83b Example Form

What is the 83b Example

The 83b election example refers to a provision under the Internal Revenue Code that allows individuals to elect to include the value of restricted property in their taxable income in the year it is transferred, rather than waiting until the property is no longer subject to restrictions. This is particularly relevant for employees receiving stock options or restricted stock as part of their compensation. By making this election, taxpayers can potentially benefit from lower tax rates on long-term capital gains if the property appreciates in value before the restrictions lapse.

How to use the 83b Example

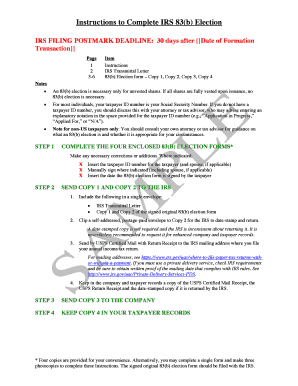

To use the 83b election example, individuals must complete the 83b election form, which requires specific information about the property received, the date of transfer, and the fair market value at the time of transfer. The completed form must be submitted to the IRS within thirty days of the property transfer. It is essential to keep a copy of the form for personal records, as it may be needed for future tax filings or if questions arise regarding the election.

Steps to complete the 83b Example

Completing the 83b election example involves several key steps:

- Gather necessary information, including the date of property transfer, fair market value, and any restrictions on the property.

- Fill out the 83b election form, ensuring all required details are accurately provided.

- Submit the completed form to the IRS within the thirty-day deadline.

- Retain a copy of the form for your records and future reference.

Legal use of the 83b Example

The legal use of the 83b election example hinges on compliance with IRS regulations. Taxpayers must ensure that they file the election within the specified thirty-day period to avoid penalties. Additionally, the election must be made for each grant of restricted property separately, as the rules can vary based on the type of property and the specific circumstances of the transfer. Consulting with a tax professional can help ensure that the election is made correctly and in accordance with the law.

IRS Guidelines

The IRS provides specific guidelines regarding the 83b election example, outlining who is eligible to make the election and the necessary steps to do so. According to IRS regulations, the election must be made in writing and submitted to the IRS within thirty days of the property transfer. The guidelines also state that the election applies to property that is subject to restrictions, such as vesting schedules, and that taxpayers must report the fair market value of the property at the time of transfer.

Filing Deadlines / Important Dates

Filing deadlines for the 83b election example are critical for compliance. The election must be submitted to the IRS within thirty days of the property transfer date. Failure to file within this timeframe can result in the loss of the election and potential tax implications. It is advisable to mark the calendar with important dates related to the transfer and submission to ensure timely compliance.

Quick guide on how to complete 83b example

Easily Prepare 83b Example on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle 83b Example on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Modify and Electronically Sign 83b Example Effortlessly

- Locate 83b Example and click on Get Form to begin.

- Use the tools at your disposal to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign 83b Example to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 83b example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 83b example?

A form 83b example refers to the IRS form used by startups and entrepreneurs to elect to be taxed on the fair market value of restricted stock at the time of granting. This can result in favorable tax treatment if the stock increases in value. Understanding a form 83b example can help founders make informed decisions about their equity compensation.

-

How can airSlate SignNow help with submitting a form 83b example?

With airSlate SignNow, businesses can easily create, sign, and send a form 83b example directly from the platform. The user-friendly interface allows for seamless document management, ensuring that important tax documents are submitted accurately and on time. Leveraging airSlate SignNow ensures that your form 83b example receives the necessary signatures quickly.

-

What features does airSlate SignNow offer for managing forms like the form 83b example?

airSlate SignNow provides a range of features, including customizable templates, in-app signing, and document tracking. For a form 83b example, you can utilize templates to streamline the process of creating the document. These features help simplify the management of essential tax-related forms.

-

Is there a cost associated with using airSlate SignNow for a form 83b example?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including managing documents like a form 83b example. The pricing is competitive and designed to provide value for businesses looking for efficient e-signature solutions. Consider choosing a plan that best suits your requirements to handle all forms effectively.

-

Can airSlate SignNow integrate with other applications for handling a form 83b example?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage documents like a form 83b example. Integration capabilities with platforms such as Google Drive and Salesforce streamline workflows and improve your overall document management process. This flexibility can save you time and effort in handling your important documents.

-

What are the benefits of using airSlate SignNow for form 83b examples?

Using airSlate SignNow for form 83b examples provides several benefits, including increased efficiency in document preparation and faster turnaround times for signatures. The platform's security features protect sensitive information, ensuring compliance with tax regulations. Moreover, the ability to track document progress helps businesses manage their forms effectively.

-

How does airSlate SignNow ensure the security of a form 83b example?

airSlate SignNow prioritizes security by employing advanced encryption protocols and secure cloud storage for documents like a form 83b example. This means that your sensitive information remains protected throughout the signing process. Regular audits and compliance with industry standards further enhance the platform’s security measures.

Get more for 83b Example

- Ignition interlock program non owned vehicle installation approval created 312 washington state patrol impaired driving section form

- Oklahoma insurance department state of oklahoma surplus lines insurance broker form sl3c quarter ampamp ok

- Cleveland clinic discharge papers form

- Charles p allen form

- 61 1re form

- Transcript student request form

- Application to vary suspend or attachment order cancel justice govt form

- Cfis form

Find out other 83b Example

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement