Revolving Note Form

What is the Revolving Note Form

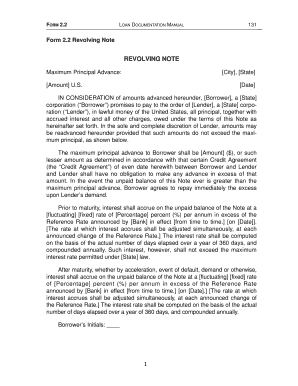

The revolving note form is a financial document used primarily in lending agreements. It allows borrowers to access a line of credit, where they can withdraw funds up to a specified limit, repay the borrowed amount, and then borrow again. This type of form is commonly utilized in business financing and personal loans, providing flexibility in managing cash flow. It is essential for both lenders and borrowers to understand the terms outlined in the form, as it governs the use of the credit line and the obligations of the parties involved.

How to use the Revolving Note Form

Using the revolving note form involves several straightforward steps. First, the borrower must fill out the form with accurate personal and financial information. This typically includes the borrower's name, address, and the amount of credit requested. Next, both the borrower and lender must review the terms of the agreement, including interest rates, repayment schedules, and any fees associated with the credit line. Once both parties agree to the terms, they must sign the form to make it legally binding. It is advisable to keep a copy of the completed form for personal records.

Steps to complete the Revolving Note Form

Completing the revolving note form requires careful attention to detail. Follow these steps to ensure accuracy:

- Provide accurate personal information, including your full name and contact details.

- Specify the credit limit you wish to request, ensuring it aligns with your financial needs.

- Review the interest rate and repayment terms, paying close attention to any fees.

- Sign and date the form, confirming your acceptance of the terms.

- Have the lender sign the form to finalize the agreement.

Legal use of the Revolving Note Form

The legal validity of the revolving note form hinges on compliance with applicable laws and regulations. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, allowing for the digital execution of the form. For the document to be enforceable, it must clearly outline the rights and obligations of both parties. This includes specifying the repayment terms, interest rates, and any conditions that may lead to default. It is crucial to ensure that both parties understand and agree to the terms to avoid potential legal disputes.

Key elements of the Revolving Note Form

Several key elements must be included in the revolving note form to ensure its effectiveness:

- Borrower Information: Full name and contact details of the borrower.

- Loan Amount: The total amount of credit available to the borrower.

- Interest Rate: The percentage charged on the borrowed amount.

- Repayment Terms: Details on how and when payments should be made.

- Default Conditions: Circumstances under which the lender may take action.

Examples of using the Revolving Note Form

The revolving note form can be utilized in various scenarios. For instance, a small business may use it to secure a line of credit for inventory purchases, allowing for flexibility in managing cash flow. Similarly, an individual may use the form to obtain a personal loan for unexpected expenses, such as medical bills or home repairs. Each use case highlights the form's versatility in providing access to funds while ensuring clear terms between the lender and borrower.

Quick guide on how to complete revolving note form

Complete Revolving Note Form effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the desired form and securely store it on the internet. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Revolving Note Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Revolving Note Form with ease

- Find Revolving Note Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign feature, which takes only seconds and bears the same legal significance as a conventional wet-ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Revolving Note Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revolving note form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Revolving Note Form?

A Revolving Note Form is a financial document that allows borrowers to access a line of credit, borrowing up to a specified limit. It enhances cash flow management by enabling businesses to withdraw funds as needed. With airSlate SignNow, you can easily create and eSign a Revolving Note Form, streamlining your financial transactions.

-

How does airSlate SignNow simplify the creation of a Revolving Note Form?

airSlate SignNow offers user-friendly templates for creating a Revolving Note Form, allowing you to customize the content easily. The drag-and-drop interface ensures that even non-technical users can design and generate documents quickly. Plus, you can save your templates for future use, enhancing efficiency.

-

What are the benefits of using a Revolving Note Form with airSlate SignNow?

Using a Revolving Note Form through airSlate SignNow offers several benefits, including rapid eSigning, secure document storage, and easy tracking of transactions. This empowers businesses to operate more efficiently while ensuring compliance and security. Additionally, its cost-effective pricing model allows businesses of all sizes to simplify their financial processes.

-

Can I integrate airSlate SignNow with other financial software for my Revolving Note Form?

Yes, airSlate SignNow offers integrations with various financial and business software, enhancing the functionality of your Revolving Note Form. This allows for seamless data transfer and improves overall workflow. Whether using accounting software or CRM systems, integrations can help streamline your financial processes.

-

Is there a mobile app for signing the Revolving Note Form?

Absolutely! airSlate SignNow provides a mobile app that allows you to sign your Revolving Note Form from anywhere, at any time. The mobile app is designed for convenience and supports all features available on the desktop version, ensuring a smooth eSigning experience.

-

What types of businesses can benefit from a Revolving Note Form?

Any business that relies on a line of credit, including small businesses and large corporations, can benefit from a Revolving Note Form. It's especially useful for companies with fluctuating cash flow needs. With airSlate SignNow, businesses can efficiently manage their credit lines and improve financial flexibility.

-

How secure is my information when using the Revolving Note Form on airSlate SignNow?

Security is a priority at airSlate SignNow. Your information while using a Revolving Note Form is protected with advanced encryption and compliance protocols. With robust security measures in place, you can trust that your documents and sensitive financial information are well-protected.

Get more for Revolving Note Form

- Indiana last will ampamp testament internet legal research group form

- I a notary public in and for said county in said state hereby certify that form

- I a in and for said county in said state hereby certify that form

- In do 10a form

- In do 1a form

- Default case with written agreement california courts form

- Attorney general dissolution ingov form

- Trustors are married and have no children form

Find out other Revolving Note Form

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy