Nyc Tax Clearance 2007

What is the NYC Tax Clearance?

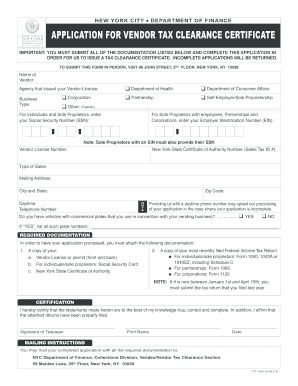

The NYC tax clearance certificate is an official document that verifies a business's compliance with tax obligations in New York City. This certificate is often required for vendors seeking to do business with the city or for those applying for permits and licenses. It confirms that all taxes owed to the city have been paid, ensuring that businesses operate within legal and financial guidelines.

How to Obtain the NYC Tax Clearance

To obtain the NYC tax clearance certificate, businesses must first ensure that all tax filings are current and that any outstanding taxes, penalties, or interest have been paid. The application process typically involves submitting the necessary documentation to the NYC Department of Finance. This may include proof of tax payments, business identification, and any other relevant financial records. Once the application is submitted, it may take several weeks to process, depending on the volume of requests.

Steps to Complete the NYC Tax Clearance

Completing the application for a vendor tax clearance certificate involves several key steps:

- Gather all required documentation, including tax returns and payment records.

- Complete the application form accurately, ensuring all information is up to date.

- Submit the application through the designated method, whether online, by mail, or in person.

- Monitor the application status and respond to any requests for additional information promptly.

Required Documents

When applying for the NYC tax clearance certificate, businesses typically need to provide several documents, including:

- Proof of tax payments, such as receipts or bank statements.

- Completed application form for the tax clearance certificate.

- Business identification documents, such as a business license or registration.

- Any relevant correspondence with the NYC Department of Finance regarding tax matters.

Legal Use of the NYC Tax Clearance

The NYC tax clearance certificate serves as a legal affirmation of a business's tax compliance status. It is often required in various legal and business transactions, including bidding for city contracts, applying for permits, and securing financing. Having this certificate can enhance a business's credibility and demonstrate its commitment to fulfilling tax obligations.

Form Submission Methods

Businesses can submit their application for the NYC tax clearance certificate through various methods, ensuring flexibility and convenience. The available submission methods include:

- Online submission via the NYC Department of Finance's official website.

- Mailing the application to the appropriate department address.

- In-person submission at designated city offices.

Quick guide on how to complete nyc tax clearance

Effortlessly Prepare Nyc Tax Clearance on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle Nyc Tax Clearance on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Nyc Tax Clearance with Ease

- Obtain Nyc Tax Clearance and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or disorganized files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nyc Tax Clearance to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nyc tax clearance

Create this form in 5 minutes!

How to create an eSignature for the nyc tax clearance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for vendor tax clearance certificate?

The application for vendor tax clearance certificate is a formal request that businesses submit to obtain certification proving that they are in compliance with local tax obligations. This certification is often required to qualify for contracts, grants, and other business opportunities. Utilizing tools like airSlate SignNow can streamline this application process.

-

How can airSlate SignNow help with the application for vendor tax clearance certificate?

airSlate SignNow simplifies the application for vendor tax clearance certificate by providing an easy-to-use platform for sending, signing, and managing documents electronically. This solution reduces the time spent on paperwork and enhances compliance by ensuring all necessary forms are completed correctly and securely.

-

What are the costs associated with using airSlate SignNow for the application for vendor tax clearance certificate?

Pricing for airSlate SignNow is competitive and cost-effective, allowing businesses to choose plans that fit their needs without blowing their budgets. Depending on the scale of your operations, you can select from various subscription options that align with your requirements for handling the application for vendor tax clearance certificate.

-

Is the application for vendor tax clearance certificate process complicated?

The application for vendor tax clearance certificate can be complex due to the various requirements imposed by different jurisdictions. However, airSlate SignNow provides guidance and templates to help users navigate the process efficiently, making it easier than ever to gather required documents and complete submissions.

-

Are there any integrations available with airSlate SignNow for the application for vendor tax clearance certificate?

Yes, airSlate SignNow offers a range of integrations with popular tools and platforms, allowing businesses to connect their workflow seamlessly. This includes integrations with accounting software and project management tools, which can streamline the entire process of applying for a vendor tax clearance certificate.

-

What benefits can I expect from using airSlate SignNow for the application for vendor tax clearance certificate?

Using airSlate SignNow for the application for vendor tax clearance certificate can greatly increase operational efficiency and save time. The platform's electronic signature capabilities and document management features ensure a faster turnaround and enhance the security of sensitive tax-related documents.

-

How quickly can I process the application for vendor tax clearance certificate with airSlate SignNow?

The processing time for the application for vendor tax clearance certificate can vary based on jurisdiction and specific requirements. However, using airSlate SignNow can signNowly reduce the overall time to complete your application by streamlining the document preparation, signing, and submission processes.

Get more for Nyc Tax Clearance

- Appraisal management company certificate of form

- Orea standard form

- The sun the wind and the rain doc templatepdffiller form

- Eunice kennedy shriver national institute of child health form

- How to become an approved provider of whs entry permit form

- Corporation income ampamp franchise taxes louisiana revenue form

- New york domestic partnership form

- Paycheck protection program application form

Find out other Nyc Tax Clearance

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online