Collectors Municipal Form

What is the Collectors Municipal

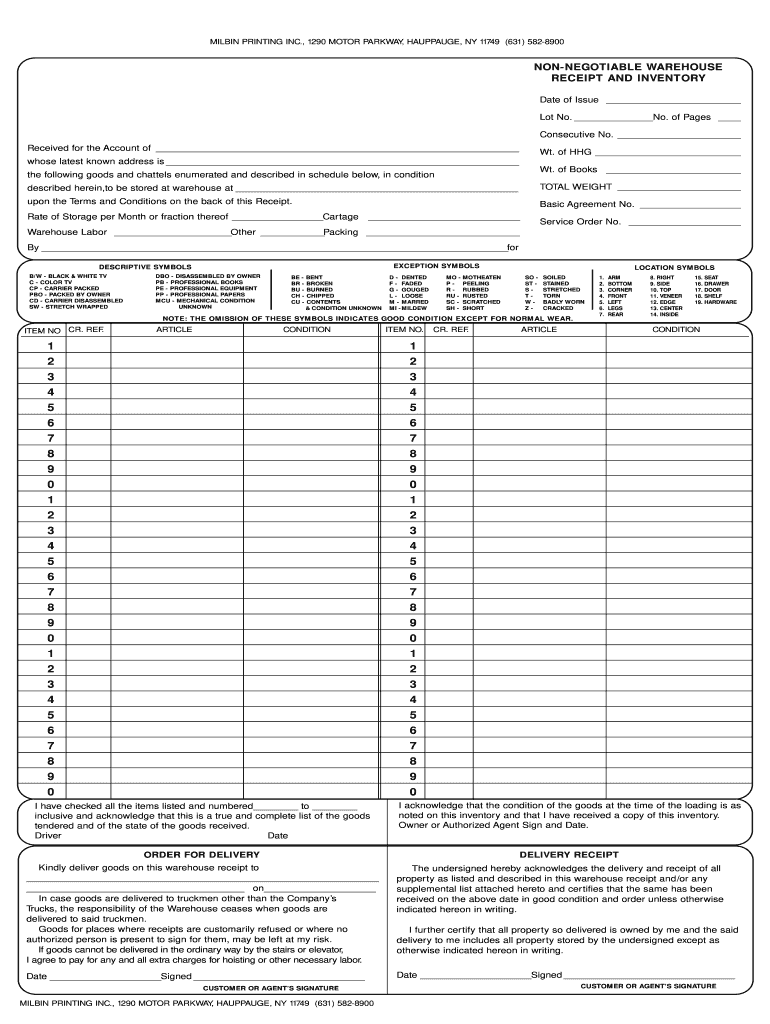

The collectors municipal form is a crucial document used by local governments in the United States to collect taxes and fees from residents and businesses. This form typically outlines the obligations of taxpayers and provides essential information about the local tax structure. It serves as a legal instrument to ensure compliance with municipal tax regulations, detailing the types of taxes applicable and the rates associated with them.

How to use the Collectors Municipal

To effectively use the collectors municipal form, individuals and businesses must first understand their tax obligations. This includes reviewing the specific taxes applicable to their situation, such as property tax or business license fees. Once familiar with the requirements, users can fill out the form accurately, ensuring all necessary information is provided. After completing the form, it should be submitted according to the instructions provided by the local government, which may include online submission, mailing, or in-person delivery.

Steps to complete the Collectors Municipal

Completing the collectors municipal form involves several key steps:

- Gather necessary information, including personal identification, property details, and financial records.

- Review the form carefully to understand the required fields and any specific instructions.

- Fill out the form accurately, ensuring all information is correct and complete.

- Double-check the form for any errors or omissions before submission.

- Submit the form through the designated method: online, by mail, or in person.

Legal use of the Collectors Municipal

The collectors municipal form is legally binding when completed and submitted in accordance with local laws. To ensure its validity, it must be filled out accurately, and all required signatures must be provided. Additionally, compliance with relevant laws and regulations, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, is essential when submitting the form electronically. This legal framework supports the enforceability of electronic signatures and documents.

Key elements of the Collectors Municipal

Several key elements are critical to the collectors municipal form:

- Taxpayer Information: This includes the name, address, and identification numbers of the taxpayer.

- Tax Type: The specific type of tax being assessed, such as property tax or business tax.

- Assessment Details: Information regarding the assessed value of property or business income.

- Payment Instructions: Guidance on how to pay the assessed taxes, including deadlines and accepted payment methods.

State-specific rules for the Collectors Municipal

Each state in the U.S. has its own regulations governing the collectors municipal form. These rules can vary significantly, affecting how the form is completed and submitted. It is important for taxpayers to familiarize themselves with their state’s specific requirements, including deadlines for submission, payment options, and any additional documentation that may be required. Consulting local government resources or tax professionals can provide valuable guidance on these state-specific rules.

Quick guide on how to complete collectors municipal

Prepare Collectors Municipal effortlessly on any device

Online document management has surged in popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Collectors Municipal on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Collectors Municipal effortlessly

- Locate Collectors Municipal and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet-ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Collectors Municipal and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collectors municipal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are collectors municipal and how can airSlate SignNow help?

Collectors municipal refers to the professionals or departments involved in managing municipal accounts and collections. airSlate SignNow streamlines the process by allowing these collectors municipal to easily send, sign, and manage documents electronically, enhancing efficiency and compliance.

-

What features does airSlate SignNow offer for collectors municipal?

AirSlate SignNow provides features tailored for collectors municipal, such as document templates, bulk sending, and secure eSigning. These features enable efficient handling of contracts, agreements, and notices, ensuring your workflow remains organized and timely.

-

How can I integrate airSlate SignNow with my existing systems for collectors municipal?

AirSlate SignNow offers seamless integrations with various platforms commonly used by collectors municipal, such as CRM and ERP systems. This ensures that adding eSignature capabilities into your existing workflow is straightforward and enhances overall productivity.

-

Is airSlate SignNow cost-effective for collectors municipal operations?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for collectors municipal, providing competitive pricing plans without compromising on essential features. This allows municipalities to save costs while improving operational efficiency.

-

What are the benefits of using airSlate SignNow for collectors municipal?

Using airSlate SignNow, collectors municipal can signNowly reduce paperwork, accelerate document processing, and enhance user experience. The platform also ensures better compliance and security, making it an ideal choice for managing municipal collections.

-

Can airSlate SignNow help with compliance requirements for collectors municipal?

Yes, airSlate SignNow is designed with compliance in mind, helping collectors municipal adhere to various legal requirements. Features such as audit trails, secure storage, and eSignature legality further ensure that all agreements meet regulatory standards.

-

What types of documents can collectors municipal sign using airSlate SignNow?

Collectors municipal can sign a variety of documents using airSlate SignNow, including notices, payment agreements, and contracts. This versatility allows for comprehensive management of municipal collections in a streamlined manner.

Get more for Collectors Municipal

- Instructions refer to your employee benefits booklet at httpsmn form

- Employee of the quarter nomination examples form

- Allinurl form

- Medical professional liability insurance claim report insurance mo form

- Sclp mental health mo application form

- Cs 201 dss form

- Life choices bates county memorial hospital form

- Mo 650 2616 form

Find out other Collectors Municipal

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free