typically fixed, meaning that the interest rate remains the same for the entire term of the CD. This characteristic allows you to predict your earnings accurately and protects you against rate fluctuations in the market during the term.

-

What are the minimum deposit requirements for LCEF CD rates?

Minimum deposit requirements for LCEF CD rates can vary depending on the institution. Many banks require a minimum deposit ranging from $500 to $1,000 to open a CD account. It is essential to check with the specific bank for their set requirements.

-

What are the benefits of investing in LCEF CDs?

Investing in LCEF CDs offers several benefits, including assured returns and lower risk compared to stocks or mutual funds. CDs are also insured by the FDIC up to the applicable limits, providing additional security for your funds. They can be a great option for those seeking guaranteed interest earnings.

-

Can I access my LCEF CD before it matures?

While you can access your LCEF CD before it matures, early withdrawal may incur penalties. These penalties typically result in a portion of the interest earned being forfeited or a fee being applied. It's advisable to understand the terms before making a deposit.

-

How do LCEF CD rates compare to other savings options?

LCEF CD rates generally offer higher interest rates than standard savings accounts, making them a more attractive option for savings. However, they come with less liquidity since your funds are committed for the term length. When choosing, consider your financial goals and how soon you may need access to your funds.

Get more for Trust Certification Lutheran Church Extension Fund LCEF Lcef

- Personal data sheet new hampshire judicial branch form

- How to serve deliver to defendant a small claims writ and form

- Official court forms of the connecticut judicial branch ctgov

- Diy divorce guide supplement connecticutincome tax in form

- Affidavit in lieu of probate 421 ct probate courts form

- In the superior court for the state of alaska at palmer form

- Ccp 211 illinois formampquot keyword found websites listing

- Petition for approval of adoption agreement adult form

Find out other Trust Certification Lutheran Church Extension Fund LCEF Lcef

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation