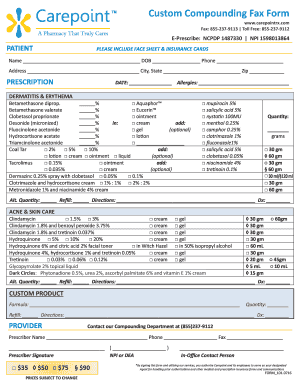

Custom Compounding Fax Form

What is the Form 101 Form?

The Form 101 form is a specific document used primarily for tax purposes in the United States. It serves as a crucial tool for individuals and businesses to report various financial activities to the Internal Revenue Service (IRS). This form may be required for specific tax filings, ensuring compliance with federal regulations. Understanding its purpose and requirements is essential for accurate filing and to avoid potential penalties.

How to Use the Form 101 Form

Using the Form 101 form involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial documents, such as income statements and expense records. Carefully read the instructions provided with the form, as they outline specific requirements and sections that must be completed. Fill out the form with accurate data, ensuring that all figures are correct to avoid discrepancies during processing. Once completed, review the form for any errors before submission.

Steps to Complete the Form 101 Form

Completing the Form 101 form can be straightforward if you follow these steps:

- Gather necessary documentation, including income and expense records.

- Read the instructions carefully to understand the requirements.

- Fill out personal information, including name, address, and Social Security number.

- Report income and expenses in the designated sections, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal Use of the Form 101 Form

The Form 101 form is legally binding when completed and submitted according to IRS guidelines. It must be filled out accurately to ensure compliance with tax laws. Providing false information can lead to legal consequences, including fines or audits. It is essential to understand the legal implications of submitting this form and to retain copies for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Form 101 form can vary depending on the specific tax year and the type of filer. Generally, individual taxpayers must submit their forms by April 15 of the following year. Businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these deadlines to avoid late fees and penalties.

Required Documents

To successfully complete the Form 101 form, certain documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Expense receipts and records.

- Previous tax returns for reference.

- Any relevant schedules or additional forms as specified by the IRS.

Form Submission Methods

The Form 101 form can be submitted through various methods, including:

- Online submission via the IRS website or approved e-filing services.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete custom compounding fax form

Effortlessly Prepare Custom Compounding Fax Form on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct template and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Custom Compounding Fax Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Method to Modify and eSign Custom Compounding Fax Form Seamlessly

- Obtain Custom Compounding Fax Form and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of your documents or mask sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Custom Compounding Fax Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the custom compounding fax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form 101 form' and how can I use it?

The 'form 101 form' is a customizable document that allows you to gather essential information from clients or stakeholders. With airSlate SignNow, you can easily create, send, and eSign this form to streamline your data collection process. Our platform ensures that filling out the 'form 101 form' is efficient and user-friendly.

-

What features does airSlate SignNow offer for the 'form 101 form'?

airSlate SignNow offers a variety of features for the 'form 101 form', including electronic signatures, document templates, and real-time tracking. You can also automate the workflow for this form to enhance your efficiency. These features make it easy to manage the 'form 101 form' from start to finish.

-

How can I integrate the 'form 101 form' with other applications?

airSlate SignNow allows seamless integration of the 'form 101 form' with various applications like Google Drive, Dropbox, and CRM tools. This enables you to manage your documents efficiently and enhances your workflow. You can easily connect these applications to keep your 'form 101 form' organized.

-

Is there a free trial available for the 'form 101 form' features?

Yes, airSlate SignNow offers a free trial that includes the features for managing the 'form 101 form'. This trial allows you to explore our document management tools without any commitments. Sign up today to experience the advantages of using the 'form 101 form' at no cost.

-

How secure is the eSigning process for the 'form 101 form'?

The eSigning process for the 'form 101 form' in airSlate SignNow is highly secure. We use encryption and advanced security measures to protect your documents and signatures. Rest assured that your 'form 101 form' will be safe and confidential throughout the signing process.

-

What are the pricing options available for using the 'form 101 form'?

airSlate SignNow offers flexible pricing plans that cater to different businesses for using the 'form 101 form'. Whether you are a small startup or a large corporation, there's a plan that fits your needs. Visit our pricing page to find the best option for managing your 'form 101 form' efficiently.

-

Can multiple users collaborate on the 'form 101 form'?

Absolutely! With airSlate SignNow, multiple users can collaborate on the 'form 101 form' simultaneously. This feature promotes teamwork and enhances communication among team members, ensuring that your 'form 101 form' is completed accurately and on time.

Get more for Custom Compounding Fax Form

Find out other Custom Compounding Fax Form

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online