Ky Dor Email Authorization Form

What is the Ky Dor Email Authorization Form

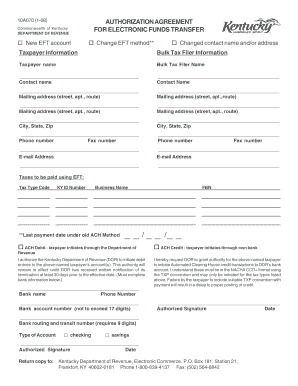

The Ky Dor Email Authorization Form is a document that allows individuals to authorize the Kentucky Department of Revenue (DOR) to communicate with them via email regarding their tax matters. This form is essential for taxpayers who prefer electronic communication for convenience and efficiency. By submitting this form, taxpayers can ensure they receive timely updates and notifications about their tax status, filings, and any other relevant information directly to their email inbox.

How to use the Ky Dor Email Authorization Form

Using the Ky Dor Email Authorization Form involves a few straightforward steps. First, you need to download the form from the Kentucky Department of Revenue's official website. After downloading, fill in the required fields, including your personal information and the email address you wish to use for correspondence. Once completed, submit the form according to the provided instructions, which may include mailing it to a designated address or submitting it electronically if available. It's important to ensure that the email address provided is accurate to avoid any communication issues.

Steps to complete the Ky Dor Email Authorization Form

Completing the Ky Dor Email Authorization Form requires careful attention to detail. Here are the steps to follow:

- Download the form from the Kentucky Department of Revenue website.

- Fill in your full name, address, and Social Security number or taxpayer identification number.

- Provide the email address where you wish to receive communications.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form as directed, either by mail or electronically.

Legal use of the Ky Dor Email Authorization Form

The legal use of the Ky Dor Email Authorization Form hinges on compliance with state regulations regarding electronic communications. By completing and submitting this form, taxpayers grant the Kentucky DOR permission to send sensitive tax-related information via email. This authorization is legally binding, provided that the form is filled out correctly and submitted according to the established guidelines. It is advisable to keep a copy of the submitted form for your records to ensure you have proof of authorization.

Key elements of the Ky Dor Email Authorization Form

Several key elements must be included in the Ky Dor Email Authorization Form to ensure its validity:

- Taxpayer Information: Full name, address, and identification number.

- Email Address: A valid email address for correspondence.

- Signature: The taxpayer's signature to confirm authorization.

- Date: The date of submission to establish a timeline for communication.

Form Submission Methods

The Ky Dor Email Authorization Form can typically be submitted through various methods, depending on the guidelines set by the Kentucky Department of Revenue. Common submission methods include:

- Mail: Sending the completed form to the designated address provided on the form.

- Online Submission: If available, submitting the form electronically through the Kentucky DOR's online portal.

Quick guide on how to complete ky dor email authorization form

Effortlessly prepare Ky Dor Email Authorization Form on any device

Online document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Ky Dor Email Authorization Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Ky Dor Email Authorization Form with ease

- Obtain Ky Dor Email Authorization Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues like lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Ky Dor Email Authorization Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ky dor email authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ky Dor Email Authorization Form?

The Ky Dor Email Authorization Form is an essential document that allows users to authorize email communications related to their accounts. It helps streamline communication processes and is vital for ensuring compliance with Kentucky's regulations. Using airSlate SignNow, you can easily create and manage this form digitally.

-

How can I create the Ky Dor Email Authorization Form using airSlate SignNow?

Creating the Ky Dor Email Authorization Form with airSlate SignNow is simple. You can use our intuitive template editor to fill in required fields, customize text, and add your logo. Once completed, just send it for eSignature to secure the authorization quickly and efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different needs, starting with a free trial for new users. Each plan provides access to features that include eSigning and document management, allowing you to efficiently handle the Ky Dor Email Authorization Form and other documents. Please visit our pricing page for detailed information on each plan.

-

What features does airSlate SignNow provide for handling the Ky Dor Email Authorization Form?

airSlate SignNow includes numerous features for managing the Ky Dor Email Authorization Form, such as customizable templates, secure eSigning, and real-time tracking of document status. You'll also benefit from cloud storage, making it easy to access your forms anywhere, anytime. These features enhance your document workflow and ensure compliance.

-

Are there any integrations available for the Ky Dor Email Authorization Form?

Yes, airSlate SignNow offers integrations with various software applications, such as Google Drive, Salesforce, and Dropbox. This allows you to seamlessly incorporate the Ky Dor Email Authorization Form into your existing workflows. Utilizing these integrations will help you save time and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Ky Dor Email Authorization Form?

Using airSlate SignNow for the Ky Dor Email Authorization Form provides numerous benefits, including faster processing times and reduced paper waste. The platform is user-friendly, helping you get documents signed without delays. Plus, you can manage your authorization forms in a secure and compliant manner, ensuring all data is protected.

-

Can I track the status of my Ky Dor Email Authorization Form?

Absolutely! With airSlate SignNow, you can track the status of your Ky Dor Email Authorization Form in real-time. You'll receive notifications when the document is opened, signed, or completed, giving you full visibility throughout the signing process. This feature helps you stay organized and informed.

Get more for Ky Dor Email Authorization Form

Find out other Ky Dor Email Authorization Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors