Fl Estimated 2017-2026

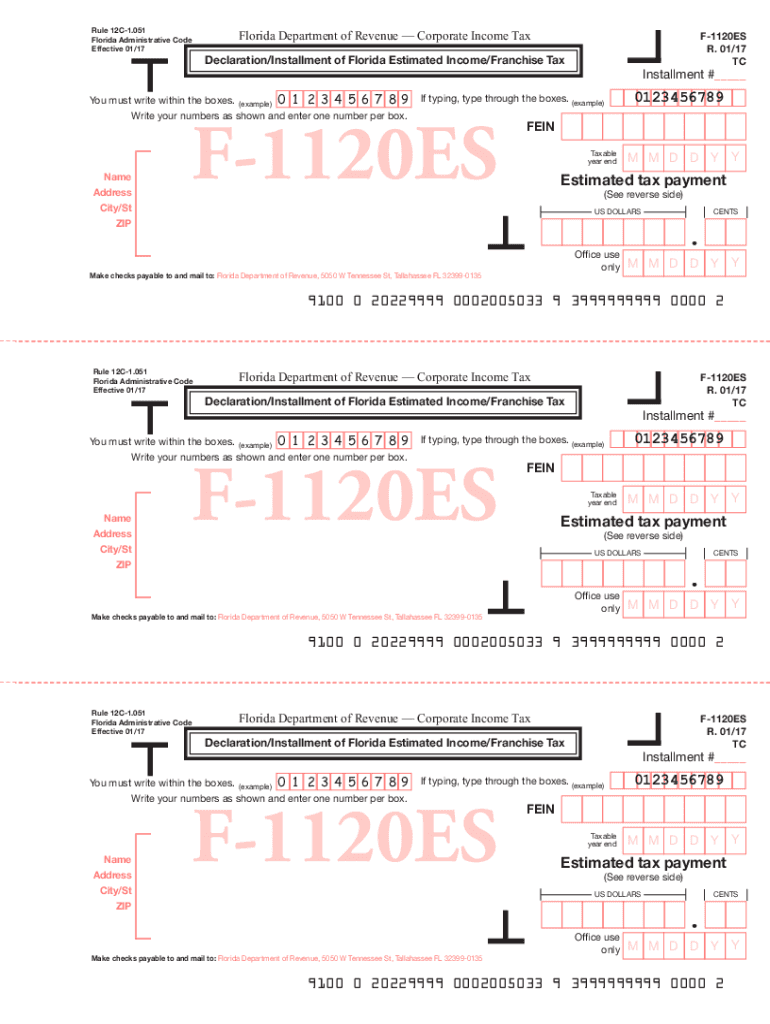

What is the FL Estimated?

The FL Estimated refers to the Florida estimated income tax, a crucial form for taxpayers who expect to owe tax of one thousand dollars or more when filing their annual return. This form is primarily used by individuals and businesses to estimate their tax liability for the year and make quarterly payments to the state. The Florida estimated tax form is essential for those who receive income that is not subject to withholding, such as self-employment income, rental income, or investment earnings.

Steps to Complete the FL Estimated

Completing the Florida estimated income tax form involves several key steps:

- Gather your financial documents, including previous tax returns, income statements, and any relevant deductions.

- Calculate your expected income for the year, taking into account all sources of income.

- Determine your estimated tax liability using the Florida tax rates and any applicable deductions or credits.

- Divide your total estimated tax liability by four to find your quarterly payment amount.

- Fill out the FL Estimated form accurately, ensuring all information is correct.

- Submit your completed form either online or via mail, depending on your preference.

Legal Use of the FL Estimated

The FL Estimated form is legally recognized by the Florida Department of Revenue. It is essential for compliance with state tax laws. Taxpayers must ensure that their estimated payments are made on time to avoid penalties and interest. The form can be submitted electronically, which is a secure and efficient way to fulfill tax obligations. Additionally, using a reliable eSignature platform like signNow can enhance the submission process, ensuring that all documents are legally binding and compliant with the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Filing Deadlines / Important Dates

Filing deadlines for the FL Estimated are crucial for taxpayers to keep in mind. Payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It's important to note that if any of these dates fall on a weekend or holiday, the due date is extended to the next business day.

Required Documents

To complete the FL Estimated form accurately, taxpayers should have the following documents ready:

- Previous year’s tax return for reference

- Income statements, including W-2s and 1099s

- Records of any deductions or credits you plan to claim

- Information on any additional income sources

Having these documents on hand will streamline the process and help ensure accuracy in estimating tax liability.

IRS Guidelines

While the FL Estimated form is specific to Florida, it is essential to consider IRS guidelines when preparing your estimated tax payments. The IRS provides rules regarding how to calculate estimated tax payments, including the safe harbor provisions that can help taxpayers avoid penalties. Understanding these guidelines is vital for ensuring compliance at both the state and federal levels.

Quick guide on how to complete f 1120es formpdffillercom 2017 2019

Your assistance manual on how to prepare your Fl Estimated

If you wish to know how to finalize and submit your Fl Estimated, here are some brief instructions to streamline tax declaration.

To begin, you simply need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow presents a very user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures, and revisit to adjust details as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Fl Estimated in no time:

- Establish your account and start editing PDFs almost instantly.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Fl Estimated in our editor.

- Complete the necessary fillable fields with your details (text content, figures, check marks).

- Employ the Sign Tool to insert your legally-valid eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may increase return errors and delay refunds. Before e-filing your taxes, ensure to verify the IRS website for submission regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct f 1120es formpdffillercom 2017 2019

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

What should I do if I filled out the FAFSA application for 2018-2019 instead of 2017-2018?

Speak with the financial aid office at the college if your choice to make sure that this is actually a problem.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the f 1120es formpdffillercom 2017 2019

How to create an eSignature for your F 1120es Formpdffillercom 2017 2019 in the online mode

How to generate an eSignature for the F 1120es Formpdffillercom 2017 2019 in Chrome

How to make an electronic signature for putting it on the F 1120es Formpdffillercom 2017 2019 in Gmail

How to make an eSignature for the F 1120es Formpdffillercom 2017 2019 from your mobile device

How to make an eSignature for the F 1120es Formpdffillercom 2017 2019 on iOS

How to make an electronic signature for the F 1120es Formpdffillercom 2017 2019 on Android

People also ask

-

What is airSlate SignNow and how does it relate to FL estimated?

airSlate SignNow is a powerful electronic signature solution that simplifies the process of sending and signing documents. By using airSlate SignNow, businesses can effectively manage their documentation needs, making it a cost-effective choice for obtaining FL estimated signatures quickly and securely.

-

How much does airSlate SignNow cost for obtaining FL estimated signatures?

airSlate SignNow offers flexible pricing plans that cater to different needs, making it suitable for both small businesses and large enterprises. You can easily find a plan that fits your budget while ensuring you can efficiently handle your FL estimated documentation processes.

-

What features does airSlate SignNow offer for FL estimated document management?

With airSlate SignNow, users benefit from a host of features including customizable templates, mobile signing, and real-time tracking of document status. These features enhance your ability to manage FL estimated documents efficiently and streamline your workflow.

-

Can airSlate SignNow integrate with other tools for FL estimated workflows?

Yes, airSlate SignNow integrates seamlessly with a variety of popular business applications. This allows you to enhance your FL estimated workflows by connecting it with tools you already use, improving efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for FL estimated signatures?

Using airSlate SignNow for FL estimated signatures offers numerous benefits, including increased efficiency, improved document security, and reduced turnaround times. By leveraging this electronic signature solution, you can focus on your core business activities while ensuring that your documentation is handled swiftly.

-

Is airSlate SignNow compliant with legal standards for FL estimated signatures?

Absolutely, airSlate SignNow complies with all relevant e-signature laws and regulations, ensuring that your FL estimated signatures are legally binding. This compliance helps provide peace of mind for businesses when managing important documents.

-

How can I get started with airSlate SignNow for FL estimated documents?

Getting started with airSlate SignNow is simple. You can sign up for a free trial on their website, which allows you to explore its features for handling FL estimated documents before committing to a paid plan.

Get more for Fl Estimated

- Employment verification form 450346359

- Authorization for use or disclosure of health information ucdmc ucdavis

- Extract of registration in the population registry form

- Sales stars and liquid ratio word problems eh sutherland ehsutherland form

- Autoridad de energa elctrica de puerto rico certificacin gobierno form

- Lewa conservancy attachment form

- Essent cash flow analysis form

- Fleet management agreement template form

Find out other Fl Estimated

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now