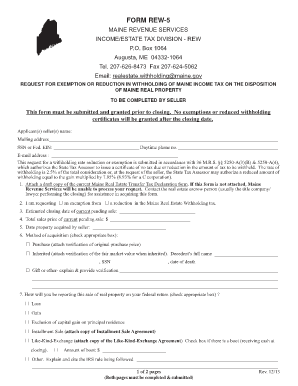

FORM REW 5 Maine Gov Maine

What is the FORM REW 5 Maine gov Maine

The FORM REW 5 is a document utilized in the state of Maine, primarily for tax-related purposes. It serves as a reporting form for specific financial transactions or tax situations. Understanding its purpose is crucial for compliance with state regulations and ensuring accurate financial reporting. The form is designed to capture essential information that may impact tax liabilities or entitlements, making it a vital tool for residents and businesses in Maine.

How to use the FORM REW 5 Maine gov Maine

Using the FORM REW 5 involves several straightforward steps. First, gather all necessary information, including financial records and any supporting documentation required for the specific reporting purpose. Next, access the form through the official Maine government website or designated state resources. Fill out the form accurately, ensuring that all fields are completed as required. Once completed, review the information for accuracy before submission to avoid any potential issues with tax compliance.

Steps to complete the FORM REW 5 Maine gov Maine

Completing the FORM REW 5 involves a series of methodical steps:

- Collect relevant financial documents and data necessary for the form.

- Download or access the FORM REW 5 from the Maine government website.

- Carefully fill in all required fields, ensuring accuracy and completeness.

- Double-check the information for any errors or omissions.

- Submit the completed form according to the guidelines provided, either online or via mail.

Legal use of the FORM REW 5 Maine gov Maine

The legal use of the FORM REW 5 is governed by Maine state laws and regulations. It is essential to use the form correctly to ensure compliance with tax obligations. Failing to adhere to the legal requirements can result in penalties or complications with tax filings. The form must be completed truthfully and submitted within the designated timeframes to maintain its legal standing.

State-specific rules for the FORM REW 5 Maine gov Maine

Maine has specific rules and regulations that govern the use of the FORM REW 5. These rules outline eligibility criteria, submission deadlines, and the types of transactions that must be reported. Familiarity with these state-specific guidelines is essential for ensuring compliance and avoiding any potential legal issues. It is advisable to consult the Maine government resources or a tax professional for detailed information regarding these regulations.

Form Submission Methods (Online / Mail / In-Person)

The FORM REW 5 can be submitted through various methods, depending on the preferences of the filer and the requirements set by the state. Options typically include:

- Online Submission: Many forms can be submitted electronically through the Maine government website, providing a quick and efficient option.

- Mail: Completed forms can be printed and mailed to the designated state office, ensuring that they are sent within the required deadlines.

- In-Person: Some individuals may choose to submit their forms in person at local government offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete form rew 5 maine gov maine

Complete FORM REW 5 Maine gov Maine effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Handle FORM REW 5 Maine gov Maine on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to alter and eSign FORM REW 5 Maine gov Maine with ease

- Find FORM REW 5 Maine gov Maine and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Alter and eSign FORM REW 5 Maine gov Maine and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rew 5 maine gov maine

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM REW 5 Maine gov Maine used for?

The FORM REW 5 Maine gov Maine is used for reporting the resale of property in the state of Maine. This form is essential for ensuring compliance with state regulations and helps streamline the property transfer process. By using airSlate SignNow, you can easily eSign and send FORM REW 5 Maine gov Maine, saving you time and effort.

-

How does airSlate SignNow make it easy to complete the FORM REW 5 Maine gov Maine?

airSlate SignNow simplifies the process of completing FORM REW 5 Maine gov Maine by providing an intuitive platform for document management and eSignature. Our user-friendly interface allows you to fill out, sign, and send the form with just a few clicks. This eliminates paperwork hassles, ensuring faster transactions.

-

Is there a cost to use airSlate SignNow for FORM REW 5 Maine gov Maine?

Yes, airSlate SignNow offers competitive pricing plans tailored to different business needs. While the basic services may be low-cost or free, accessing premium features, including advanced integrations and more storage space, may incur additional charges. Using our platform for FORM REW 5 Maine gov Maine can be a cost-effective solution for your document signing needs.

-

Can I integrate airSlate SignNow with other applications for FORM REW 5 Maine gov Maine?

Absolutely! airSlate SignNow offers integration with multiple applications, including CRM systems and cloud storage solutions. This means you can streamline the entire process of completing, eSigning, and storing FORM REW 5 Maine gov Maine across your business tools for greater efficiency.

-

What are the benefits of using airSlate SignNow for FORM REW 5 Maine gov Maine?

Using airSlate SignNow for FORM REW 5 Maine gov Maine provides numerous benefits, including reduced turnaround times and enhanced security for your documents. The platform ensures that all signers receive notifications and can easily complete the form anytime, anywhere. This flexibility can signNowly improve your workflow.

-

Is my data secure when using airSlate SignNow for FORM REW 5 Maine gov Maine?

Yes, your data security is our top priority at airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to ensure that information related to FORM REW 5 Maine gov Maine is protected. You can trust that your documents are kept private and secure.

-

How can I track the status of my FORM REW 5 Maine gov Maine submissions?

With airSlate SignNow, you can easily track the status of your FORM REW 5 Maine gov Maine submissions in real-time. Our platform provides notifications as documents are viewed, signed, and finalized. This visibility allows you to stay informed about every transaction and manage your documents effectively.

Get more for FORM REW 5 Maine gov Maine

- Instructions for completing petition for judgment of emancipation form

- Emancipation of a minor family law self help center form

- Emancipation the superior court of california county of santa clara form

- Waiver of notice on termination of child support form

- Notice of transfer and release of liability dmv state of california form

- For judgment of form

- To download the pro se information packet mississippi department of

- Note fill out one form for each person to be served

Find out other FORM REW 5 Maine gov Maine

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free