Form 3522 Online

What is the Form 3522 Online

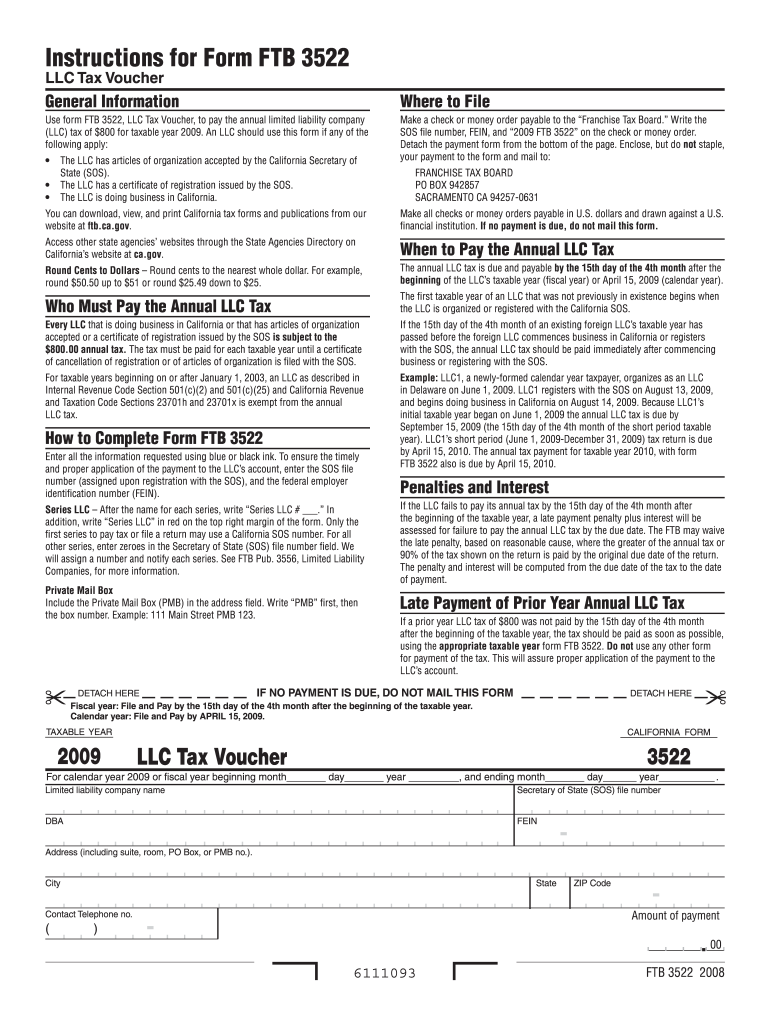

The Form 3522, also known as the LLC Tax Voucher, is a tax document used by limited liability companies (LLCs) in the United States to report and pay their annual franchise tax. This form is essential for maintaining compliance with state regulations, particularly in California. By completing the form online, businesses can streamline the process, ensuring timely submission and payment of the required tax.

How to use the Form 3522 Online

Using the Form 3522 online involves several straightforward steps. First, access the digital version of the form through a reliable platform. Next, fill in the required fields, including your LLC's name, address, and tax identification number. After completing the form, review all entries for accuracy. Finally, submit the form electronically to the appropriate state agency, ensuring you receive confirmation of submission for your records.

Steps to complete the Form 3522 Online

Completing the Form 3522 online requires careful attention to detail. Follow these steps for successful submission:

- Gather necessary information, such as your LLC's name and tax ID.

- Access the online form through a secure platform.

- Fill in all required fields accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically and save the confirmation receipt.

Legal use of the Form 3522 Online

The legal validity of the Form 3522 when submitted online is supported by compliance with electronic signature laws, such as the ESIGN Act and the Uniform Electronic Transactions Act (UETA). To ensure that your submission is legally binding, it is important to use a trusted electronic signature solution that provides verification and security features, such as audit trails and encryption.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 3522 is crucial for compliance. Typically, the form must be submitted by the 15th day of the fourth month following the close of your LLC's fiscal year. For most LLCs operating on a calendar year, this means the deadline is April 15. It is important to mark your calendar and plan ahead to avoid penalties for late submission.

Required Documents

When completing the Form 3522 online, certain documents may be necessary to ensure accurate reporting. These documents typically include:

- Your LLC's tax identification number.

- Financial records that detail your LLC's income and expenses.

- Previous year’s tax returns, if applicable.

Having these documents ready will facilitate a smoother completion process.

Quick guide on how to complete form 3522 online

Complete Form 3522 Online effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files promptly without delays. Manage Form 3522 Online on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Form 3522 Online with ease

- Obtain Form 3522 Online and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 3522 Online and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3522 online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3522 online?

Form 3522 online is a digital version of the California Department of Motor Vehicles' vehicle registration renewal form. This online process allows users to efficiently complete and submit their renewal without the need for paper forms, streamlining the experience for both individuals and businesses.

-

How do I fill out form 3522 online with airSlate SignNow?

To fill out form 3522 online using airSlate SignNow, simply create an account and upload the form. You can easily fill in the required fields, sign your document, and secure it with eSignature technology, all in a user-friendly interface.

-

Is it secure to use airSlate SignNow for form 3522 online?

Yes, using airSlate SignNow for form 3522 online is highly secure. Our platform utilizes encryption protocols and advanced security features to ensure that your personal information and documents remain protected throughout the signing process.

-

What are the pricing options for using airSlate SignNow to complete form 3522 online?

airSlate SignNow offers flexible pricing plans to suit different needs, starting with a free trial. As you explore the features for completing form 3522 online, you can choose from various subscription options that provide access to advanced functionalities at competitive rates.

-

Can I track the status of my form 3522 online submission?

Absolutely! airSlate SignNow allows you to track the status of your form 3522 online submission in real time. You will receive notifications once your document is signed, and you can view the signing history for complete transparency.

-

Does airSlate SignNow support integrations with other applications for form 3522 online?

Yes, airSlate SignNow provides numerous integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This compatibility ensures that you can efficiently manage your documents, including form 3522 online, in a seamless workflow.

-

What advantages does airSlate SignNow offer for completing form 3522 online compared to traditional methods?

The main advantages of using airSlate SignNow for form 3522 online include faster processing times, reduced paperwork, and enhanced convenience. With eSigning capabilities, you can complete and submit your form quickly, saving both time and resources typically associated with traditional methods.

Get more for Form 3522 Online

- Chuo cha utumishi wa umma form

- Formulario 399 tributum

- Modello f24 predeterminato editabile form

- Kanyashree 2020 2021 form

- Motion for continuance template form

- Landlord verification form 100078553

- Full name of party filing documentmailing address form

- Small claims idaho court assistance office state of idaho form

Find out other Form 3522 Online

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement