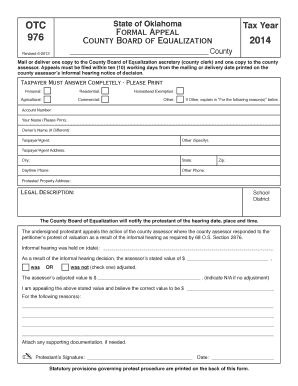

OTC 976 Oklahoma Tax Commission Tax Ok Form

What is the OTC 976 Oklahoma Tax Commission Tax Ok

The OTC 976 form is a crucial document issued by the Oklahoma Tax Commission. It is primarily used for tax purposes, allowing individuals and businesses to report specific tax-related information. This form is essential for ensuring compliance with state tax regulations and helps facilitate the accurate assessment of taxes owed or refunds due. Understanding the purpose and requirements of the OTC 976 is vital for taxpayers in Oklahoma.

How to use the OTC 976 Oklahoma Tax Commission Tax Ok

Using the OTC 976 form involves several steps. First, gather all necessary information related to your tax situation, including income, deductions, and any credits you may qualify for. Next, fill out the form accurately, ensuring that all fields are completed to avoid delays in processing. Once the form is filled, you can submit it electronically or via mail, depending on your preference and the specific instructions provided by the Oklahoma Tax Commission.

Steps to complete the OTC 976 Oklahoma Tax Commission Tax Ok

Completing the OTC 976 form requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Download the OTC 976 form from the Oklahoma Tax Commission website.

- Fill out the form, ensuring that all personal and financial information is accurate.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate address.

Legal use of the OTC 976 Oklahoma Tax Commission Tax Ok

The OTC 976 form is legally binding when completed and submitted according to the guidelines set by the Oklahoma Tax Commission. It must be signed by the taxpayer or an authorized representative. Compliance with eSignature laws is crucial if the form is submitted electronically. The use of a reputable eSigning platform ensures that the form meets all legal requirements, providing a digital certificate that verifies the identity of the signer.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the OTC 976 form. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special tax situations. Always check the Oklahoma Tax Commission's official website for the most current information regarding deadlines and important dates.

Required Documents

To complete the OTC 976 form accurately, several documents are required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents on hand will streamline the process and help ensure that all information reported is accurate and complete.

Quick guide on how to complete otc 976 oklahoma tax commission tax ok

Finish OTC 976 Oklahoma Tax Commission Tax Ok effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and safely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without hindrances. Manage OTC 976 Oklahoma Tax Commission Tax Ok on any device with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The easiest method to modify and electronically sign OTC 976 Oklahoma Tax Commission Tax Ok with no hassle

- Locate OTC 976 Oklahoma Tax Commission Tax Ok and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to keep your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign OTC 976 Oklahoma Tax Commission Tax Ok and guarantee exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the otc 976 oklahoma tax commission tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OTC 976 Oklahoma Tax Commission Tax Ok form, and why do I need it?

The OTC 976 Oklahoma Tax Commission Tax Ok form is necessary for individuals and businesses in Oklahoma to report tax information effectively. Completing this form helps ensure compliance with state tax regulations and simplifies your tax filing process. Utilizing airSlate SignNow makes it easy to eSign and submit the OTC 976 form securely.

-

How can airSlate SignNow help with the OTC 976 Oklahoma Tax Commission Tax Ok form?

airSlate SignNow provides a user-friendly platform to easily fill out, eSign, and manage your OTC 976 Oklahoma Tax Commission Tax Ok forms. With its intuitive interface, you can save time and reduce errors, ensuring that your tax submission is accurate and compliant. This tool streamlines the entire tax process for both individuals and businesses.

-

What are the pricing options for using airSlate SignNow to manage the OTC 976 Oklahoma Tax Commission Tax Ok forms?

airSlate SignNow offers several pricing plans to suit various needs, including individual, small business, and enterprise options. Each plan provides access to features required for managing documents, including the OTC 976 Oklahoma Tax Commission Tax Ok form. You can explore these options to find a plan that aligns with your budget and usage needs.

-

Can I integrate airSlate SignNow with my existing software for handling the OTC 976 Oklahoma Tax Commission Tax Ok form?

Yes, airSlate SignNow provides seamless integrations with popular software solutions, making it easier to manage your OTC 976 Oklahoma Tax Commission Tax Ok forms alongside your existing tools. This enhances your workflow and helps maintain consistency across your documentation process. Check our integrations page for a list of compatible software.

-

What security measures does airSlate SignNow provide for the OTC 976 Oklahoma Tax Commission Tax Ok forms?

airSlate SignNow prioritizes your security, using industry-standard encryption to protect your OTC 976 Oklahoma Tax Commission Tax Ok forms and data. You can trust that your sensitive information is handled with the utmost care, ensuring compliance with privacy regulations. Additionally, our platform includes audit trails to monitor document activity.

-

Is there customer support available when using airSlate SignNow for OTC 976 Oklahoma Tax Commission Tax Ok?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions or issues related to using the platform for your OTC 976 Oklahoma Tax Commission Tax Ok forms. Our knowledgeable support team is available through various channels to provide timely assistance and ensure a smooth experience.

-

Can I track the status of my OTC 976 Oklahoma Tax Commission Tax Ok submissions with airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your OTC 976 Oklahoma Tax Commission Tax Ok submissions. Our platform provides real-time notifications and updates on document progress, allowing you to stay informed and ensure timely processing of your tax forms. This feature aids in better management of your tax-related tasks.

Get more for OTC 976 Oklahoma Tax Commission Tax Ok

- 2020 form irs 6252 fill online printable fillable blank

- 2018 form irs instruction 1099 r ampampamp 5498 fill online

- Wwwirsgovpubirs pdf2021 form 8854 internal revenue service

- Get the free form 4835 department of the treasury internal

- Wwwtaxformfinderorgfederalform 8879 pefederal form 8879 pe irs e file signature authorization for

- Wwwfccgovfile12944quick form application for authorization in the ship

- Wwwmassgovdocmassachusetts application forhow to apply massachusetts form

- 2021 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

Find out other OTC 976 Oklahoma Tax Commission Tax Ok

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document