Form 4419 PDF

What is the Form 4419 Pdf

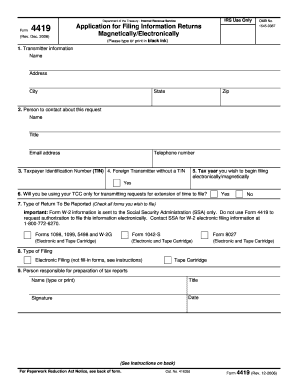

The Form 4419 is an essential document used by businesses and individuals to request an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This form is particularly important for those who need to file tax returns or other documents that require an EIN. The form can be completed online or in paper format, and it is crucial for ensuring compliance with federal tax regulations.

How to use the Form 4419 Pdf

To use the Form 4419 effectively, you must first gather the necessary information, such as your legal business name, address, and the type of entity you are registering. Once you have this information, you can fill out the form accurately. After completing the form, it must be submitted to the IRS for processing. This can be done electronically or via mail, depending on your preference. Using electronic tools can streamline the process and help ensure that your submission is accurate and secure.

Steps to complete the Form 4419 Pdf

Completing the Form 4419 involves several key steps:

- Gather all required information, including your legal business name, address, and entity type.

- Access the Form 4419 PDF from the IRS website or a trusted source.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS either electronically or by mailing it to the appropriate address.

Legal use of the Form 4419 Pdf

The legal use of the Form 4419 is governed by IRS regulations. When properly completed and submitted, the form serves as an official request for an EIN, which is necessary for various tax-related activities. Ensuring that the form is filled out correctly and submitted on time is critical for compliance with federal laws. Failure to do so could result in delays or penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 4419. These guidelines include instructions on the required information, submission methods, and deadlines. It is important to follow these guidelines closely to ensure that your form is processed without issues. The IRS also offers resources and support for individuals and businesses needing assistance with the form.

Form Submission Methods (Online / Mail / In-Person)

The Form 4419 can be submitted through various methods, providing flexibility for users. You can choose to submit the form online via the IRS website, which is often the fastest method. Alternatively, you may opt to mail the completed form to the IRS at the designated address. In-person submission is generally not available for this form, making online and mail submissions the primary options. Each method has its own processing times, so consider your needs when choosing how to submit.

Quick guide on how to complete form 4419 pdf

Prepare Form 4419 Pdf effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Form 4419 Pdf on any platform with airSlate SignNow for Android or iOS and simplify any document-related process today.

How to modify and eSign Form 4419 Pdf without hassle

- Find Form 4419 Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, via email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 4419 Pdf and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4419 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4419, and why do I need it?

Form 4419 is an application that facilitates the electronic filing of tax forms through the IRS. If you're looking to streamline your tax submission process with airSlate SignNow, completing form 4419 is essential. This form ensures that you have authorization to file electronically, making your tax reporting faster and more efficient.

-

How does airSlate SignNow help with filling out form 4419?

AirSlate SignNow offers an intuitive platform that simplifies the process of completing form 4419. Users can fill out the form electronically, eSign it, and submit it directly within the application. This eliminates the hassle of paperwork while ensuring compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for form 4419?

Yes, while airSlate SignNow offers a range of pricing plans, the cost can vary depending on the features you choose. However, the investment is often minimal when compared to the time and resources saved by using our platform to manage form 4419 and other important documents efficiently.

-

What features does airSlate SignNow offer for managing form 4419?

AirSlate SignNow provides several features for managing form 4419, including electronic signature capabilities, document templates, and secure cloud storage. Users can track the status of their submissions and ensure compliance with IRS guidelines, making the process smooth and reliable.

-

Can I integrate airSlate SignNow with other tools for handling form 4419?

Absolutely! AirSlate SignNow seamlessly integrates with various productivity tools like Google Drive and CRM systems. This allows users to access, fill out, and manage form 4419 alongside their other important workflows, enhancing collaboration and efficiency.

-

What are the advantages of using airSlate SignNow for form 4419 over traditional methods?

Using airSlate SignNow for form 4419 offers numerous advantages, including speed, convenience, and security. The electronic submission process reduces the risk of errors and delays associated with paper forms, while eSigning ensures that your documents remain legally binding and protected.

-

How secure is my data when I use airSlate SignNow for form 4419?

AirSlate SignNow prioritizes the security of your data, especially when handling sensitive forms like form 4419. We utilize advanced encryption protocols and secure cloud storage to protect your information. You can trust that your data remains confidential while using our platform.

Get more for Form 4419 Pdf

Find out other Form 4419 Pdf

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online