Wi Repo Affidavit Form

What is the Wi Repo Affidavit

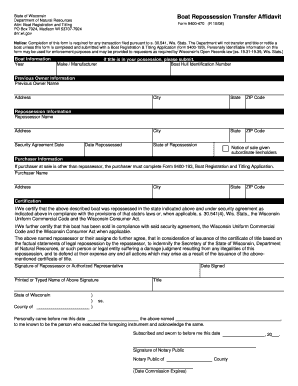

The Wisconsin repo affidavit is a legal document used in the repossession process. It serves as a formal declaration by the repossessor, affirming their right to reclaim property due to a default in payment by the borrower. This affidavit outlines the details of the repossession, including the type of property involved, the circumstances leading to the repossession, and the identities of both the repossessor and the borrower. Understanding this document is crucial for both parties involved, as it establishes the legal basis for the repossession action.

How to Use the Wi Repo Affidavit

Using the Wisconsin repossession affidavit involves several key steps. First, the repossessor must complete the affidavit accurately, ensuring all required information is included. Once filled out, the affidavit must be signed and dated by the repossessor. It is important to keep a copy for personal records. The completed affidavit may need to be presented to law enforcement if assistance is required during the repossession process. Additionally, the affidavit may be filed with the court if legal proceedings arise from the repossession.

Steps to Complete the Wi Repo Affidavit

Completing the Wisconsin repo affidavit requires careful attention to detail. Follow these steps:

- Gather necessary information, including the borrower's details, property description, and the reason for repossession.

- Fill out the affidavit form, ensuring all fields are completed accurately.

- Sign the affidavit in the presence of a notary public, if required.

- Make copies of the signed affidavit for your records.

- Submit the affidavit to the appropriate parties, such as law enforcement or the court, if necessary.

Legal Use of the Wi Repo Affidavit

The legal use of the Wisconsin repo affidavit is governed by state laws. It must be executed properly to be considered valid. This includes ensuring that all information is truthful and that the affidavit is signed by the repossessor. Misrepresentation or failure to follow legal procedures can lead to complications, including legal challenges from the borrower. Therefore, it is essential to understand the legal framework surrounding repossession in Wisconsin to ensure compliance.

Key Elements of the Wi Repo Affidavit

Several key elements must be included in the Wisconsin repo affidavit to ensure its validity:

- Identification of the parties: Names and addresses of both the repossessor and the borrower.

- Property description: A clear description of the property being repossessed.

- Reason for repossession: A statement detailing why the repossession is occurring, typically due to default on payment.

- Signature and date: The repossessor must sign and date the affidavit, often in the presence of a notary.

State-Specific Rules for the Wi Repo Affidavit

Wisconsin has specific rules governing the repossession process, which must be adhered to when using the repo affidavit. These rules include the proper notification to the borrower before repossession occurs and compliance with local laws regarding the handling of repossessed property. It is important for repossessors to familiarize themselves with these regulations to avoid legal issues and ensure a smooth repossession process.

Quick guide on how to complete wi repo affidavit

Complete Wi Repo Affidavit effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without delays. Manage Wi Repo Affidavit on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Wi Repo Affidavit with ease

- Obtain Wi Repo Affidavit and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from the device of your choice. Modify and electronically sign Wi Repo Affidavit and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wi repo affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key Wisconsin repo laws that affect vehicle repossession?

Wisconsin repo laws dictate the procedures that lenders must follow when repossessing a vehicle. These laws require lenders to provide a written notice to the borrower before any repossession occurs. Understanding these laws can help protect your rights and ensure the process is conducted legally.

-

How can airSlate SignNow help with documentation related to Wisconsin repo laws?

AirSlate SignNow streamlines the process of creating and signing legal documents necessary for compliance with Wisconsin repo laws. By utilizing our platform, you can ensure that all required notices and agreements are properly prepared and executed. This helps both lenders and borrowers navigate the complexities of repossession effectively.

-

Are there any costs associated with using airSlate SignNow for Wisconsin repo law documents?

airSlate SignNow offers a cost-effective solution for managing documentation, including those that comply with Wisconsin repo laws. Our pricing plans are designed to suit various business needs without burdening your budget. You can choose from multiple tiers based on your document volume and features required.

-

What features does airSlate SignNow offer for customers dealing with repossession?

With airSlate SignNow, users can easily create, manage, and eSign documents relevant to Wisconsin repo laws. Key features include customizable templates, automation of workflows, and secure document storage. These functionalities ensure you can handle the repossession process efficiently and legally.

-

Can airSlate SignNow integrate with other platforms for repossession management?

Yes, airSlate SignNow can seamlessly integrate with various platforms to enhance your repossession management process. Integrations with CRM and accounting software can help streamline workflows related to Wisconsin repo laws. This allows your team to remain organized and ensures compliance throughout the repossession process.

-

How does eSigning documents help with compliance to Wisconsin repo laws?

eSigning documents via airSlate SignNow ensures that all agreements related to Wisconsin repo laws are legally binding and easily verifiable. The electronic signature feature simplifies the signing process for all parties involved and maintains compliance with state regulations. This reduces the chances of disputes arising from documentation errors.

-

What are the benefits of using airSlate SignNow for my repossession business?

Using airSlate SignNow for your repossession business offers numerous benefits, including increased efficiency and improved compliance with Wisconsin repo laws. The platform's user-friendly interface allows for quick document preparation and signing, saving your team valuable time. Additionally, automated reminders help keep all parties informed throughout the repossession process.

Get more for Wi Repo Affidavit

- Officeisrequiredbythefederalgovernmenttoverifytheinformationyouprovidedonyourfinancialaidapplicationfafsais

- 2020 2021 student verification worksheet federal student form

- Intern keys form

- Formspierpont campamptc pierpont community ampamp technical

- 20182019 citizenship affidavit form

- Fillable online us army form tc 44 635 13 fax email

- 20202021 supplemental verification worksheet drexel form

- Conditions of participation agreement point park form

Find out other Wi Repo Affidavit

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online