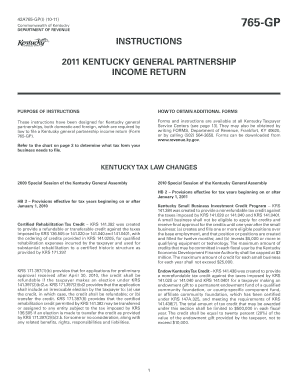

Kentucky Form 765 Instructions

What is the Kentucky Form 765 Instructions

The Kentucky Form 765 Instructions provide detailed guidance for taxpayers on how to complete the Kentucky Form 765, which is used for reporting certain tax-related information. This form is specifically designed for partnerships and limited liability companies (LLCs) that are classified as partnerships for tax purposes. The instructions outline the necessary steps to accurately fill out the form, ensuring compliance with state tax regulations.

Steps to complete the Kentucky Form 765 Instructions

Completing the Kentucky Form 765 requires careful attention to detail. Here are the key steps to follow:

- Gather all relevant financial documents, including income statements and expense reports for the partnership or LLC.

- Review the instructions thoroughly to understand the requirements for each section of the form.

- Fill out the form accurately, ensuring all figures are correct and match the supporting documents.

- Double-check for any required signatures and dates before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Kentucky Form 765 Instructions

The Kentucky Form 765 Instructions are legally binding when followed correctly. They ensure that the form is completed in accordance with Kentucky tax laws. Adhering to these instructions helps prevent issues with the Kentucky Department of Revenue and ensures that all reported information is accurate and compliant with legal standards.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Kentucky Form 765. Typically, the form must be submitted by the 15th day of the fourth month following the close of the tax year. For partnerships and LLCs operating on a calendar year, this means the deadline is April 15. Missing this deadline may result in penalties and interest on any taxes owed.

Required Documents

When completing the Kentucky Form 765, certain documents are necessary to ensure accurate reporting. These include:

- Financial statements detailing income and expenses for the partnership or LLC.

- Any relevant tax documents from previous years that may affect the current filing.

- Supporting schedules or forms that provide additional details about specific income or deductions.

Who Issues the Form

The Kentucky Form 765 is issued by the Kentucky Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides the necessary forms and instructions to assist taxpayers in fulfilling their obligations.

Penalties for Non-Compliance

Failing to comply with the Kentucky Form 765 filing requirements can lead to significant penalties. These may include:

- Monetary fines for late submissions or inaccuracies in reporting.

- Interest on any unpaid taxes, which accrues over time.

- Potential legal action for continued non-compliance, including audits or further investigation by the Kentucky Department of Revenue.

Quick guide on how to complete kentucky form 765 instructions

Complete Kentucky Form 765 Instructions effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to design, modify, and electronically sign your documents quickly and without interruptions. Manage Kentucky Form 765 Instructions on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to modify and electronically sign Kentucky Form 765 Instructions with ease

- Obtain Kentucky Form 765 Instructions and click Get Form to begin.

- Leverage the tools we provide to complete your document.

- Mark signNow sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Alter and electronically sign Kentucky Form 765 Instructions and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kentucky form 765 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Kentucky 765 instructions 2018 for eSigning documents?

The Kentucky 765 instructions 2018 outline the key steps and requirements for electronically signing legal documents in Kentucky. These instructions ensure compliance with state laws and provide guidance on how to properly utilize digital signatures. Following these guidelines can help streamline your document workflows while maintaining legal validity.

-

How does airSlate SignNow facilitate compliance with Kentucky 765 instructions 2018?

airSlate SignNow is designed to help users comply with the Kentucky 765 instructions 2018 by offering secure electronic signing features and an easy-to-use interface. Our platform provides templates and tips to ensure that your eSignatures meet state requirements. By using our solution, you can be confident that your documents are legally binding.

-

What is the pricing structure for using airSlate SignNow?

Our pricing for airSlate SignNow is competitive and tailored to meet the needs of businesses of all sizes. We offer a range of plans, ensuring that you can find a cost-effective solution that fits your budget. With affordable options, you can easily manage your document signing processes while adhering to Kentucky 765 instructions 2018.

-

What features does airSlate SignNow offer to enhance eSigning?

airSlate SignNow offers a variety of features, including customizable templates, team collaboration tools, and automated reminders, which all support the efficient signing of documents. These features facilitate the quick completion of documents while ensuring they align with Kentucky 765 instructions 2018. With these tools, you can enhance your workflow and improve productivity.

-

How can I integrate airSlate SignNow with other software?

airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Salesforce, and more. This allows you to incorporate eSigning capabilities into your existing workflows while ensuring compliance with Kentucky 765 instructions 2018. Integration enhances efficiency and allows for a more streamlined document management system.

-

What are the benefits of using airSlate SignNow for Kentucky 765 instructions 2018?

Using airSlate SignNow for Kentucky 765 instructions 2018 provides several benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the signing process, which allows for quicker turnaround times and reduced document errors. Businesses can also track document status in real-time, ensuring a smoother experience.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes the security of your documents. We use advanced encryption and authentication measures to ensure that all eSignatures comply with Kentucky 765 instructions 2018 securely. This allows users to sign sensitive documents while maintaining the confidentiality and integrity of their information.

Get more for Kentucky Form 765 Instructions

Find out other Kentucky Form 765 Instructions

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free