Renewing Your Occupational Tax Certificate 2023-2026

What is the renewing your occupational tax certificate?

The renewing your occupational tax certificate is an essential document for businesses operating in specific jurisdictions within the United States. This certificate verifies that a business has complied with local tax regulations and is authorized to conduct its operations legally. It typically needs to be renewed annually or biannually, depending on the local laws governing the area where the business is located.

Obtaining this certificate ensures that a business is in good standing with local authorities and can avoid potential penalties for non-compliance. The process may vary by state or municipality, making it crucial for business owners to understand their local requirements.

Steps to complete the renewing your occupational tax certificate

Completing the renewing your occupational tax certificate involves several key steps to ensure compliance with local regulations. Here is a general outline of the process:

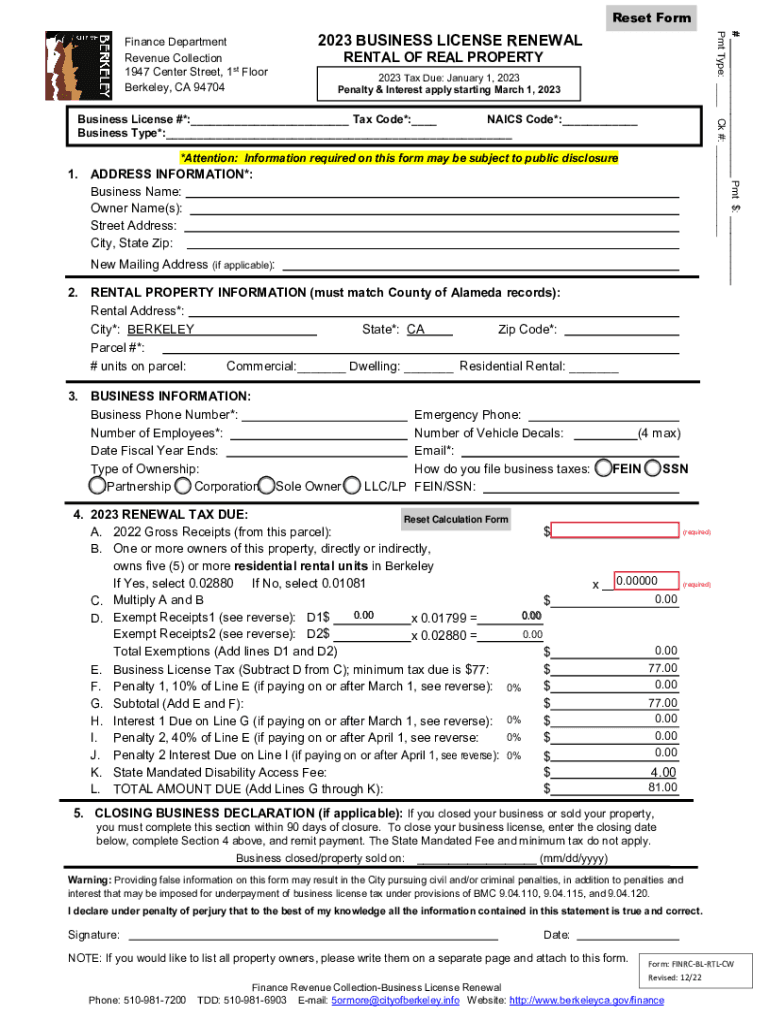

- Gather necessary information: Collect all relevant business details, including your business name, address, and tax identification number.

- Review local requirements: Check the specific regulations for your city or county regarding the renewal of occupational tax certificates.

- Fill out the application form: Complete the required form accurately, ensuring all information is current and correct.

- Submit the application: Depending on local rules, you may submit your application online, by mail, or in person.

- Pay any applicable fees: Be prepared to pay a renewal fee, which can vary based on your location and business type.

- Receive confirmation: After processing, you will receive confirmation of your renewed certificate, which should be displayed at your business location.

Legal use of the renewing your occupational tax certificate

The renewing your occupational tax certificate serves as a legal affirmation that a business is authorized to operate within a specific jurisdiction. This document is often required for various business activities, including applying for loans, bidding on contracts, or obtaining permits. Failure to renew this certificate can lead to legal repercussions, including fines or the suspension of business operations.

It is essential to maintain compliance with local laws and regulations to ensure the continued legality of your business operations. Regularly reviewing the requirements for your occupational tax certificate can help avoid any lapses in compliance.

Required documents

To successfully renew your occupational tax certificate, you will typically need to provide several key documents. These may include:

- Completed application form for the occupational tax certificate renewal.

- Proof of business registration, such as a business license or articles of incorporation.

- Tax identification number (TIN) or Employer Identification Number (EIN).

- Payment receipt for any renewal fees.

- Any additional documentation requested by local authorities, such as proof of insurance or compliance with health and safety regulations.

Who issues the form?

The renewing your occupational tax certificate is typically issued by the local government authority, which may vary based on your location. This could be the city or county clerk's office, the department of revenue, or a similar regulatory body. It is important to identify the correct issuing authority for your area to ensure that you are following the appropriate procedures for renewal.

Contacting your local government office can provide clarity on the specific requirements and processes involved in obtaining or renewing your occupational tax certificate.

Penalties for non-compliance

Failing to renew your occupational tax certificate can result in significant penalties. These may include:

- Fines imposed by local authorities for operating without a valid certificate.

- Legal actions that may lead to the suspension or revocation of your business license.

- Increased scrutiny from regulatory bodies, which can complicate future business operations.

- Potential loss of business opportunities, as many contracts and permits require proof of a valid occupational tax certificate.

Understanding the importance of timely renewal can help protect your business from these risks and ensure continued compliance with local laws.

Quick guide on how to complete renewing your occupational tax certificate

Effortlessly Prepare Renewing Your Occupational Tax Certificate on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it on the internet. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without delays. Manage Renewing Your Occupational Tax Certificate on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The easiest method to modify and electronically sign Renewing Your Occupational Tax Certificate effortlessly

- Obtain Renewing Your Occupational Tax Certificate and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Renewing Your Occupational Tax Certificate and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct renewing your occupational tax certificate

Create this form in 5 minutes!

How to create an eSignature for the renewing your occupational tax certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an occupational tax certificate?

An occupational tax certificate is a document issued by local governments that allows individuals or businesses to operate in a specific area while complying with local regulations. Obtaining an occupational tax certificate demonstrates your business's legitimacy and fulfills local tax obligations.

-

How can airSlate SignNow help in obtaining an occupational tax certificate?

airSlate SignNow streamlines the documentation process required to apply for an occupational tax certificate. By providing a platform for eSigning and sending necessary forms, it ensures that your application is submitted quickly and securely, helping you meet compliance requirements.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans include essential features for managing documents and eSigning, making it budget-friendly for individuals and organizations seeking to obtain their occupational tax certificate efficiently.

-

What features does airSlate SignNow provide for managing documents related to occupational tax certificates?

airSlate SignNow includes features like automated workflows, document templates, and secure eSignature options, making it easier to manage the paperwork required for your occupational tax certificate. These features help keep your documents organized and ensure a smooth submission process.

-

Is airSlate SignNow suitable for small businesses seeking an occupational tax certificate?

Yes, airSlate SignNow is particularly beneficial for small businesses looking to obtain an occupational tax certificate. Its user-friendly interface and affordable pricing make it accessible, helping small business owners navigate the application process efficiently.

-

Can I integrate airSlate SignNow with other software for managing my occupational tax certificate applications?

Absolutely! airSlate SignNow offers integrations with popular applications like CRM systems and accounting software. This integration allows you to manage your occupational tax certificate applications more effectively and keep all your important documents synced.

-

What benefits does using airSlate SignNow provide in the process of acquiring an occupational tax certificate?

Using airSlate SignNow simplifies the acquisition of your occupational tax certificate by reducing paperwork, saving time, and enhancing document security. The platform's eSignature capabilities ensure that your applications are signed and submitted swiftly, accelerating your path to compliance.

Get more for Renewing Your Occupational Tax Certificate

- Idaho change address form

- Defibrillator questionnaire form

- Singapore police force coc form

- Army publishing directorate da form

- Delaware 1811cc 0701 form

- Cocodoccomform350367519 reclassificationreclassification questionnaireindd backstage library works

- La cift 620 form

- Wwwhealthvermontgovstatsvital recordsvital records ampamp population data vermont department of health form

Find out other Renewing Your Occupational Tax Certificate

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF