CT 1096, Connecticut Annual Summary and Transmittal of Form

What is the CT 1096, Connecticut Annual Summary And Transmittal Of

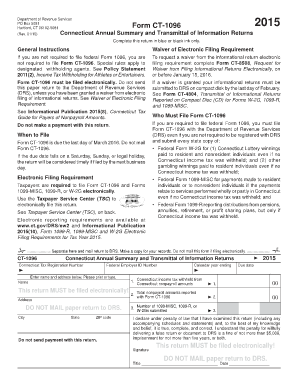

The CT 1096, Connecticut Annual Summary and Transmittal Of, is a crucial tax form that businesses in Connecticut must complete to report annual wage and tax information to the state. This form consolidates data from various employee wage statements, such as W-2 forms, and provides the Connecticut Department of Revenue Services with a comprehensive overview of the payroll taxes withheld throughout the year. It is essential for ensuring compliance with state tax regulations and for accurate reporting of employee earnings.

Steps to complete the CT 1096, Connecticut Annual Summary And Transmittal Of

Completing the CT 1096 involves several key steps to ensure accuracy and compliance. First, gather all necessary employee wage statements, including W-2 forms. Next, summarize the total wages paid and the total state income tax withheld for each employee. This information should be compiled in the designated sections of the CT 1096 form. After filling out the form, review it for any errors or omissions. Finally, submit the completed form to the Connecticut Department of Revenue Services by the specified deadline, either electronically or via mail.

Legal use of the CT 1096, Connecticut Annual Summary And Transmittal Of

The CT 1096 serves a legal purpose in tax reporting and compliance for businesses operating in Connecticut. By accurately completing and submitting this form, employers fulfill their obligation to report wages and taxes withheld from employees. This compliance is essential to avoid potential penalties and legal repercussions. The form must be signed and dated by an authorized representative of the business, ensuring that the information provided is truthful and complete.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines associated with the CT 1096. Typically, the form must be submitted by the end of January following the tax year being reported. This deadline ensures that the Connecticut Department of Revenue Services receives timely information regarding employee wages and taxes. Employers should also keep in mind any specific dates for electronic filing, as these may differ from paper submission deadlines.

Form Submission Methods (Online / Mail / In-Person)

The CT 1096 can be submitted through various methods, providing flexibility for employers. Businesses may choose to file the form electronically via the Connecticut Department of Revenue Services' online portal, which is often the preferred method due to its efficiency and ease of use. Alternatively, employers can print the completed form and submit it by mail. In-person submissions may also be possible at designated state offices, although this method is less common.

Key elements of the CT 1096, Connecticut Annual Summary And Transmittal Of

Understanding the key elements of the CT 1096 is vital for accurate completion. The form typically includes sections for reporting the total number of employees, total wages paid, and total state income tax withheld. Additionally, it requires the employer's identification information, including the Federal Employer Identification Number (FEIN) and the business name and address. Ensuring that all these elements are correctly filled out is crucial for compliance and accurate reporting.

Quick guide on how to complete ct 1096 connecticut annual summary and transmittal of

Prepare CT 1096, Connecticut Annual Summary And Transmittal Of with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle CT 1096, Connecticut Annual Summary And Transmittal Of on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign CT 1096, Connecticut Annual Summary And Transmittal Of hassle-free

- Obtain CT 1096, Connecticut Annual Summary And Transmittal Of and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details thoroughly and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign CT 1096, Connecticut Annual Summary And Transmittal Of to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 connecticut annual summary and transmittal of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 1096, Connecticut Annual Summary And Transmittal Of?

The CT 1096, Connecticut Annual Summary And Transmittal Of is a form that businesses in Connecticut use to summarize and transmit various tax-related documents to the state. It provides important information about payments made during the year, ensuring compliance with state regulations. Proper submission of the CT 1096 is crucial for maintaining good standing with the Connecticut Department of Revenue Services.

-

How can airSlate SignNow simplify the CT 1096, Connecticut Annual Summary And Transmittal Of process?

airSlate SignNow streamlines the process of preparing and submitting the CT 1096, Connecticut Annual Summary And Transmittal Of by providing intuitive templates and electronic signature capabilities. Users can fill out the necessary forms quickly and securely, ensuring accurate data collection and reducing the chance of errors. This efficiency saves time and enhances compliance when submitting the summary.

-

What are the costs associated with using airSlate SignNow for the CT 1096, Connecticut Annual Summary And Transmittal Of?

airSlate SignNow offers flexible pricing plans that cater to various business sizes, making it a cost-effective solution for handling the CT 1096, Connecticut Annual Summary And Transmittal Of. The plans typically include features such as unlimited document templates, electronic signatures, and integrations with other tools, ensuring you get the best value for your needs. To find the right plan, it's recommended to visit our pricing page.

-

What features does airSlate SignNow offer for managing the CT 1096, Connecticut Annual Summary And Transmittal Of?

airSlate SignNow offers a variety of features designed to facilitate the management of the CT 1096, Connecticut Annual Summary And Transmittal Of. Key features include customizable templates, eSignature functionality, and secure document storage. These tools work together to ensure that your summary is prepared accurately and submitted on time.

-

Are there any integrations with other tools for managing the CT 1096, Connecticut Annual Summary And Transmittal Of?

Yes, airSlate SignNow integrates seamlessly with various productivity and accounting tools to assist in managing the CT 1096, Connecticut Annual Summary And Transmittal Of. By integrating with platforms such as QuickBooks, Salesforce, and Google Drive, users can easily import data and streamline the document submission process. This connectivity enhances efficiency and promotes accurate reporting.

-

Can I track the status of my CT 1096, Connecticut Annual Summary And Transmittal Of submission with airSlate SignNow?

Absolutely! With airSlate SignNow, users can track the status of their CT 1096, Connecticut Annual Summary And Transmittal Of submission in real-time. The platform provides notifications and updates, ensuring you are informed about the progress of your documents. This transparency helps you stay on top of compliance requirements.

-

Is airSlate SignNow secure for submitting the CT 1096, Connecticut Annual Summary And Transmittal Of?

Yes, airSlate SignNow prioritizes security and incorporates advanced encryption to ensure the safety of your CT 1096, Connecticut Annual Summary And Transmittal Of submissions. With secure cloud storage and strict access controls, you can trust that your sensitive information remains protected. Compliance with data security standards is a core commitment of airSlate SignNow.

Get more for CT 1096, Connecticut Annual Summary And Transmittal Of

- Kind of business form

- Unpaid corporation form

- Horse lease agreement example form

- Waiver of lien individual form

- Consumer loan application peoples bank texas form

- Waiver of lien corporation form

- Waiver of stop lending notice rights individual form

- Full text of ampquotcalifornia department of business oversight form

Find out other CT 1096, Connecticut Annual Summary And Transmittal Of

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now