Mortgagee Clause Form

What is the mortgagee clause?

The mortgagee clause is a critical component of a mortgage agreement that protects the lender's interests in the event of a loss. It stipulates that the lender is entitled to receive insurance proceeds directly if the property is damaged or destroyed. This clause ensures that the lender's financial stake in the property is safeguarded, allowing them to recover their investment in case of unforeseen events. Understanding the mortgagee clause is essential for both borrowers and lenders to ensure compliance with the terms of the mortgage and to protect their respective interests.

Key elements of the mortgagee clause

A mortgagee clause typically includes several key elements that define its scope and application. These elements may include:

- Identification of the mortgagee: The clause must clearly identify the lender or mortgagee by name and address.

- Insurance coverage: It specifies the type of insurance coverage required, such as homeowners insurance or hazard insurance.

- Payment provisions: The clause outlines how insurance proceeds will be paid to the mortgagee in the event of a claim.

- Notification requirements: It may include stipulations regarding how and when the mortgagee must be notified of any claims or changes in insurance status.

Steps to complete the mortgagee clause

Completing the mortgagee clause involves several important steps to ensure its validity and enforceability. Here are the steps to follow:

- Review the mortgage agreement: Understand the specific requirements outlined in your mortgage documents regarding the mortgagee clause.

- Obtain the necessary insurance policy: Ensure you have an insurance policy that meets the lender's requirements.

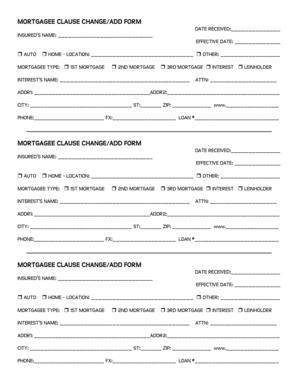

- Fill out the mortgagee clause: Accurately complete the clause with the lender's information and any other required details.

- Submit the clause to your insurer: Provide the completed mortgagee clause to your insurance company for inclusion in your policy.

- Keep records: Maintain copies of all documents related to the mortgagee clause for future reference.

How to use the mortgagee clause

The mortgagee clause is used primarily in the context of property insurance. When a property is insured, the mortgagee clause ensures that the lender receives any insurance payouts in the event of a loss. To use the mortgagee clause effectively:

- Ensure compliance: Make sure your insurance policy includes the mortgagee clause as required by your lender.

- File claims properly: In the event of a loss, file claims through your insurance provider, ensuring that the mortgagee is notified as required.

- Communicate with your lender: Keep your lender informed about any changes to your insurance policy or coverage to maintain compliance.

Legal use of the mortgagee clause

The legal use of the mortgagee clause is governed by state laws and the terms of the mortgage agreement. It is essential to understand the legal implications of the clause, including:

- Enforceability: The mortgagee clause must be clearly defined and included in the insurance policy to be enforceable.

- Compliance with state laws: Different states may have specific regulations regarding mortgagee clauses, so it is important to be aware of local laws.

- Impact on insurance claims: The clause can affect how claims are processed and who receives payment, making it crucial for all parties involved to understand its terms.

Examples of using the mortgagee clause

Understanding how the mortgagee clause functions in real-life scenarios can provide valuable insights. Here are a few examples:

- Homeowners insurance: A homeowner has a mortgage with a lender and secures homeowners insurance with a mortgagee clause. If the home suffers damage from a fire, the insurance payout goes directly to the lender to cover the outstanding mortgage balance.

- Property damage: In the event of severe weather causing significant damage, the homeowner files a claim. The insurance company processes the claim and pays the lender as specified in the mortgagee clause, ensuring the lender's investment is protected.

Quick guide on how to complete mortgagee clause

Effortlessly Prepare Mortgagee Clause on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Mortgagee Clause on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related procedure today.

How to Modify and Electronically Sign Mortgagee Clause Without Strain

- Obtain Mortgagee Clause and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or mask sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Alter and electronically sign Mortgagee Clause to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgagee clause

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgagee clause example in a signing document?

A mortgagee clause example is a provision in an insurance policy or mortgage agreement that protects the lender's interests. It typically outlines the lender's rights in terms of property insurance claims. Understanding this clause is crucial for both lenders and borrowers to ensure proper protection.

-

How does airSlate SignNow handle mortgagee clause examples in documents?

airSlate SignNow allows you to easily include a mortgagee clause example in your electronic documents. Our platform provides customizable templates that ensure all necessary provisions are included. This feature helps streamline the signing process while maintaining compliance with legal requirements.

-

Are there any costs associated with using airSlate SignNow for mortgage-related documents?

Yes, airSlate SignNow offers competitive pricing options for users looking to handle mortgage documents, including those with mortgagee clause examples. Our cost-effective solution is designed for businesses of all sizes, ensuring you only pay for what you need without compromising on features.

-

Can I automate the inclusion of mortgagee clause examples in my documents?

Absolutely! airSlate SignNow provides automation features that allow you to include mortgagee clause examples automatically. This saves time and reduces the chance of errors when preparing documents for your clients, making eSigning a seamless experience.

-

What benefits does airSlate SignNow provide for managing mortgagee clause examples?

Using airSlate SignNow for managing mortgagee clause examples offers several benefits, including improved efficiency, ease of use, and secure document handling. Our platform enhances collaboration between parties while ensuring that all necessary clauses are addressed during the signing process.

-

Is airSlate SignNow easy to integrate with other mortgage software?

Yes, airSlate SignNow offers easy integrations with various mortgage and financial software platforms. This capability allows users to enhance their workflows, ensuring related documents, including those with mortgagee clause examples, can be processed seamlessly across systems.

-

What compliance measures does airSlate SignNow have for mortgagee clause examples?

airSlate SignNow adheres to strict compliance standards to protect sensitive information, including mortgagee clause examples. We ensure that all electronic signatures and document handling comply with industry regulations, providing peace of mind for our users.

Get more for Mortgagee Clause

- Verbal warning tracking form ageia health services internal website

- Proposal development guideuniversity of delaware research form

- Volunteer application hispanic organization for progress form

- Employees withholding allowance certificate de 4 rev 48 form

- Bill of sale form d 4 employee withholding allowance

- School portrait order form creative images photography inc

- Private party agreement painting with friends form

- Merchandise claim form rev0511 two039s company

Find out other Mortgagee Clause

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form