Cp1030 Form

What is the Cp1030 Form

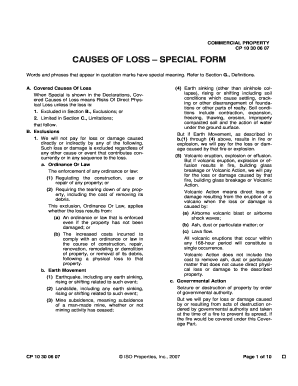

The Cp1030 form, also known as the cp 10 30 06 07, is a specialized document used primarily in the context of insurance claims. This form is designed to outline specific causes of loss and is essential for businesses and individuals seeking to report incidents that may lead to a claim. Understanding the purpose and structure of the Cp1030 form is crucial for ensuring that all necessary information is accurately conveyed to the relevant parties.

How to use the Cp1030 Form

Using the Cp1030 form involves several key steps. First, gather all relevant information regarding the incident or loss being reported. This includes details such as the date of the loss, a description of the incident, and any supporting documentation. Once this information is compiled, fill out the form accurately, ensuring that each section is completed as required. After completing the form, it should be submitted to the appropriate insurance provider or authority for processing.

Steps to complete the Cp1030 Form

Completing the Cp1030 form requires careful attention to detail. Follow these steps for a smooth process:

- Begin by reading the instructions provided with the form to understand the requirements.

- Fill in your personal or business information at the top of the form.

- Provide a detailed description of the loss, including dates and circumstances.

- Attach any necessary documentation that supports your claim, such as photographs or receipts.

- Review the completed form for accuracy before submission.

Legal use of the Cp1030 Form

The legal validity of the Cp1030 form hinges on its proper completion and submission. To ensure that the form is legally binding, it must be filled out in accordance with applicable laws and regulations. This includes adhering to any state-specific requirements that may apply. Additionally, utilizing a reliable eSignature solution can enhance the legal standing of the form, ensuring that all signatures are verifiable and compliant with eSignature laws.

Key elements of the Cp1030 Form

Several key elements must be included in the Cp1030 form to ensure its effectiveness:

- Claimant Information: Details about the individual or business filing the claim.

- Description of Loss: A clear and concise account of the incident.

- Date of Loss: When the incident occurred.

- Supporting Documents: Evidence that substantiates the claim.

- Signature: A signature confirming the accuracy of the information provided.

Who Issues the Form

The Cp1030 form is typically issued by insurance companies or regulatory bodies involved in the claims process. It is important to obtain the form directly from these sources to ensure that you are using the most current version and that it complies with all necessary guidelines. Always verify that the issuing authority is recognized and that the form meets the required standards for your specific situation.

Quick guide on how to complete cp1030 form

Effortlessly Complete Cp1030 Form on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as it allows you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Cp1030 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

How to Edit and eSign Cp1030 Form with Ease

- Locate Cp1030 Form and click on Get Form to begin.

- Make use of the tools we offer to finish your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Cp1030 Form to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp1030 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cp 10 30 in the context of airSlate SignNow?

The term cp 10 30 refers to a specific pricing plan offered by airSlate SignNow, designed to cater to small to medium-sized businesses. This plan enables users to access essential eSigning features at an economical rate, making it an ideal choice for teams looking to streamline their document management.

-

What features are included in the cp 10 30 plan?

The cp 10 30 plan includes several key features such as unlimited eSignatures, document templates, custom branding, and integration with popular applications. These features allow businesses to enhance their workflows and improve document turnaround times efficiently.

-

How does the cp 10 30 pricing compare to other eSigning solutions?

The cp 10 30 pricing plan is highly competitive when compared to other eSigning solutions on the market. It offers a cost-effective way to utilize advanced features without compromising quality, making it a solid choice for businesses looking to save on document management costs.

-

Can I integrate cp 10 30 with other software applications?

Yes, the cp 10 30 plan allows for seamless integration with a variety of software applications, including CRM systems, cloud storage services, and collaboration tools. This facilitates a smoother workflow by connecting your existing tools directly with airSlate SignNow.

-

What are the benefits of using airSlate SignNow with the cp 10 30 plan?

Using airSlate SignNow with the cp 10 30 plan provides numerous benefits, such as increased efficiency and reduced paper clutter. Users can eSign documents faster and track their progress in real-time, which ultimately improves overall productivity for any business.

-

Is there a free trial available for the cp 10 30 plan?

Yes, airSlate SignNow offers a free trial for the cp 10 30 plan, allowing prospective customers to experience its features before committing. This makes it easy for businesses to evaluate the solution and see how it meets their eSigning needs.

-

What customer support options are available for cp 10 30 users?

Users of the cp 10 30 plan have access to various customer support options, including online chat, email support, and a comprehensive help center. This ensures that businesses can get assistance whenever they need it, enhancing their overall experience with airSlate SignNow.

Get more for Cp1030 Form

Find out other Cp1030 Form

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now