F 1120es Formpdffillercom 2012

What is the F 1120es Formpdffillercom

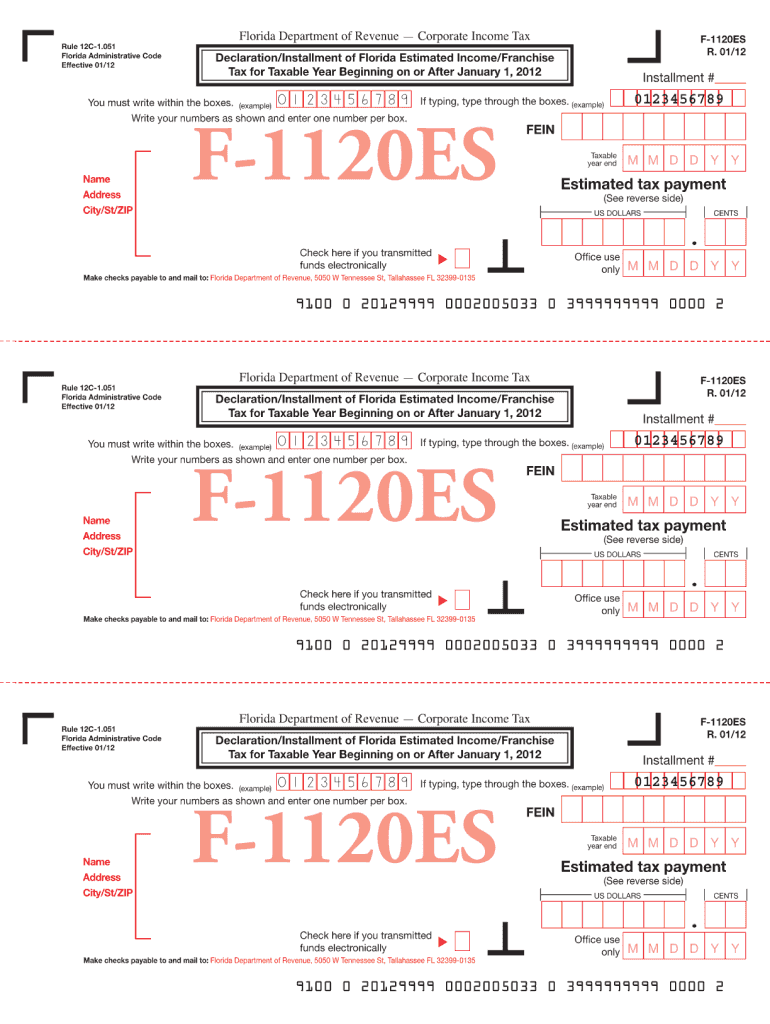

The F 1120es Formpdffillercom is an essential tax form used by corporations in the United States to make estimated tax payments. This form is specifically designed for C corporations, allowing them to report and pay their estimated taxes quarterly. By using this form, businesses can ensure they meet their federal tax obligations and avoid potential penalties for underpayment. Understanding the purpose and requirements of this form is crucial for maintaining compliance with IRS regulations.

How to use the F 1120es Formpdffillercom

Using the F 1120es Formpdffillercom involves several straightforward steps. First, gather the necessary financial information, including projected income and deductions for the year. Next, calculate the estimated tax liability based on these projections. Once you have this information, complete the form by entering the required details in the appropriate fields. After filling out the form, you can submit it electronically or by mail, ensuring that you adhere to the IRS guidelines for submission.

Steps to complete the F 1120es Formpdffillercom

Completing the F 1120es Formpdffillercom requires careful attention to detail. Follow these steps for accurate completion:

- Gather your financial records, including income statements and expense reports.

- Calculate your estimated tax liability for the year based on your projected income.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form by the due date, either electronically or via mail.

Legal use of the F 1120es Formpdffillercom

The F 1120es Formpdffillercom is legally recognized as a valid method for corporations to report and pay estimated taxes. Compliance with IRS regulations is essential to avoid penalties. The IRS allows electronic signatures on this form, making the submission process more efficient. It is important to ensure that all information provided is accurate and complete to maintain the legal integrity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the F 1120es Formpdffillercom are crucial for compliance. Corporations must submit their estimated tax payments quarterly, with specific due dates typically falling on the fifteenth day of April, June, September, and December. It is important to stay informed about these deadlines to avoid late payment penalties and interest charges. Marking these dates on your calendar can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The F 1120es Formpdffillercom can be submitted through various methods, providing flexibility for businesses. Corporations can file the form electronically through the IRS e-file system, which is a quick and efficient option. Alternatively, the form can be mailed to the appropriate IRS address, depending on the corporation's location. In-person submission is generally not available for this form, making electronic and mail submissions the primary methods for filing.

Quick guide on how to complete f 1120es formpdffillercom 2012

Your assistance manual on how to prepare your F 1120es Formpdffillercom

If you’re unsure about how to create and submit your F 1120es Formpdffillercom, here are some brief instructions to make tax processing more manageable.

To begin, you simply need to set up your airSlate SignNow account to enhance how you handle documents online. airSlate SignNow is a highly user-friendly and effective document solution that enables you to modify, design, and finalize your tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, returning to edit details as necessary. Streamline your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your F 1120es Formpdffillercom in just a few minutes:

- Create your account and start processing PDFs in moments.

- Browse our directory to find any IRS tax form; search through variations and schedules.

- Click Get form to access your F 1120es Formpdffillercom in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. Furthermore, before e-filing your taxes, consult the IRS website for the filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct f 1120es formpdffillercom 2012

FAQs

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do you find out if a company is open to using a staffing agency to fill positions?

Get an introduction to the target company through a referral if possible. A lot of the companies that retain us even talk explicitly about "no agency referrals" on their website. There are times that going in through HR or their staffing org can be to your benefit but more often that not it helps to have a referral with a "VP" in their title to get you that introduction. You might still be a long way from getting a fee agreement signed (retained or contingent) but you'll be a lot close than being one of the hundreds of agency recruiters leaving voicemails for the VP HR or Staffing Manager.

-

Why does the Mayan Calendar end on 12/21/2012?

Why does the 18-month playful puppies calendar end on 31 July 2014? Why does the Justin Bieber calendar end on 31 December 2013?Quite simply, they ran out of space on the calendar. We run out of space on our calender every December 31st. It isn't a big deal. We just start over the next day. The Mayan calendar is no different. It is designed to optimize space by using a series of concentric circles that act like gears. A full revolution of one circle is equivalent to a cog on the next circle.The hierarchy works as follows: a day -> 20 days -> 360 days -> 7200 days -> 144,000 days. That last unit (144,000 days) is called a Baktun. Their long count calendar is designed to equal 13 Baktuns.There is absolutely no evidence to believe that the Mayans felt that 13 Baktuns from the initiation of the long count calendar would align with the end of the world. They could have designed their calendar so that the Uinal (20 days) wheel was actually 30 days, like our month, in which case the calendar would last another 2000 years. The number for each wheel was selected because it was a number of significance to them - not because it would work out so that the calendar ended when the world ended.Any Mayans around today, still using their calendar, rather than celebrating the end of the world on December 21st, will be celebrating the start of a new long count calendar on December 22nd.

-

Musicians: How many songs do you think you'd need to perform to fill out a two-hour gig?

A two-hour gig? That's 120 minutes of on stage performance or setup inclusion? I'll go with stage time, and also assume you've negotiated appropriate setup, and such.Another assumption is genre. I'll assume it's pop structured (as most radio friendly music is these days), so average song time would be roughly 3 and a half minutes…give or take.You're looking at roughly 30 songs. Thats…over 2 hours. Now, that's a rough estimate, as song times vary, etc.Oh, but wait. You'll need to include breaks, for “personnel” i.e. the band members. Normally, the drummer will need the longest break, followed by others. The drummer is using all four limbs continuously, so…they need them.If you're headlining, and depending on what you've negotiated, you might not be allotted “dead air”, so someone's staying on stage on breaks. Usually, that means at least a guitar player and/or the singer. Maybe not a long guitar solo, but…maybe an acoustic filler/singalong for the crowd. Plus, in between banter, there's that too (paring that down was always a plus for us back in the day)So, practice 30ish and get them flawless, because you're only going to need 20ish. Why 30ish? Because…more is good for flexibility. Always. Plus, it allows you to keep your set list semi-”fresh”, while only putting in a little extra work.setlist.fm - the setlist wiki is a good resource for structuring a setlist in a professional way (I wish it was around during the “trial and error” days.)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the f 1120es formpdffillercom 2012

How to make an electronic signature for the F 1120es Formpdffillercom 2012 in the online mode

How to generate an eSignature for the F 1120es Formpdffillercom 2012 in Chrome

How to create an eSignature for signing the F 1120es Formpdffillercom 2012 in Gmail

How to create an eSignature for the F 1120es Formpdffillercom 2012 right from your mobile device

How to make an eSignature for the F 1120es Formpdffillercom 2012 on iOS

How to create an eSignature for the F 1120es Formpdffillercom 2012 on Android

People also ask

-

What is the F 1120es FormsignNowcom and how can it help my business?

The F 1120es FormsignNowcom is a specialized tool designed to simplify the process of filling out and filing your 1120-ES tax forms electronically. With airSlate SignNow, businesses can easily complete the F 1120es FormsignNowcom, ensuring accuracy and compliance while saving time on tax preparation.

-

How can I access the F 1120es FormsignNowcom through airSlate SignNow?

To access the F 1120es FormsignNowcom, simply sign up for an airSlate SignNow account and navigate to the forms section. There, you will find the F 1120es FormsignNowcom available for use, allowing you to fill it out seamlessly and securely.

-

What features does airSlate SignNow offer for the F 1120es FormsignNowcom?

airSlate SignNow provides a range of features for the F 1120es FormsignNowcom, including electronic signatures, collaboration tools, and customizable templates. These features enhance the efficiency of completing your forms and facilitate easy sharing with clients or team members.

-

Is airSlate SignNow affordable for small businesses needing the F 1120es FormsignNowcom?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to utilize the F 1120es FormsignNowcom. With flexible pricing plans, you can choose a package that fits your budget while accessing powerful tools for document management and eSigning.

-

Can I integrate airSlate SignNow with other software while using the F 1120es FormsignNowcom?

Absolutely! airSlate SignNow offers integrations with various popular software platforms, allowing seamless workflow management when using the F 1120es FormsignNowcom. This means you can connect your existing tools, such as CRM systems and cloud storage services, for enhanced productivity.

-

What are the benefits of using airSlate SignNow for the F 1120es FormsignNowcom?

Using airSlate SignNow for the F 1120es FormsignNowcom provides several benefits, including time savings, increased accuracy, and streamlined collaboration. The user-friendly interface ensures even those unfamiliar with tax forms can complete them efficiently and correctly.

-

How secure is airSlate SignNow when filling out the F 1120es FormsignNowcom?

Security is a top priority for airSlate SignNow. When filling out the F 1120es FormsignNowcom, your data is protected with advanced encryption and compliance with industry standards, ensuring that your sensitive tax information remains safe from unauthorized access.

Get more for F 1120es Formpdffillercom

- Application for handicap parking permit ontario pdf form

- Safety standards forms number

- I i i alderman building form

- Hhsc medicaid provider agreement tmhpcom form

- Molina healthcare doctors note form

- Oklahoma operators security verification form

- Life science a water field study form

- Account information and contractor registration cityoftulsa

Find out other F 1120es Formpdffillercom

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe