Uk Form Capital Gains

Understanding the CG34 Form

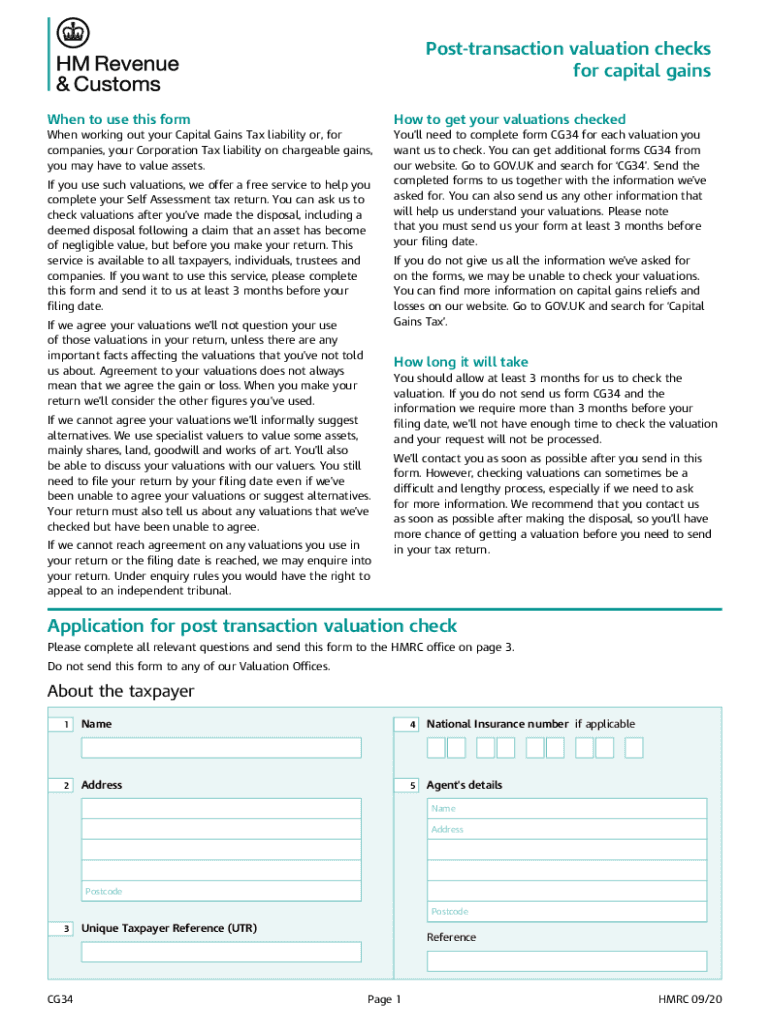

The CG34 form is a crucial document used for reporting capital gains in the United Kingdom. It is primarily utilized by individuals and businesses to declare gains made from the sale of assets, ensuring compliance with tax regulations. Understanding the purpose and requirements of the CG34 form is essential for accurate reporting and to avoid potential penalties.

Steps to Complete the CG34 Form

Completing the CG34 form involves several important steps to ensure accuracy and compliance. Here are the key steps to follow:

- Gather all necessary information regarding the assets sold, including purchase and sale dates, sale price, and costs associated with the sale.

- Fill out the form with accurate details, ensuring that all figures are correct and reflect the actual transactions.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on the preferred submission method.

Legal Use of the CG34 Form

The CG34 form must be completed in accordance with legal requirements to be considered valid. This includes providing accurate information and adhering to deadlines set by tax authorities. Failure to comply with these regulations can result in penalties or fines. It is important to keep records of all transactions and submissions related to the CG34 form to ensure legal protection and compliance.

Filing Deadlines for the CG34 Form

Filing deadlines for the CG34 form are critical to avoid late fees and penalties. Typically, the form must be submitted within a specific timeframe following the sale of an asset. It is advisable to check the current tax year’s deadlines to ensure timely submission. Keeping track of these dates can help maintain compliance and avoid unnecessary complications.

Required Documents for the CG34 Form

When completing the CG34 form, certain documents are necessary to support the information provided. These may include:

- Proof of purchase and sale of the asset, such as contracts or receipts.

- Documentation of any costs incurred during the sale process, which can be deducted from the total gain.

- Previous tax returns, if applicable, to provide context for the current filing.

Examples of Using the CG34 Form

Examples of situations where the CG34 form is applicable include:

- Individuals selling real estate, such as a home or rental property, and needing to report capital gains.

- Businesses liquidating assets, such as equipment or inventory, that have appreciated in value.

- Investors selling stocks or bonds that have generated profits, requiring declaration of those gains.

Quick guide on how to complete uk form capital gains

Complete Uk Form Capital Gains effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the required form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Uk Form Capital Gains on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Uk Form Capital Gains with ease

- Locate Uk Form Capital Gains and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Uk Form Capital Gains and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is cg34 in the context of airSlate SignNow?

Cg34 refers to a specific feature within airSlate SignNow that enhances document signing and management. This functionality allows users to streamline their workflows, making it easier to send and eSign documents securely. With cg34, you can expect a more integrated experience that supports your business needs efficiently.

-

How does airSlate SignNow pricing work with cg34?

airSlate SignNow offers flexible pricing plans that include access to the cg34 features. Depending on your business size and needs, you can choose a plan that fits your budget while still leveraging the advantages of cg34. This ensures you get the best value for deploying document signing solutions.

-

What benefits does cg34 provide for businesses?

Cg34 brings several benefits to businesses, including improved turnaround times for document approvals and enhanced compliance tracking. By using cg34 within airSlate SignNow, you will experience increased operational efficiency as signatures are collected electronically. This not only speeds up processes but also reduces paper waste.

-

Can airSlate SignNow’s cg34 integrate with other software applications?

Yes, cg34 can seamlessly integrate with various software applications, allowing for a smoother workflow. Common integrations include CRM systems, HR software, and cloud storage solutions. This flexibility means you can enhance your document management processes without disrupting your existing tools.

-

What types of documents can I send using cg34?

Using cg34, you can send a wide variety of documents including contracts, agreements, and official forms. The flexibility of airSlate SignNow means you can customize document templates to fit your needs. This functionality makes cg34 suitable for different industries and business cases.

-

Is airSlate SignNow secure when using cg34?

Absolutely, airSlate SignNow prioritizes security, particularly with its cg34 functionalities. It employs advanced encryption protocols and complies with industry regulations to ensure your documents are safely transmitted and stored. You can trust cg34 for secure eSigning experiences.

-

How do I get started with cg34 on airSlate SignNow?

Getting started with cg34 on airSlate SignNow is simple. You can sign up for a trial or select a pricing plan that meets your needs. Once you have access, the interface guides you through setting up your documents and eSigning processes.

Get more for Uk Form Capital Gains

- Acupuncture consent form aacp

- Trichotillomania self monitoring form

- Donation receipt template canada form

- Thor rv manuals online form

- Application for emergency admission application for emergency admission form

- Form 02hm001e ag 2 part i oklahoma gov

- F8857 form

- Request for official letter of registration pdf durham college form

Find out other Uk Form Capital Gains

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney