Rita Form 11a

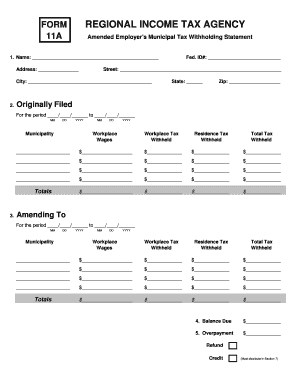

What is the Rita Form 11a

The Rita Form 11a is a specific document used in the United States, primarily for tax-related purposes. This form is essential for individuals and businesses to report certain financial information to the relevant authorities. It serves as a formal declaration of income, deductions, and other pertinent financial details that may impact tax obligations. Understanding the purpose of the Rita Form 11a is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the Rita Form 11a

Using the Rita Form 11a involves several key steps. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant receipts. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery to the appropriate tax office.

Steps to complete the Rita Form 11a

Completing the Rita Form 11a requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary documentation, including income statements and receipts.

- Fill out the form, ensuring that you provide accurate information in each section.

- Double-check for any errors or missing information.

- Sign and date the form to certify its accuracy.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Rita Form 11a

The Rita Form 11a is legally binding when completed and submitted according to the established regulations. To ensure its legal validity, it is important to comply with all relevant laws and guidelines. This includes using a reliable platform for electronic signatures, which can provide an electronic certificate. Adhering to the requirements set forth by the IRS and other regulatory bodies will help ensure that the form is accepted and recognized as a legitimate document.

Key elements of the Rita Form 11a

Several key elements must be included in the Rita Form 11a to ensure its completeness and accuracy. These elements typically include:

- Personal information, such as name, address, and Social Security number.

- Details of income sources, including wages, business income, and investment earnings.

- Deductions and credits that may apply to your financial situation.

- Signature and date to validate the submission.

Form Submission Methods (Online / Mail / In-Person)

The Rita Form 11a can be submitted through various methods, depending on the preferences of the filer and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many users prefer to complete and submit the form electronically for convenience and speed.

- Mail: The form can be printed and sent via postal service to the designated tax office.

- In-Person: Filers may also choose to deliver the form directly to the tax office for immediate processing.

Quick guide on how to complete rita form 11a

Complete Rita Form 11a seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Rita Form 11a on any device using the airSlate SignNow Android or iOS applications and streamline any paperwork process today.

How to edit and eSign Rita Form 11a effortlessly

- Locate Rita Form 11a and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to confirm your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Rita Form 11a and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rita form 11a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rita form 11a and how is it used?

The rita form 11a is an essential document for businesses that need to streamline workflows and ensure compliance. By utilizing airSlate SignNow, you can easily fill out, send, and eSign the rita form 11a, making your document management process more efficient.

-

How much does it cost to use airSlate SignNow for the rita form 11a?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Whether you're a small team or a large enterprise, you can access the features necessary for managing the rita form 11a effectively without breaking your budget.

-

What features does airSlate SignNow offer for rita form 11a management?

With airSlate SignNow, you get features including templates, collaboration tools, and secure electronic signatures, specifically designed for managing the rita form 11a. These tools enhance productivity and make document handling straightforward.

-

Can I integrate airSlate SignNow with other applications for managing rita form 11a?

Yes, airSlate SignNow seamlessly integrates with a variety of applications such as CRM systems, cloud storage solutions, and more. This allows you to automate processes associated with the rita form 11a, ensuring a smoother workflow.

-

What are the benefits of using airSlate SignNow for the rita form 11a?

Using airSlate SignNow for the rita form 11a offers numerous benefits including faster turnaround times, improved document security, and greater accessibility. It empowers your team to complete documents quickly while maintaining compliance and accuracy.

-

Is airSlate SignNow secure for handling the rita form 11a?

Absolutely, airSlate SignNow prioritizes security for all documents, including the rita form 11a. With encryption, two-factor authentication, and compliance with industry standards, your sensitive information remains protected at all times.

-

How can I get started with airSlate SignNow for the rita form 11a?

Getting started with airSlate SignNow is easy! Simply sign up for a free trial on our website and explore the features tailored for the rita form 11a. You can begin managing your documents efficiently in just a few clicks.

Get more for Rita Form 11a

- Control number va p004 pkg form

- Control number va p009 pkg form

- Control number va p012 pkg form

- Code of virginia 32 form

- This letter is used to inform an interviewed applicant that a job offer will not be extended

- Control number va p031 pkg form

- Control number va p032 pkg form

- Control number va p034 pkg form

Find out other Rita Form 11a

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy