Rita Tax Forms

What is the Rita Tax Forms

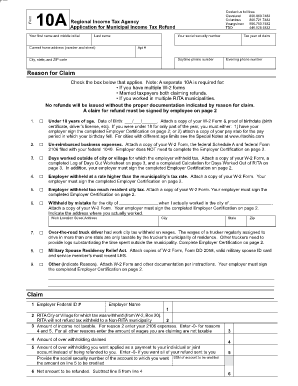

The Rita Tax Forms are specific documents used for reporting income and tax obligations in certain jurisdictions. These forms are essential for individuals and businesses to comply with local tax regulations. They typically include information about income earned, deductions, and credits applicable to the taxpayer's situation. Understanding the purpose and structure of the Rita Tax Forms is crucial for accurate filing and compliance.

How to use the Rita Tax Forms

Using the Rita Tax Forms involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts. Next, carefully fill out the forms, ensuring that all information is accurate and complete. It is advisable to review the completed forms for any errors before submission. Finally, submit the forms through the designated method, whether online or by mail, depending on local regulations.

Steps to complete the Rita Tax Forms

Completing the Rita Tax Forms requires a systematic approach:

- Gather Documentation: Collect all necessary financial records, including income statements and receipts.

- Fill Out the Forms: Enter your personal information, income details, and applicable deductions.

- Review for Accuracy: Double-check all entries for correctness, ensuring no information is omitted.

- Submit the Forms: Choose the appropriate submission method, either electronically or by mail, as required.

Legal use of the Rita Tax Forms

The Rita Tax Forms are legally binding documents when completed and submitted according to regulatory guidelines. To ensure their legal validity, it is essential to comply with all applicable laws and regulations governing tax reporting in your jurisdiction. This includes adhering to deadlines and providing accurate information to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Rita Tax Forms vary depending on the specific form and jurisdiction. Generally, individuals and businesses must submit their forms by the established due dates to avoid late fees and penalties. It's important to keep track of these dates to ensure timely compliance. Mark your calendar with important dates, such as the start of the filing season and the final submission deadline.

Required Documents

To complete the Rita Tax Forms, you will need several key documents, including:

- Income statements (W-2s, 1099s)

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any other relevant financial documentation

Form Submission Methods (Online / Mail / In-Person)

The Rita Tax Forms can typically be submitted through various methods, including:

- Online Submission: Many jurisdictions allow electronic filing through secure platforms.

- Mail: Forms can be printed and mailed to the appropriate tax authority.

- In-Person: Some locations may offer in-person submission options at designated offices.

Quick guide on how to complete rita tax forms

Easily Set Up Rita Tax Forms on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delay. Manage Rita Tax Forms on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Simplest Way to Edit and Electronically Sign Rita Tax Forms Effortlessly

- Find Rita Tax Forms and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to preserve your changes.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Rita Tax Forms to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rita tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Rita Sample Harvest AL and how can it benefit my business?

Rita Sample Harvest AL is an innovative platform that allows businesses to efficiently manage document signing and workflows. By utilizing airSlate SignNow, your team can streamline processes, reduce turnaround times, and enhance overall productivity. This solution is especially beneficial for organizations looking to improve their electronic signing capabilities.

-

How does pricing work for Rita Sample Harvest AL?

Pricing for Rita Sample Harvest AL is designed to be cost-effective, offering various plans to suit different business needs. Each plan includes essential features like document templates and basic integrations. For current pricing details tailored to your organization, visit the airSlate SignNow website.

-

What features are included with Rita Sample Harvest AL?

Rita Sample Harvest AL includes a suite of features such as customizable templates, automated workflows, and advanced signature options. Additionally, users benefit from robust tracking and reporting capabilities to monitor document statuses. This combination of features helps streamline the signing process and ensures compliance.

-

Can I integrate Rita Sample Harvest AL with other tools?

Yes, Rita Sample Harvest AL offers various integrations with popular business applications, including CRM, project management, and cloud storage solutions. These integrations help create a seamless workflow, allowing users to manage documents directly within their preferred tools. Check the airSlate SignNow integrations page for a complete list.

-

Is Rita Sample Harvest AL compliant with electronic signature regulations?

Absolutely! Rita Sample Harvest AL adheres to all major electronic signature laws and regulations, including the U.S. ESIGN Act and the Uniform Electronic Transactions Act. This compliance ensures that all electronically signed documents are legally binding, providing peace of mind for users and their clients alike.

-

How easy is it to use Rita Sample Harvest AL for new users?

Rita Sample Harvest AL is built with user-friendliness in mind, making it easy for new users to get started quickly. The intuitive interface requires minimal training, and resources like tutorials and customer support are readily available. This allows users to expedite their document processes without getting bogged down by technical challenges.

-

What are the key benefits of using Rita Sample Harvest AL for document signing?

Using Rita Sample Harvest AL for document signing offers signNow benefits, including reduced paper usage, faster turnaround times, and improved visibility into document workflows. Moreover, it enhances collaboration among team members, ensuring everyone stays on the same page throughout the signing process. These advantages contribute to higher productivity for businesses.

Get more for Rita Tax Forms

- The childrens center of form

- Staff orientation checklist group child care centers cfs 2026 child care licensing form

- Instructions for completing form pa 600b

- Fca433 531 a 580 316 form 4 24 5 16uifsa 10 1

- Wwwpdffillercom303775285 eoiapplicationformfillable online newquaycouncil co expression of interest form

- Wwwfultoncourtorgfamilyformssuperior court of fulton county state of georgia civil action

- Fillable online wage garnishment in wisconsin legal form

- 2017 2021 form ca jv 710 fill online printable fillable

Find out other Rita Tax Forms

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template