REV 1752 as 01 14 Co Armstrong Pa Form

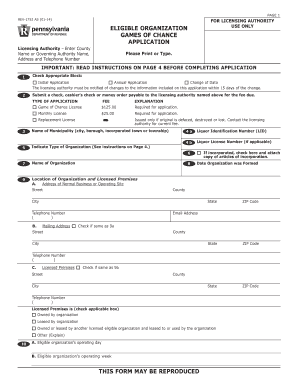

What is the REV 1752 Form?

The REV 1752 form is a document used in the United States for specific tax-related purposes, particularly concerning property tax exemptions. This form is essential for individuals or entities seeking to claim certain exemptions or reductions in their property tax obligations. Understanding the purpose of the REV 1752 is crucial for ensuring compliance with local tax regulations and taking advantage of available benefits.

How to Use the REV 1752 Form

Using the REV 1752 form involves several key steps. First, ensure you have the correct version of the form, as updates may occur. Next, gather all necessary information, including property details and any relevant financial data. Complete the form accurately, paying close attention to the instructions provided. Once filled out, submit the form according to your local jurisdiction's requirements, which may include online submission, mailing, or in-person delivery.

Steps to Complete the REV 1752 Form

Completing the REV 1752 form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the REV 1752 form from your local tax authority.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including name, address, and property details.

- Provide any necessary financial information to support your claim.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to ensure timely processing.

Legal Use of the REV 1752 Form

The REV 1752 form is legally binding when completed and submitted in accordance with state and local laws. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the exemption. Familiarize yourself with the legal implications of submitting this form to ensure compliance with all relevant regulations.

Key Elements of the REV 1752 Form

Several key elements are critical when filling out the REV 1752 form:

- Property Identification: Clearly identify the property for which the exemption is being claimed.

- Claimant Information: Provide accurate details about the individual or entity making the claim.

- Supporting Documentation: Attach any required documents that substantiate the exemption request.

- Signature: Ensure the form is signed by the appropriate party to validate the submission.

Form Submission Methods

The REV 1752 form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many jurisdictions allow electronic filing through their official websites.

- Mail: You can send the completed form via postal service to the designated tax authority.

- In-Person: Some individuals prefer to deliver the form directly to the local tax office for immediate processing.

Quick guide on how to complete rev 1752 as 01 14 co armstrong pa

Effortlessly Prepare REV 1752 AS 01 14 Co Armstrong Pa on Any Device

Digital document management has gained signNow popularity among organizations and individuals. It serves as an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the required form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage REV 1752 AS 01 14 Co Armstrong Pa on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign REV 1752 AS 01 14 Co Armstrong Pa with Ease

- Obtain REV 1752 AS 01 14 Co Armstrong Pa and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign REV 1752 AS 01 14 Co Armstrong Pa and ensure excellent communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 1752 as 01 14 co armstrong pa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rev 1752 form and why is it important?

The rev 1752 form is used for certain types of tax adjustments in businesses. Completing this form correctly is crucial as it helps ensure tax liabilities are accurately reported and managed, ultimately aiding in compliance with federal regulations.

-

How can airSlate SignNow assist with completing the rev 1752 form?

airSlate SignNow provides an easy-to-use platform that allows users to fill out, eSign, and manage their rev 1752 form seamlessly. With customizable templates and a straightforward workflow, it simplifies the document handling process for stakeholders.

-

Is there a cost associated with using airSlate SignNow for the rev 1752 form?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses of different sizes. Signing up provides access to a range of features including the ability to work with the rev 1752 form quickly and efficiently.

-

Does airSlate SignNow offer integration options for the rev 1752 form?

Absolutely! airSlate SignNow integrates with many popular applications, allowing users to streamline their workflow when handling the rev 1752 form. This cross-application capability enhances productivity and ensures a smooth process.

-

What features does airSlate SignNow offer for effective management of the rev 1752 form?

airSlate SignNow includes features such as document sharing, eSignatures, and real-time tracking, all of which simplify managing the rev 1752 form. These tools boost efficiency and help maintain document security throughout the process.

-

Can I collaborate with others on the rev 1752 form using airSlate SignNow?

Yes, airSlate SignNow enables collaboration on the rev 1752 form with multiple users. This feature allows teams to work together in real-time, ensuring that everyone involved can contribute and review changes promptly.

-

What are the benefits of using airSlate SignNow for the rev 1752 form?

Using airSlate SignNow for the rev 1752 form simplifies the signing process and enhances accuracy and compliance. The platform's intuitive design and automation features help save time and reduce the risk of errors in documentation.

Get more for REV 1752 AS 01 14 Co Armstrong Pa

- Application for adjuster entity license texas department of form

- Virginia it agency form

- Fin501 form

- Qrt arizona quarterly withholding tax return arizona form

- Form h1205 texas streamlined applicationtexas health

- Dwc form 121 claim administration contact information dwc form 121 claim administration contact information

- Fint09 form

- Before your upcoming appointment i want to say thank you for allowing me the privilege of taking care of you form

Find out other REV 1752 AS 01 14 Co Armstrong Pa

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors