Hays Salary Sacrifice Form

What is the Hays Salary Sacrifice

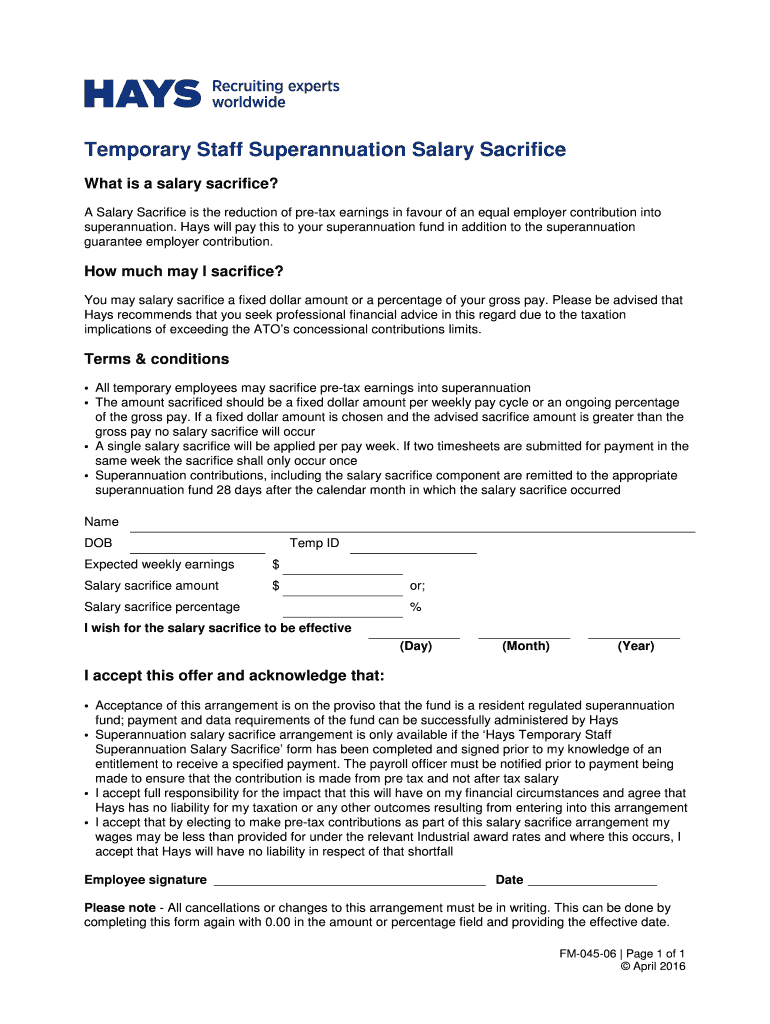

The Hays Salary Sacrifice is a financial arrangement where an employee agrees to forgo a portion of their salary in exchange for non-cash benefits. This can include contributions to retirement plans, health insurance, or other perks that may offer tax advantages. By participating in a salary sacrifice scheme, employees can potentially reduce their taxable income, leading to lower tax liabilities. This arrangement can be beneficial for both employees and employers, as it can enhance employee satisfaction while also providing cost savings for the organization.

How to use the Hays Salary Sacrifice

Utilizing the Hays Salary Sacrifice involves a few straightforward steps. First, employees should consult with their HR department or financial advisor to understand the available benefits and how they align with personal financial goals. Next, employees need to formally agree to the salary sacrifice arrangement, which typically requires completing specific forms. Once the agreement is in place, the designated portion of the salary will be redirected towards the chosen benefits before taxes are applied, effectively lowering the employee's taxable income.

Steps to complete the Hays Salary Sacrifice

Completing the Hays Salary Sacrifice process involves several key steps:

- Review available benefits: Understand what non-cash benefits are offered through the salary sacrifice scheme.

- Consult with HR: Discuss the implications of salary sacrifice with your HR department or a financial advisor.

- Complete necessary forms: Fill out the required documentation to formalize the salary sacrifice agreement.

- Submit the forms: Ensure that all forms are submitted to the appropriate department for processing.

- Monitor your pay: After the arrangement is in place, regularly check your pay stubs to confirm the correct deductions are being made.

Legal use of the Hays Salary Sacrifice

The legal framework governing the Hays Salary Sacrifice is essential for ensuring compliance with tax regulations. Employees must ensure that their salary sacrifice agreement is documented properly and adheres to relevant laws, such as the Internal Revenue Code. It is crucial that the arrangement does not violate any employment contracts or labor laws. Employers should also maintain accurate records to demonstrate compliance in case of audits or inquiries from tax authorities.

Eligibility Criteria

To participate in the Hays Salary Sacrifice, employees typically need to meet certain eligibility criteria. These may include being a full-time employee, having a minimum length of service with the employer, and being enrolled in the benefits offered under the scheme. Some organizations may impose additional requirements based on their specific policies or the types of benefits available. It is advisable for employees to verify their eligibility with HR before proceeding.

Examples of using the Hays Salary Sacrifice

There are various ways employees can utilize the Hays Salary Sacrifice to their advantage. Common examples include:

- Contributing to a retirement plan, which can enhance future financial security.

- Opting for additional health insurance coverage, leading to better healthcare access.

- Participating in a childcare voucher scheme, which can help offset childcare costs.

These examples illustrate how salary sacrifice can provide tangible benefits while also reducing taxable income.

Quick guide on how to complete hays salary sacrifice

Effortlessly Prepare Hays Salary Sacrifice on Any Device

Digital document management has become popular among businesses and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without any delays. Manage Hays Salary Sacrifice on any device using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to Modify and eSign Hays Salary Sacrifice with Ease

- Locate Hays Salary Sacrifice and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only moments and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Hays Salary Sacrifice, ensuring excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hays salary sacrifice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is hays salary sacrifice?

Hays salary sacrifice is an arrangement where an employee agrees to give up a portion of their salary in exchange for non-cash benefits, such as additional holidays or pension contributions. This system can be beneficial for tax savings and enhancing employee satisfaction. Companies can utilize the airSlate SignNow platform to eSign the necessary documents quickly and securely, streamlining the process.

-

How can hays salary sacrifice benefit my business?

Implementing hays salary sacrifice can enhance your employee benefits package, potentially improving retention rates. It helps in lowering the overall tax burden for both employers and employees, making it a cost-effective solution. Businesses using airSlate SignNow can efficiently manage and eSign agreements related to these sacrifices, making the process seamless.

-

What features does airSlate SignNow offer for managing hays salary sacrifice agreements?

AirSlate SignNow provides a user-friendly interface for managing hays salary sacrifice agreements with features like secure eSigning, document tracking, and templates for quick setup. These tools enable businesses to efficiently handle paperwork while ensuring compliance and reducing administrative overhead. The platform is designed to simplify the experience for both employers and employees.

-

Is there a cost associated with hays salary sacrifice setup in airSlate SignNow?

While the cost of implementing hays salary sacrifice varies depending on your specific package with airSlate SignNow, it is generally considered a cost-effective solution compared to traditional methods. The platform offers flexible pricing plans, allowing businesses of all sizes to choose a solution that fits their budget. It's advisable to signNow out for a quote based on your operational needs.

-

Can hays salary sacrifice be integrated with existing payroll systems?

Yes, hays salary sacrifice can be integrated with many existing payroll systems. AirSlate SignNow supports various integrations, allowing for easier data management and transaction tracking. This integration helps automate the salary sacrifice process, ensuring that all calculations and records are accurate and up-to-date.

-

What are the tax implications of hays salary sacrifice?

Hays salary sacrifice can provide tax advantages for both employees and employers, as it minimizes taxable income. Employers can save on National Insurance contributions while employees may benefit from reduced Income Tax liabilities. It's essential to consult with a tax advisor to understand fully how hays salary sacrifice might affect your specific tax situation.

-

How can employees learn more about the hays salary sacrifice options available?

Employees can educate themselves about hays salary sacrifice by reviewing the resources provided by their employer, including informational sessions or documentation. Additionally, airSlate SignNow can facilitate easy access to documents outlining available benefits and how to participate effectively. Open communication between employers and employees is key to maximizing participation in these programs.

Get more for Hays Salary Sacrifice

- Named below to the authorized persons or organization named below for the tax types specified below form

- De form 8821de

- Form 6401

- State of delaware delaware division of revenue delawaregov form

- Form 1100 ext

- Person claiming refund for deceased taxpayer indiviudal taxpayer form

- Form 5347

- Tax year 1099 misc instructions to agencies 1099 instructions form

Find out other Hays Salary Sacrifice

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy