Fy Chapter 59 Asset Forfeiture Report by Law Enforcement Agency Texasattorneygeneral Form

Understanding the Chapter 59 Asset Forfeiture Report by Law Enforcement Agency

The Chapter 59 Asset Forfeiture Report is a crucial document used by law enforcement agencies in Texas to detail the assets seized during criminal investigations. This report serves multiple purposes, including providing transparency regarding asset seizures and ensuring compliance with state laws. It is mandated by the Texas Attorney General's Office, which requires law enforcement agencies to submit this report annually. The report includes information about the type of assets seized, the circumstances surrounding the seizure, and the intended use of the forfeited assets. Understanding the legal framework and requirements surrounding this report is essential for law enforcement agencies to maintain accountability and uphold public trust.

Steps to Complete the Chapter 59 Asset Forfeiture Report

Completing the Chapter 59 Asset Forfeiture Report involves several key steps to ensure accuracy and compliance with legal standards. First, law enforcement agencies must gather all relevant data regarding the seized assets, including descriptions, values, and the basis for seizure. Next, agencies should accurately fill out the report form, ensuring that all sections are completed thoroughly. It is important to review the report for any errors or omissions before submission. Once finalized, the report must be submitted to the Texas Attorney General's Office by the specified deadline, typically within a set timeframe after the end of the fiscal year. Agencies should keep a copy of the submitted report for their records.

Legal Use of the Chapter 59 Asset Forfeiture Report

The Chapter 59 Asset Forfeiture Report has significant legal implications for law enforcement agencies. It is not only a tool for accountability but also a means of ensuring compliance with state laws regarding asset forfeiture. The report must accurately reflect the activities and outcomes of asset seizures to avoid legal repercussions. Failure to comply with reporting requirements can result in penalties, including loss of forfeiture funds and potential legal action against the agency. Therefore, it is essential for agencies to understand the legal framework governing asset forfeiture and the importance of maintaining accurate records.

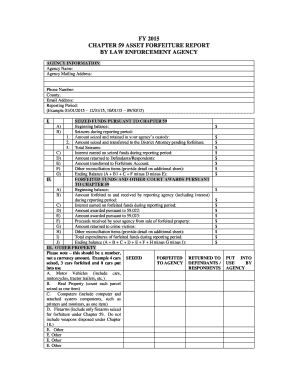

Key Elements of the Chapter 59 Asset Forfeiture Report

Several key elements must be included in the Chapter 59 Asset Forfeiture Report to meet legal requirements. These elements typically include:

- Agency Information: Name and contact details of the law enforcement agency submitting the report.

- Asset Details: Comprehensive descriptions of the seized assets, including types, values, and any relevant identification numbers.

- Seizure Information: Circumstances surrounding the seizure, including the date, location, and basis for the asset forfeiture.

- Disposition of Assets: Information on how the seized assets will be used or disposed of, including any sales or transfers.

- Signature and Certification: A designated official must sign the report to certify its accuracy and completeness.

How to Obtain the Chapter 59 Asset Forfeiture Report

Law enforcement agencies can obtain the Chapter 59 Asset Forfeiture Report form through the Texas Attorney General's Office website or by contacting the office directly. It is important for agencies to ensure they are using the most current version of the form to comply with any updates in legal requirements. Additionally, agencies should familiarize themselves with any accompanying guidelines or instructions provided by the Attorney General's Office to facilitate the accurate completion of the report.

Penalties for Non-Compliance with the Chapter 59 Asset Forfeiture Report

Non-compliance with the requirements for the Chapter 59 Asset Forfeiture Report can result in serious consequences for law enforcement agencies. Penalties may include financial repercussions, such as the forfeiture of seized assets and loss of funding for law enforcement activities. In some cases, agencies may face legal challenges or scrutiny from oversight bodies, which can damage public trust and agency reputation. Therefore, it is critical for agencies to adhere to reporting deadlines and ensure the accuracy of the information submitted in the report.

Quick guide on how to complete fy chapter 59 asset forfeiture report by law enforcement agency texasattorneygeneral

Complete Fy Chapter 59 Asset Forfeiture Report By Law Enforcement Agency Texasattorneygeneral seamlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Fy Chapter 59 Asset Forfeiture Report By Law Enforcement Agency Texasattorneygeneral on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The optimal way to modify and eSign Fy Chapter 59 Asset Forfeiture Report By Law Enforcement Agency Texasattorneygeneral effortlessly

- Obtain Fy Chapter 59 Asset Forfeiture Report By Law Enforcement Agency Texasattorneygeneral and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Fy Chapter 59 Asset Forfeiture Report By Law Enforcement Agency Texasattorneygeneral while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fy chapter 59 asset forfeiture report by law enforcement agency texasattorneygeneral

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a chapter 59 asset forfeiture report?

A chapter 59 asset forfeiture report is a legal document that outlines the details of seized assets related to criminal activities. It provides a comprehensive overview of the items forfeited and the laws governing their seizure. Understanding the chapter 59 asset forfeiture report is crucial for legal compliance and asset recovery.

-

How can airSlate SignNow help with chapter 59 asset forfeiture reports?

airSlate SignNow simplifies the process of creating, sending, and eSigning chapter 59 asset forfeiture reports. With our easy-to-use interface, you can customize reports quickly and ensure they are signed by all necessary parties promptly. Our platform enhances the efficiency of handling legal documents like chapter 59 asset forfeiture reports.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSignature capabilities, custom templates, and real-time tracking for chapter 59 asset forfeiture reports. You can collaborate with teams and clients effortlessly, ensuring that all stakeholders can review and approve documents quickly. These features enhance overall productivity and streamline the document workflow.

-

Is there a pricing plan specifically for managing chapter 59 asset forfeiture reports?

Yes, airSlate SignNow offers flexible pricing plans suitable for businesses handling chapter 59 asset forfeiture reports and other legal documents. Our plans cater to different needs, ranging from individual users to larger enterprises. You can choose the plan that best fits your budget while accessing all necessary features.

-

Can I integrate airSlate SignNow with other software for managing chapter 59 asset forfeiture reports?

Absolutely! airSlate SignNow supports integration with various software applications like CRM systems and cloud storage services, making it easier to manage chapter 59 asset forfeiture reports. This integration helps centralize your document management process and enhances collaboration across different platforms.

-

What benefits does eSigning provide for chapter 59 asset forfeiture reports?

ESigning chapter 59 asset forfeiture reports ensures that documents are legally binding and can be executed quickly. It saves time compared to traditional signing methods and reduces the likelihood of errors or misunderstandings. Additionally, eSignatures enhance document security with encryption and authentication features.

-

How does airSlate SignNow ensure the security of my chapter 59 asset forfeiture reports?

airSlate SignNow employs advanced security protocols to protect your chapter 59 asset forfeiture reports. Our platform includes encryption, secure access controls, and compliance with industry standards to ensure your documents are safe from unauthorized access. Your sensitive information remains confidential throughout the document management process.

Get more for Fy Chapter 59 Asset Forfeiture Report By Law Enforcement Agency Texasattorneygeneral

- Circle the verbs worksheet for grade 1 form

- Faa 8060 12 form

- Dsc distress communication form

- Citibank w9 form

- Service hour sheet form

- Isa health clearance form pdf learning abroad center umabroad umn

- Nexus questionnaire state of west virginia state wv form

- Application for radio operator certificate 463076236 form

Find out other Fy Chapter 59 Asset Forfeiture Report By Law Enforcement Agency Texasattorneygeneral

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors