Indiana Organization Form

What is the Indiana Organization

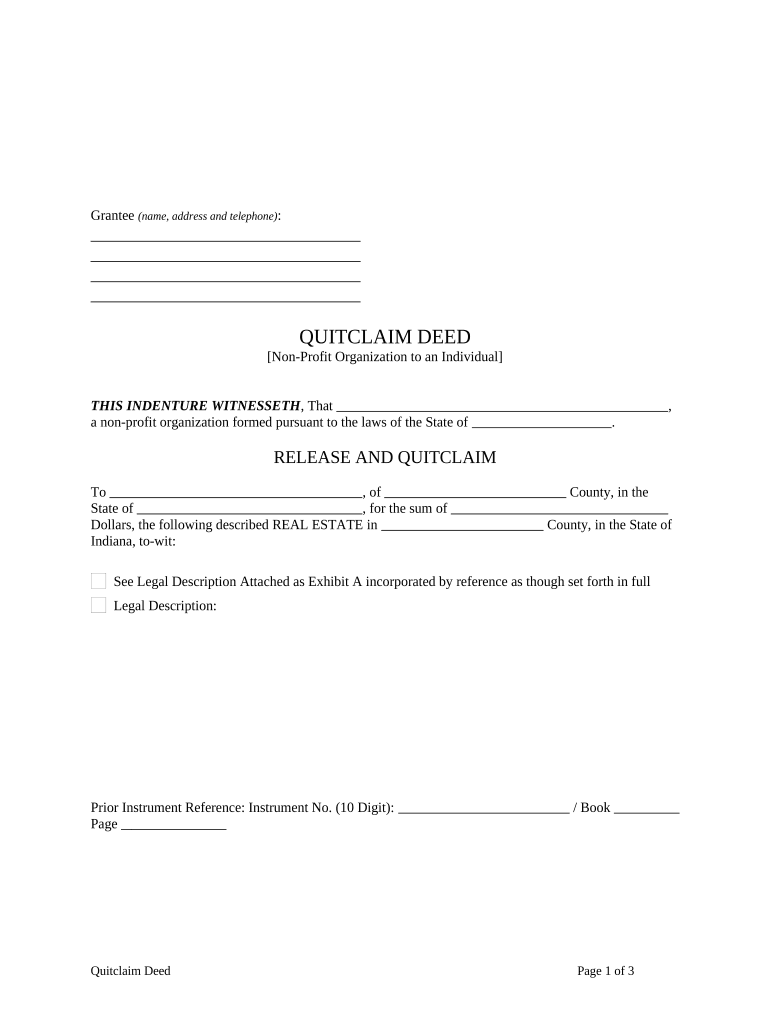

The Indiana Organization refers to the official documentation required for establishing a business entity in the state of Indiana. This form is essential for individuals or groups looking to form various types of organizations, such as corporations, limited liability companies (LLCs), or partnerships. The Indiana Organization form outlines the basic information about the entity, including its name, purpose, and structure, ensuring compliance with state regulations.

How to use the Indiana Organization

Using the Indiana Organization form involves several straightforward steps. First, gather the necessary information about your business, including its name, address, and the names of the members or directors. Next, fill out the form accurately, ensuring all required fields are completed. Once the form is filled, it can be submitted electronically or via mail to the appropriate state office. Utilizing an eSignature solution can streamline this process, allowing for secure and efficient submission.

Steps to complete the Indiana Organization

Completing the Indiana Organization form requires careful attention to detail. Follow these steps:

- Gather required information, including business name, address, and member details.

- Access the Indiana Organization form through the state’s official website or a trusted source.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, depending on your preference.

Legal use of the Indiana Organization

The legal use of the Indiana Organization form is crucial for establishing a valid business entity in Indiana. This form must be completed in accordance with state laws to ensure that the organization is recognized legally. Compliance with the Indiana Business Corporation Law and other relevant regulations is necessary for the organization to operate legally and avoid penalties.

Key elements of the Indiana Organization

Key elements of the Indiana Organization form include:

- Business Name: The official name under which the organization will operate.

- Business Address: The physical location of the business.

- Type of Entity: The classification of the organization, such as LLC or corporation.

- Member Information: Names and addresses of members, directors, or officers.

Required Documents

When completing the Indiana Organization form, several documents may be required. These typically include:

- Identification documents for all members or directors.

- Proof of address for the business location.

- Any additional documentation that may support the formation, such as operating agreements or bylaws.

Quick guide on how to complete indiana organization

Complete Indiana Organization seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without delays. Manage Indiana Organization on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign Indiana Organization effortlessly

- Locate Indiana Organization and then click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your preference. Modify and eSign Indiana Organization and ensure excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit an Indiana organization?

airSlate SignNow is a powerful e-signature solution that helps Indiana organizations streamline their document management processes. It allows businesses to send and securely eSign documents, ensuring efficiency and compliance. By using SignNow, your Indiana organization can reduce paperwork, save time, and enhance productivity.

-

What pricing plans does airSlate SignNow offer for Indiana organizations?

airSlate SignNow provides flexible pricing plans tailored for Indiana organizations of all sizes. The plans range from a basic option for small teams to comprehensive packages for larger enterprises. Each plan includes essential features that can be customized to meet the unique needs of your Indiana organization.

-

What essential features does airSlate SignNow offer for Indiana organizations?

airSlate SignNow includes a variety of features designed for Indiana organizations, such as document templates, real-time tracking, and secure cloud storage. These features facilitate easy collaboration among team members while ensuring that all documents are maintained securely. This makes managing e-signatures efficient for any Indiana organization.

-

How does airSlate SignNow improve the signing process for an Indiana organization?

With airSlate SignNow, Indiana organizations experience a streamlined signing process that eliminates the hassle of traditional paper methods. Users can send documents for e-signature in just a few clicks, leading to quicker turnaround times. This enhanced efficiency is particularly beneficial for Indiana organizations looking to improve workflow and client satisfaction.

-

Can airSlate SignNow integrate with other software used by Indiana organizations?

Yes, airSlate SignNow offers seamless integrations with various applications commonly used by Indiana organizations, such as CRMs, cloud storage services, and productivity tools. This integration capability allows businesses to maintain a smooth workflow and leverage existing tools effectively. Your Indiana organization can maximize productivity by bringing all systems together.

-

How secure is airSlate SignNow for Indiana organizations handling sensitive documents?

airSlate SignNow prioritizes security with features like encryption, secure access controls, and compliance with legal regulations. Indiana organizations can trust that their sensitive documents are handled with the utmost security, providing peace of mind when sending and signing important agreements electronically. This focus on security helps protect an Indiana organization's reputation and data.

-

What benefits can Indiana organizations expect from using airSlate SignNow?

Indiana organizations using airSlate SignNow can expect numerous benefits, including reduced operational costs, improved efficiency, and enhanced collaboration among teams. The ability to quickly send and eSign documents leads to faster decision-making and better customer experiences. By choosing SignNow, your Indiana organization can distinguish itself in a competitive market.

Get more for Indiana Organization

Find out other Indiana Organization

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation