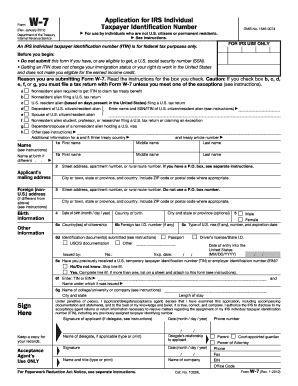

Taxpayer Identification Number Form

What makes the taxpayer identification number form legally valid?

As the world ditches office work, the completion of documents more and more happens online. The taxpayer identification number form isn’t an exception. Dealing with it using electronic tools differs from doing this in the physical world.

An eDocument can be considered legally binding provided that specific requirements are satisfied. They are especially critical when it comes to signatures and stipulations associated with them. Typing in your initials or full name alone will not guarantee that the institution requesting the sample or a court would consider it accomplished. You need a reliable solution, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your taxpayer identification number form when filling out it online?

Compliance with eSignature laws is only a portion of what airSlate SignNow can offer to make document execution legal and safe. It also offers a lot of possibilities for smooth completion security smart. Let's quickly run through them so that you can be certain that your taxpayer identification number form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: major privacy standards in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties identities through additional means, like an SMS or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information securely to the servers.

Filling out the taxpayer identification number form with airSlate SignNow will give greater confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete taxpayer identification number

Complete Taxpayer Identification Number seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to generate, modify, and eSign your documents quickly without delays. Handle Taxpayer Identification Number on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Taxpayer Identification Number with ease

- Locate Taxpayer Identification Number and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Taxpayer Identification Number to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer identification number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a taxpayer identification number (TIN)?

A taxpayer identification number (TIN) is a unique number assigned to individuals and businesses for tax purposes. It is essential for filing tax returns and reporting income accurately. In some cases, a TIN can be your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). Understanding your TIN is crucial for compliance and effective record-keeping.

-

How can airSlate SignNow help with taxpayer identification numbers?

airSlate SignNow streamlines the process of collecting and managing taxpayer identification numbers through secure electronic signatures. With our platform, you can easily send documents that require TINs and ensure that they are signed quickly and securely. This simplifies compliance for businesses while reducing the risk of errors and omissions in your paperwork.

-

Is there a cost associated with using airSlate SignNow for managing taxpayer identification numbers?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution provides access to features such as document signing, secure storage, and easy collection of taxpayer identification numbers. You can choose a plan that fits your budget and offers the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for handling documents with taxpayer identification numbers?

AirSlate SignNow offers features that are ideal for handling documents requiring taxpayer identification numbers, including electronic signatures, templates, and real-time tracking of document status. Our user-friendly interface allows users to create, send, and manage documents effortlessly. You can also customize templates to include fields specifically for taxpayer identification numbers.

-

Can I integrate airSlate SignNow with other platforms for managing taxpayer identification numbers?

Yes, airSlate SignNow integrates seamlessly with various platforms and applications, allowing you to manage taxpayer identification numbers and other essential documentation easily. Our integrations with popular tools enhance your workflow, helping you store, track, and utilize TINs effectively within your existing systems. This means greater efficiency and reduced administrative overhead.

-

How secure is airSlate SignNow when handling taxpayer identification numbers?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive information like taxpayer identification numbers. We employ industry-standard encryption and compliance measures to ensure your data is protected. Additionally, our platform is designed to maintain confidentiality and integrity while processing your documents.

-

Can I access signed documents containing taxpayer identification numbers from anywhere?

Yes, with airSlate SignNow, you can access signed documents containing taxpayer identification numbers from anywhere, anytime. Our cloud-based platform enables you to manage and retrieve your documents securely on any device with an internet connection. This flexibility allows you to stay organized and responsive to your business needs.

Get more for Taxpayer Identification Number

- Time and start of completion form

- Contractor shall commence the work to be form

- Such plans and specifications are hereby made a part of this contract form

- Usual and customary excavation and grading on the work site as may be required in the judgment form

- Performed under this contract on or before

- Roads driveways foundations walls walkways and parking lots form

- Repairing replacing re setting altering converting or moving heat producing systems electric or form

- Work area together with a description of the work to be done materials to be used and the form

Find out other Taxpayer Identification Number

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors