New York Ct 60 Qsss Form

What is the New York Ct 60 Qsss Form

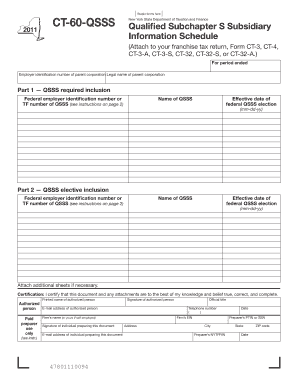

The New York Ct 60 Qsss form is a tax document used by certain businesses to report income and expenses for tax purposes. It is specifically designed for qualified subchapter S subsidiaries (QSSS) and is crucial for ensuring compliance with state tax regulations. This form allows businesses to consolidate their tax reporting, streamlining the process for both the parent company and its subsidiaries.

How to use the New York Ct 60 Qsss Form

Using the New York Ct 60 Qsss form involves several key steps. First, gather all necessary financial information related to the subsidiary's income, deductions, and credits. Next, accurately complete the form by entering the required data in the designated fields. It is important to ensure that all figures are correct to avoid potential penalties. After completing the form, it should be submitted to the appropriate state tax authority, either electronically or via mail.

Steps to complete the New York Ct 60 Qsss Form

Completing the New York Ct 60 Qsss form requires careful attention to detail. Follow these steps:

- Collect financial records for the subsidiary, including income statements and expense reports.

- Fill out the form, ensuring all required sections are completed, including business identification information and financial data.

- Double-check all calculations for accuracy.

- Sign and date the form, confirming that the information provided is true and accurate.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the New York Ct 60 Qsss Form

The New York Ct 60 Qsss form is legally binding when completed and submitted according to state regulations. It must be filled out accurately to reflect the financial status of the subsidiary. Failure to comply with the legal requirements associated with this form can result in penalties, including fines or additional tax liabilities. It is essential to understand the legal implications of submitting this form to ensure compliance with state tax laws.

Key elements of the New York Ct 60 Qsss Form

Several key elements must be included in the New York Ct 60 Qsss form to ensure it is complete and accurate:

- Business Identification: Include the name, address, and identification number of the subsidiary.

- Income Reporting: Accurately report all income earned by the subsidiary during the tax year.

- Deductions: List all allowable deductions to reduce taxable income.

- Signatures: Ensure that the form is signed by an authorized representative of the business.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the New York Ct 60 Qsss form. Typically, the form must be submitted by the due date of the parent company's tax return. This ensures that all income and expenses are reported in a timely manner. Missing the deadline can lead to penalties and interest on any unpaid taxes. Keeping track of these important dates is essential for maintaining compliance.

Quick guide on how to complete new york ct 60 qsss form

Complete New York Ct 60 Qsss Form easily on any gadget

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents promptly without any setbacks. Handle New York Ct 60 Qsss Form across any platform with airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

The easiest way to edit and eSign New York Ct 60 Qsss Form effortlessly

- Find New York Ct 60 Qsss Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal value as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require the printing of new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Edit and eSign New York Ct 60 Qsss Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york ct 60 qsss form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'ny ct 60' and how does it relate to airSlate SignNow?

The 'ny ct 60' form is essential for businesses operating in New York. airSlate SignNow simplifies the process of completing and submitting this form electronically, ensuring compliance and efficiency. With our platform, you can quickly fill out and eSign your ny ct 60, streamlining your operations.

-

How much does it cost to use airSlate SignNow for completing the ny ct 60?

airSlate SignNow offers competitive pricing plans that can fit various business needs. You can choose a plan that suits your budget, ensuring that completing forms like the ny ct 60 is cost-effective. Explore our pricing options to find the best fit for your operations.

-

What features does airSlate SignNow offer for completing the ny ct 60?

airSlate SignNow provides a user-friendly interface, customizable templates, and secure eSigning capabilities for completing the ny ct 60. These features enhance efficiency and reduce errors, making document management straightforward. Plus, you can access your files anytime, anywhere.

-

Can I track the status of my ny ct 60 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your ny ct 60 in real-time. You can see when the document has been viewed, signed, or completed by all parties involved. This feature helps you stay organized and informed throughout the process.

-

Is airSlate SignNow compliant with legal requirements for the ny ct 60?

Absolutely! airSlate SignNow is designed to comply with legal requirements related to electronic signatures and document submissions, including the ny ct 60. This ensures that your signed documents are legally binding and accepted by regulatory bodies.

-

What benefits does airSlate SignNow provide for businesses using the ny ct 60?

By using airSlate SignNow for your ny ct 60, businesses can reduce paperwork, save time, and improve accuracy. The platform automates repetitive tasks, allowing teams to focus on more critical operations. This efficiency translates into cost savings and enhanced productivity.

-

Does airSlate SignNow integrate with other software for managing the ny ct 60?

Yes, airSlate SignNow can seamlessly integrate with various software applications to enhance your workflow. Whether you use CRM, accounting, or project management tools, our integrations help you manage the ny ct 60 and other documents efficiently. This increases collaboration across teams.

Get more for New York Ct 60 Qsss Form

Find out other New York Ct 60 Qsss Form

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter