Public Liability Insurance Malaysia Form

What is public liability insurance in Malaysia?

Public liability insurance in Malaysia is a type of insurance designed to protect businesses from claims made by third parties for injuries or damages that occur as a result of the business's operations. This insurance covers legal costs and compensation payments, ensuring that businesses can operate without the constant fear of financial loss due to unforeseen incidents. It is particularly important for businesses that interact with the public, such as retailers, contractors, and service providers.

How to obtain public liability insurance in Malaysia

To obtain public liability insurance in Malaysia, businesses typically follow a straightforward process. First, they should assess their specific needs based on the nature of their operations and the level of risk involved. Next, businesses can contact insurance providers to request quotes. It is advisable to compare different policies, coverage limits, and premiums. After selecting a suitable policy, businesses will need to complete an application form and provide necessary documentation, such as business registration details and financial statements. Once approved, the policy will be issued, and coverage will commence.

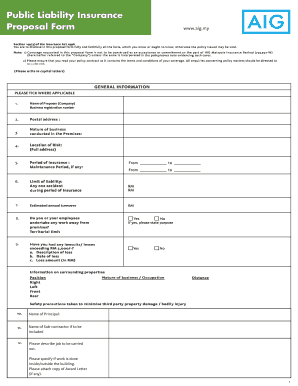

Steps to complete the public liability insurance form

Completing the public liability insurance form requires careful attention to detail. Here are the essential steps:

- Gather necessary information about your business, including its legal structure, address, and contact details.

- Provide details about your operations, including the types of services or products offered and the number of employees.

- Disclose any previous claims or incidents that may affect your coverage.

- Review the terms and conditions of the policy thoroughly before submission.

- Submit the completed form to the insurance provider and keep a copy for your records.

Legal use of public liability insurance in Malaysia

The legal use of public liability insurance in Malaysia is governed by specific regulations that ensure businesses are protected against claims. It is essential for businesses to maintain accurate records of their insurance policies and to comply with any reporting requirements set forth by the insurer. In the event of a claim, businesses must notify their insurer promptly and provide all necessary documentation to support the claim. Failure to comply with these legal obligations may result in denial of coverage.

Key elements of public liability insurance in Malaysia

Key elements of public liability insurance in Malaysia include:

- Coverage Limits: The maximum amount the insurer will pay for a claim.

- Exclusions: Specific situations or types of claims that are not covered by the policy.

- Premiums: The cost of the insurance policy, which can vary based on the level of coverage and risk factors.

- Deductibles: The amount the business must pay out of pocket before the insurer covers the remaining costs.

Examples of using public liability insurance in Malaysia

Public liability insurance can be beneficial in various scenarios. For instance, if a customer slips and falls in a retail store, the insurance can cover medical expenses and legal fees. Similarly, if a contractor accidentally damages a client's property while working, the policy can help cover repair costs. These examples illustrate the importance of having adequate public liability insurance to safeguard against potential financial liabilities.

Quick guide on how to complete public liability insurance malaysia

Prepare Public Liability Insurance Malaysia effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Public Liability Insurance Malaysia on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Public Liability Insurance Malaysia seamlessly

- Locate Public Liability Insurance Malaysia and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Purge any concerns about lost or misplaced documents, tedious form searches, or errors that necessitate new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Public Liability Insurance Malaysia and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the public liability insurance malaysia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is public liability insurance Malaysia?

Public liability insurance Malaysia is a type of coverage that protects businesses from claims made by third parties for injuries or damages. It is essential for businesses that interact with the public, ensuring that they can handle legal claims effectively and avoid hefty financial burdens.

-

How much does public liability insurance Malaysia cost?

The cost of public liability insurance Malaysia varies based on factors such as the size of the business, industry, and coverage limits. Typically, premiums can range from a few hundred to several thousand ringgit annually, so it's crucial to assess your specific needs to get an accurate quote.

-

What benefits does public liability insurance Malaysia provide?

Public liability insurance Malaysia offers several benefits, including financial protection against lawsuits, coverage for legal costs, and peace of mind when conducting business. This insurance enables companies to focus on growth without the constant worry of potential claims.

-

What types of businesses need public liability insurance Malaysia?

Any business that interacts with the public should consider public liability insurance Malaysia. This includes retailers, contractors, event organizers, and service providers, as all face the risk of accidents or incidents that could lead to claims from clients or customers.

-

How can businesses obtain public liability insurance Malaysia?

Businesses can obtain public liability insurance Malaysia through insurance brokers or directly from insurance companies. It's advisable to compare different policies, assess coverage options, and seek professional advice to ensure the right coverage is chosen based on business needs.

-

Are there exclusions in public liability insurance Malaysia?

Yes, public liability insurance Malaysia often contains exclusions that businesses should be aware of. Common exclusions may include intentional acts, contractual liabilities, and certain business types or activities, so it's essential to read the terms and conditions carefully.

-

Can public liability insurance Malaysia be bundled with other policies?

Yes, many insurers offer the option to bundle public liability insurance Malaysia with other types of coverage, such as property or professional indemnity insurance. Bundling can result in cost savings and simplified management of policies for businesses.

Get more for Public Liability Insurance Malaysia

- Dole tupad application form

- Fiche de renseignement form

- Klb book 3 form

- Pmdc registration renewal form 2021

- Health promotion officer past question papers form

- Ea 250 proof of service of response by mail elder or dependent adult abuse prevention form

- Jv 433 six month permanency attachment reunification services terminated welf inst code 366 21e form

- Rein property analyzer real estate investment network form

Find out other Public Liability Insurance Malaysia

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement