Form 3552

What is the Form 3552

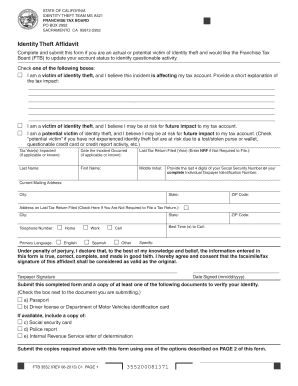

The Form 3552 is a tax-related document used by businesses and individuals in the United States to report specific financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is often required for various tax-related purposes. Understanding the purpose and requirements of Form 3552 is crucial for accurate reporting and avoiding potential penalties.

How to use the Form 3552

Using the Form 3552 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents and data needed to complete the form. Next, fill out the required sections, ensuring that all entries are precise and complete. Finally, review the form for accuracy before submission. It is important to follow IRS guidelines to ensure that the form is processed without issues.

Steps to complete the Form 3552

Completing the Form 3552 requires careful attention to detail. Start by downloading the latest version of the form from the IRS website. Next, fill in your personal information, including your name, address, and taxpayer identification number. Proceed to enter the financial data as required, ensuring that you follow the instructions provided on the form. After completing all sections, double-check your entries for accuracy. Once verified, sign and date the form before submitting it to the appropriate IRS address.

Legal use of the Form 3552

The Form 3552 must be used in accordance with IRS regulations to be considered legally binding. This includes ensuring that all information provided is truthful and accurate. Failure to comply with the legal requirements can result in penalties or audits. It is advisable to keep a copy of the completed form for your records, as well as any supporting documentation, to demonstrate compliance if required.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3552 can vary based on specific circumstances, such as the type of entity filing or the tax year in question. Generally, it is essential to submit the form by the designated due date to avoid penalties. Keeping track of important dates related to tax filings can help ensure timely compliance. Consult the IRS guidelines for specific deadlines relevant to your situation.

Form Submission Methods (Online / Mail / In-Person)

The Form 3552 can be submitted through various methods, including online filing, mailing, or in-person delivery to the IRS. Online submission is often the most efficient method, allowing for quicker processing times. If mailing the form, ensure that it is sent to the correct IRS address and consider using a trackable mailing service. In-person submissions may be possible at designated IRS offices, but it is recommended to check availability and hours before visiting.

Quick guide on how to complete form 3552

Complete Form 3552 effortlessly on any device

Managing documents online has become increasingly popular among enterprises and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork since you can easily locate the appropriate form and keep it safely online. airSlate SignNow gives you all the resources necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle Form 3552 on any device with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to edit and electronically sign Form 3552 without hassle

- Locate Form 3552 and click on Get Form to begin.

- Use the various tools we provide to finalize your document.

- Mark important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), an invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious searches for forms, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 3552 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3552

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3552, and how can airSlate SignNow help with it?

Form 3552 is a specific document used in various business processes, and airSlate SignNow simplifies its signing and management. By using our platform, you can securely eSign form 3552 and streamline your workflows. Our intuitive interface makes it easy to fill out and send this form without hassle.

-

How does airSlate SignNow ensure the security of form 3552?

airSlate SignNow prioritizes the security of your documents, including form 3552. We employ advanced encryption technologies and secure cloud storage to keep your information safe. Additionally, all eSignatures are legally binding, providing peace of mind when managing sensitive forms.

-

Is there a free trial available for using airSlate SignNow with form 3552?

Yes, airSlate SignNow offers a free trial that allows you to experience our features, including eSigning form 3552, without any upfront cost. During this trial period, you can explore all functionalities and see how they fit your business needs. Sign up today to start using form 3552 effectively.

-

What are the pricing options for airSlate SignNow when using form 3552?

The pricing for airSlate SignNow is competitive and designed to cater to businesses of all sizes, whether for occasional use of form 3552 or for frequent transactions. We offer various plans based on your volume needs and feature requirements. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software while using form 3552?

Absolutely! airSlate SignNow provides seamless integrations with popular software like CRM and project management tools. This allows you to enhance your workflow when handling form 3552 and other documents, ensuring everything is connected for optimal efficiency.

-

What features does airSlate SignNow offer for managing form 3552?

airSlate SignNow includes several features specifically designed to enhance the management of form 3552. You can easily create templates, track the signing progress, and set reminders for outstanding tasks. This simplicity saves you time, allowing you to focus on your business goals.

-

How can airSlate SignNow benefit my business when using form 3552?

Using airSlate SignNow for form 3552 can signNowly improve your business efficiency. Our easy-to-use platform reduces the time spent on paperwork, speeds up the signing process, and enhances document accuracy. Enjoy the benefits of a cost-effective solution while maintaining compliance with regulations.

Get more for Form 3552

- Imaging request form pdf centre for health centreforhealth org

- Case report form malaria public health surveillance surv esr cri

- Taylor fire department form

- Alameda county birth certificate application form

- Canada forms permit application

- Form 4003

- Quit voluntary separation from employment hrsdc ins5109 form

- Isp1002 form

Find out other Form 3552

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer