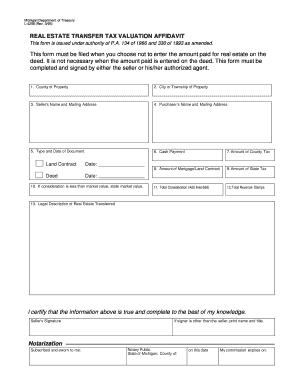

Real Estate Transfer Valuation Affidavit Form

What is the Real Estate Transfer Valuation Affidavit

The real estate transfer tax valuation affidavit is a legal document used in the United States to report the value of a property being transferred. This affidavit is essential for determining the applicable transfer taxes owed during a property sale or transfer. By accurately stating the property's value, the affidavit helps ensure compliance with local tax regulations. Each state may have specific requirements regarding the information included in the affidavit, making it crucial for sellers and buyers to understand their obligations.

How to Use the Real Estate Transfer Valuation Affidavit

Using the real estate transfer tax valuation affidavit involves several steps. First, the seller must complete the affidavit, providing accurate information about the property, including its sale price and any relevant details that may affect its value. Once completed, the affidavit must be signed and dated by the seller. Depending on state regulations, this document may need to be submitted alongside other paperwork during the property transfer process. It is advisable to consult with a real estate professional or attorney to ensure proper usage and compliance with local laws.

Steps to Complete the Real Estate Transfer Valuation Affidavit

Completing the real estate transfer tax valuation affidavit requires careful attention to detail. Here are the steps involved:

- Gather necessary information about the property, including its address, sale price, and any improvements made.

- Obtain the official form from your state or local tax authority.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the affidavit for any errors or omissions.

- Sign and date the affidavit, ensuring it is completed in accordance with state laws.

- Submit the affidavit as required, either online, by mail, or in person.

Key Elements of the Real Estate Transfer Valuation Affidavit

The real estate transfer tax valuation affidavit includes several key elements that must be addressed to ensure validity. These elements typically include:

- The full legal description of the property being transferred.

- The sale price or value of the property.

- Identification of the parties involved in the transaction, including the seller and buyer.

- Any exemptions or deductions that may apply to the transfer.

- Signature and date of the seller, affirming the accuracy of the information provided.

State-Specific Rules for the Real Estate Transfer Valuation Affidavit

Each state in the U.S. has its own regulations governing the real estate transfer tax valuation affidavit. These rules can vary significantly, affecting how the affidavit is filled out and submitted. Some states may require additional documentation or specific forms to be included with the affidavit. It is essential for individuals involved in property transfers to familiarize themselves with their state's requirements to avoid penalties or delays in the transaction process.

Form Submission Methods

The real estate transfer tax valuation affidavit can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state or local tax authority's website.

- Mailing the completed affidavit to the appropriate tax office.

- In-person submission at designated government offices.

Choosing the right submission method is important for ensuring timely processing and compliance with local laws.

Quick guide on how to complete real estate transfer valuation affidavit

Effortlessly Prepare Real Estate Transfer Valuation Affidavit on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Real Estate Transfer Valuation Affidavit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Real Estate Transfer Valuation Affidavit with Ease

- Locate Real Estate Transfer Valuation Affidavit and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Real Estate Transfer Valuation Affidavit to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the real estate transfer valuation affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a real estate transfer tax valuation affidavit?

A real estate transfer tax valuation affidavit is a legal document used to report the value of a property during a transfer. It helps assess the appropriate transfer tax based on the property's assessed value. This affidavit is crucial for ensuring compliance with local tax regulations.

-

How does airSlate SignNow facilitate the creation of a real estate transfer tax valuation affidavit?

airSlate SignNow provides easy-to-use templates for generating a real estate transfer tax valuation affidavit. Users can customize these templates to include necessary details about the property and the parties involved. The platform streamlines the document creation process, making it efficient.

-

Is there a cost associated with using airSlate SignNow for the real estate transfer tax valuation affidavit?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs. These plans allow users to access all features, including the creation of a real estate transfer tax valuation affidavit. You can choose a plan that fits your budget and document requirements.

-

What are the benefits of using airSlate SignNow for real estate documents?

Using airSlate SignNow for real estate documents like the real estate transfer tax valuation affidavit ensures faster processing and signing. The platform enhances collaboration between all parties involved in the transaction, which can expedite the entire process. Additionally, it offers security features to protect sensitive information.

-

Can I integrate airSlate SignNow with other applications for managing real estate documents?

Absolutely! airSlate SignNow offers integrations with multiple applications, enhancing your real estate workflow. You can connect it with CRM systems, cloud storage, and other platforms to streamline processes related to real estate transfer tax valuation affidavits and other documents.

-

How secure is my information when using airSlate SignNow for real estate transfer tax valuation affidavits?

airSlate SignNow prioritizes the security of user information with advanced encryption methods. All documents, including real estate transfer tax valuation affidavits, are protected during storage and transmission. This ensures that personal and financial information remains confidential and secure.

-

Is there customer support available for help with real estate transfer tax valuation affidavits?

Yes, airSlate SignNow offers robust customer support to assist users with any questions about real estate transfer tax valuation affidavits. Whether you're encountering issues or need guidance on using features, their support team is readily available to help you navigate the platform effectively.

Get more for Real Estate Transfer Valuation Affidavit

- Board notice louisiana board of pharmacy form

- Receipt of human remains at crematory release of cremated dhmh maryland form

- 2015 maine ems treatment protocols effective july 1 maine form

- State variations in nursing home social worker qualifications form

- Uapa keyword ideas generator form

- Maine caregiver form

- Title 22 2423 a authorized conduct for the medical use of form

- Adult day services andor assisted housing mainegov form

Find out other Real Estate Transfer Valuation Affidavit

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter