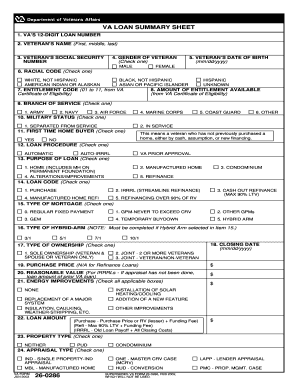

Loan Summary Sheet Form

What is the Loan Summary Sheet

The loan summary sheet is a crucial document that provides a concise overview of the terms and conditions associated with a loan. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. It serves as a reference for both borrowers and lenders, ensuring that all parties are aware of their obligations and rights under the loan agreement. Understanding the components of the loan summary sheet is vital for making informed financial decisions.

How to Use the Loan Summary Sheet

Utilizing the loan summary sheet effectively involves reviewing its contents carefully. Borrowers should examine the key terms outlined in the document, such as the total amount borrowed and the interest rate. It is also essential to note the repayment schedule, including the frequency of payments and the total duration of the loan. By understanding these elements, borrowers can better manage their finances and ensure timely payments. Additionally, having a clear grasp of the loan summary sheet can aid in discussions with lenders and help address any questions or concerns.

Steps to Complete the Loan Summary Sheet

Completing the loan summary sheet requires attention to detail. Here are the steps to follow:

- Gather all necessary information about the loan, including the amount, interest rate, and repayment terms.

- Fill in the borrower and lender details accurately, ensuring that names and addresses are correct.

- Clearly outline the loan amount and any fees associated with the loan.

- Specify the interest rate and how it is applied (fixed or variable).

- Detail the repayment schedule, including the start date and frequency of payments.

- Review the completed form for accuracy before submission.

Key Elements of the Loan Summary Sheet

The loan summary sheet includes several key elements that are critical for understanding the loan agreement. These elements typically consist of:

- Loan Amount: The total sum of money borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: Details about how and when payments are to be made.

- Fees: Any additional costs associated with the loan, such as origination fees.

- Borrower and Lender Information: Names and contact details of both parties involved in the loan.

Legal Use of the Loan Summary Sheet

The loan summary sheet is legally binding when completed correctly and signed by both parties. It is essential to ensure that all information is accurate and that both the borrower and lender understand the terms outlined in the document. Compliance with relevant laws, such as the Truth in Lending Act, is also necessary to protect the rights of both parties. Utilizing a reliable electronic signature solution can further enhance the legal standing of the loan summary sheet.

Examples of Using the Loan Summary Sheet

The loan summary sheet can be used in various scenarios, including:

- Personal loans for purchasing a vehicle or financing home improvements.

- Business loans for expanding operations or purchasing equipment.

- Student loans for funding education expenses.

In each case, the loan summary sheet provides a clear outline of the loan terms, helping borrowers make informed decisions and manage their repayment responsibilities effectively.

Quick guide on how to complete loan summary sheet

Complete Loan Summary Sheet smoothly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Loan Summary Sheet on any gadget with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Loan Summary Sheet effortlessly

- Locate Loan Summary Sheet and click Get Form to begin.

- Use the tools we provide to finish your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for such tasks.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors necessitating new printed copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign Loan Summary Sheet and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan summary sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan summary template and how can it benefit my business?

A loan summary template is a document that outlines the details of a loan, including the amount, interest rate, repayment terms, and any additional fees. Using a loan summary template can help your business present loan information clearly and professionally, streamlining communication with clients and stakeholders.

-

How much does the loan summary template feature cost with airSlate SignNow?

The pricing for the loan summary template feature is competitive and varies based on the specific plan you choose. AirSlate SignNow offers flexible pricing options to suit the needs of different businesses, ensuring that you can access vital document tools like the loan summary template without breaking your budget.

-

Can I customize the loan summary template to fit my company's branding?

Yes, airSlate SignNow allows you to customize the loan summary template to align with your company's branding. You can add your logo, change the color scheme, and modify the layout to create a professional look that reflects your business identity.

-

Are there any integrations available for the loan summary template?

Absolutely! The loan summary template can be easily integrated with various applications and platforms that your business already uses. This integration capability enhances your workflow and ensures that your loan documentation processes are seamless and efficient.

-

Is it easy to eSign a loan summary template using airSlate SignNow?

Yes, airSlate SignNow simplifies the eSigning process for your loan summary template. With just a few clicks, you can send the template to clients for signatures, ensuring that obtaining approvals on loan documents is quick and hassle-free.

-

What features does the loan summary template include?

The loan summary template includes essential features such as customizable fields, automatic calculations for payments, and space for borrower and lender signatures. These features are designed to enhance accuracy and usability, making your documentation process more efficient.

-

Can I share the loan summary template with others securely?

Yes, airSlate SignNow provides robust security measures for sharing your loan summary template. You can securely send the template to clients or team members while ensuring that sensitive data is protected, giving you peace of mind during the document-sharing process.

Get more for Loan Summary Sheet

- Patient consent form phi patient consent form phi

- Beneficiary nomination form commonwealth

- Fillable online pubs usgs characteristics of streams and form

- Sanitation department rssc form fill online printable

- 7 top questions to ask before opening a bank account form

- Auburn favn form

- Informed consent for exercise treadmill test informed consent for exercise treadmill test

- Competition mail claim for rebate recipient created tax form

Find out other Loan Summary Sheet

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document