Printable Texas Tax Exempt Form

What is the Printable Texas Tax Exempt Form

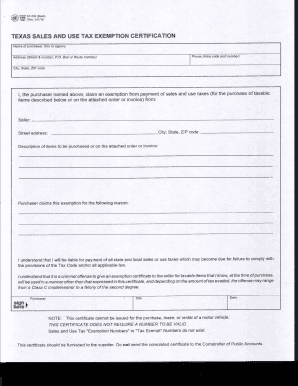

The Printable Texas Tax Exempt Form is a crucial document used by organizations and individuals in Texas to claim exemption from sales tax. This form is essential for entities that qualify under specific categories, such as non-profit organizations, educational institutions, or government agencies. By presenting this form, eligible buyers can purchase goods and services without incurring sales tax, thereby reducing their overall expenses.

How to Use the Printable Texas Tax Exempt Form

Using the Printable Texas Tax Exempt Form involves several steps. First, ensure that you meet the eligibility criteria for tax exemption. Once confirmed, download the form, fill in the required details, and present it to the seller at the time of purchase. It is important to provide accurate information, including your organization’s name, address, and the reason for the exemption, to avoid any complications during the transaction.

Steps to Complete the Printable Texas Tax Exempt Form

Completing the Printable Texas Tax Exempt Form requires careful attention to detail. Follow these steps:

- Download the form from a reliable source.

- Fill in your organization’s name and address accurately.

- Specify the type of exemption you are claiming.

- Include the signature of an authorized representative.

- Ensure all information is correct before submitting the form to the seller.

Legal Use of the Printable Texas Tax Exempt Form

The legal use of the Printable Texas Tax Exempt Form is governed by Texas state laws. To be valid, the form must be completed accurately and presented at the time of purchase. Misuse of the form, such as claiming exemption without proper qualification, can lead to penalties and legal repercussions. It is essential to understand the specific exemptions allowed under Texas law to ensure compliance.

Key Elements of the Printable Texas Tax Exempt Form

Several key elements must be included in the Printable Texas Tax Exempt Form to ensure its validity:

- Organization Name: The legal name of the entity claiming the exemption.

- Address: The physical address of the organization.

- Reason for Exemption: A clear explanation of why the exemption is being claimed.

- Authorized Signature: A signature from a person with the authority to sign on behalf of the organization.

Examples of Using the Printable Texas Tax Exempt Form

Examples of using the Printable Texas Tax Exempt Form include transactions made by non-profit organizations purchasing supplies for charitable events or schools acquiring educational materials. In these scenarios, presenting the form allows these entities to avoid paying sales tax, which can result in significant savings. Each example illustrates the practical application of the form in everyday business transactions.

Quick guide on how to complete printable texas tax exempt form 16934776

Prepare Printable Texas Tax Exempt Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Printable Texas Tax Exempt Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Printable Texas Tax Exempt Form with ease

- Locate Printable Texas Tax Exempt Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to store your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and eSign Printable Texas Tax Exempt Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable texas tax exempt form 16934776

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas tax exempt form PDF?

A Texas tax exempt form PDF is a document used by businesses and organizations to demonstrate their tax-exempt status under Texas state law. This form allows entities to make purchases without paying sales tax, thus saving money on eligible purchases. Understanding how to properly use and submit this form is essential for compliance.

-

How can I obtain a Texas tax exempt form PDF?

You can obtain a Texas tax exempt form PDF from the official Texas Comptroller's website or through various accounting resources online. It's important to ensure that the form you are using is the most current version to avoid potential issues during transactions. Once completed, you can use airSlate SignNow to easily sign and send the document.

-

Is there a cost for using airSlate SignNow for Texas tax exempt form PDFs?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can start with a free trial to see how the platform meets your needs for completing and signing the Texas tax exempt form PDF. Pricing varies based on features selected, providing a cost-effective solution for document management.

-

What features does airSlate SignNow offer for Texas tax exempt form PDFs?

airSlate SignNow provides an array of features designed to streamline the process of managing Texas tax exempt form PDFs. With options for electronic signatures, document editing, and powerful integrations, you can efficiently handle all aspects of your tax-exempt documentation. Additionally, the platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other software for Texas tax exempt forms?

Yes, airSlate SignNow seamlessly integrates with various software solutions, enhancing your workflow related to Texas tax exempt form PDFs. Whether you're using accounting software, CRM systems, or other business applications, these integrations ensure that document management is efficient and streamlined. Check our integration options to find out how we can fit into your existing tech stack.

-

What are the benefits of using airSlate SignNow for Texas tax exempt form PDFs?

Using airSlate SignNow for Texas tax exempt form PDFs provides numerous benefits, including enhanced efficiency and improved compliance. The platform allows you to digitally sign documents, track their status, and save costs associated with printing and postage. This modern approach reduces paperwork while ensuring your forms are processed quickly and securely.

-

How secure is airSlate SignNow for handling Texas tax exempt form PDFs?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like Texas tax exempt form PDFs. The platform employs advanced encryption and secure storage solutions to protect your data. With compliance to industry standards, you can trust that your documents are handled with the utmost security.

Get more for Printable Texas Tax Exempt Form

- Form el101b income tax declaration for businesses

- Form 588 direct deposit of maryland income tax refund to

- Consumers real estate connecticut form

- Pdf amended tax return comptroller of maryland form

- Pdf dhcd md tax credit form habitat for humanity of wicomico county

- Maryland form 502 instructions esmart tax

- Beer wine andor liquor protest form sc

- Exempt property sc department of revenue form

Find out other Printable Texas Tax Exempt Form

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free