Form W 4

What is the Form W-4

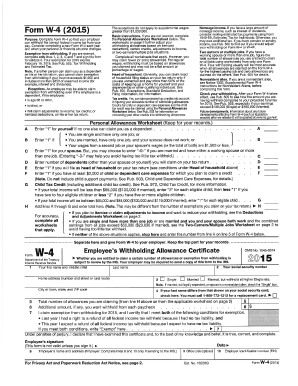

The Form W-4, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employer about the amount of federal income tax to withhold from their paychecks. This form helps ensure that the correct amount of tax is withheld, which can prevent underpayment or overpayment of taxes throughout the year. The information provided on the W-4 directly impacts an employee's take-home pay and tax liability during tax season.

How to use the Form W-4

Using the Form W-4 is straightforward. Employees should complete the form when they start a new job or when their financial situation changes, such as marriage, divorce, or the birth of a child. To use the form effectively, follow these steps:

- Obtain the latest version of the Form W-4 from the IRS website or your employer.

- Fill out personal information, including your name, address, Social Security number, and filing status.

- Indicate the number of allowances you are claiming, which affects how much tax is withheld.

- Consider additional withholdings if you expect to owe more taxes.

- Sign and date the form before submitting it to your employer.

Steps to complete the Form W-4

Completing the Form W-4 involves several key steps to ensure accuracy and compliance:

- Start by entering your personal details at the top of the form.

- Choose your filing status: single, married filing jointly, married filing separately, or head of household.

- Claim allowances based on your personal and financial situation. The more allowances you claim, the less tax will be withheld.

- If applicable, include any additional amount you want withheld from each paycheck.

- Review your entries for accuracy, then sign and date the form before submitting it to your employer.

Legal use of the Form W-4

The legal use of the Form W-4 is governed by IRS guidelines. Employees must provide accurate information to avoid penalties. Misrepresentation on the form can lead to under-withholding, resulting in a tax bill at the end of the year. Employers are required to keep the W-4 on file and use it to calculate the correct withholding amount. It is essential to update the form whenever there are significant life changes that affect your tax situation.

IRS Guidelines

The IRS provides specific guidelines for completing the Form W-4. These guidelines include:

- Understanding how allowances work and their impact on withholding.

- Using the IRS withholding calculator to determine the right number of allowances.

- Submitting a new W-4 whenever there are changes in personal circumstances that affect tax liability.

- Consulting IRS publications for detailed instructions and examples.

Form Submission Methods

Submitting the Form W-4 can be done in various ways, depending on your employer's preferences:

- Online: Many employers allow employees to complete and submit the form electronically through their payroll system.

- Mail: If required, you can print the completed form and mail it directly to your employer's HR or payroll department.

- In-Person: You may also deliver the form personally to your employer's HR department.

Quick guide on how to complete form w 4 100517140

Complete Form W 4 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the right format and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without hold-ups. Manage Form W 4 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to update and eSign Form W 4 without hassle

- Find Form W 4 and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your preference. Edit and eSign Form W 4 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4 100517140

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 4 and why is it important?

Form W 4 is a tax form used by employers to calculate the correct amount of federal income tax to withhold from employees' paychecks. Completing Form W 4 accurately ensures that proper withholding amounts are deducted, helping employees avoid underpayment or overpayment of taxes throughout the year.

-

How can airSlate SignNow help with Form W 4 management?

airSlate SignNow streamlines the process of filling out and signing Form W 4 by providing an intuitive platform for electronic signatures. This allows employees to easily complete and submit their W 4 forms securely and efficiently, reducing paperwork and ensuring timely compliance.

-

Is there a cost associated with using airSlate SignNow for Form W 4?

Yes, airSlate SignNow offers a cost-effective pricing model that varies based on the plan chosen. Pricing is competitive, and the platform provides various features to facilitate the electronic signing process of documents like Form W 4, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for Form W 4 documentation?

airSlate SignNow includes features such as template creation for Form W 4, easy document sharing, secure electronic signatures, and automated reminders to ensure the completion of forms. These features enhance efficiency and accuracy in managing employee tax forms.

-

How does airSlate SignNow ensure the security of Form W 4 submissions?

Security is a top priority for airSlate SignNow. The platform uses encryption, secure servers, and compliance with regulations such as GDPR and HIPAA to protect sensitive information submitted in Form W 4, ensuring that both employers and employees can trust the handling of their data.

-

Can Form W 4 be integrated with other HR systems using airSlate SignNow?

Yes, airSlate SignNow provides robust integrations with various HR and payroll systems, enabling seamless processes for managing Form W 4 across platforms. This integration ensures that the necessary data flows between systems, minimizing manual entry and reducing potential errors.

-

What benefits does airSlate SignNow provide for businesses handling Form W 4?

By using airSlate SignNow for handling Form W 4, businesses benefit from reduced turnaround time, improved accuracy in document processing, and enhanced employee satisfaction due to the easy-to-use interface. The platform allows for faster onboarding and ensures compliance with tax regulations.

Get more for Form W 4

- Louisiana lease termination notices and formsus legal forms

- Hawaii 5 day notice to quit formnon payment of rent

- Eviction notice florida templateestemplatega form

- Free indiana standard residential lease agreement template form

- Indiana standard residential lease agreement template eforms

- Free colorado lease termination letter form jdf 97 pdf

- Kansas lease agreement with option to purchase form

- Iowa lease with option to purchase lease to own agreement form

Find out other Form W 4

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form