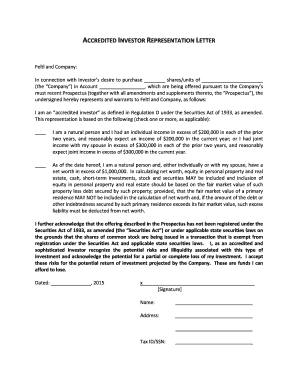

ACCREDITED INVESTOR REPRESENTATION LETTER Form

What is the letter of accreditation?

The letter of accreditation is a formal document that certifies an individual's status as an accredited investor. This designation is crucial for individuals seeking to participate in certain investment opportunities that are not available to the general public. The letter typically verifies that the individual meets specific financial criteria established by regulatory bodies, such as the Securities and Exchange Commission (SEC). These criteria often include having a net worth exceeding one million dollars, excluding primary residence, or having an income of at least two hundred thousand dollars in each of the last two years, or three hundred thousand dollars combined with a spouse. This document serves as proof of eligibility for investments in private placements, hedge funds, and other high-risk investment vehicles.

Key elements of the letter of accreditation

A well-structured letter of accreditation should include several key elements to ensure its validity and acceptance by investment firms. These elements typically consist of:

- Investor's Name: The full legal name of the accredited investor.

- Verification Statement: A statement confirming that the individual meets the criteria for accredited investor status.

- Financial Advisor or CPA Information: The name and contact details of the financial advisor or CPA issuing the letter.

- Date of Issuance: The date on which the letter is issued, ensuring it is current.

- Signature: The signature of the CPA or financial advisor, validating the authenticity of the letter.

Steps to complete the letter of accreditation

Completing a letter of accreditation involves several steps to ensure accuracy and compliance with legal standards. The process typically includes:

- Gathering Financial Information: Collect all necessary financial documents, including tax returns, bank statements, and investment portfolios.

- Consulting with a CPA: Work with a certified public accountant (CPA) to assess your financial status and determine if you meet the accredited investor criteria.

- Drafting the Letter: The CPA will draft the letter, ensuring all required elements are included and accurately reflect your financial situation.

- Reviewing the Document: Carefully review the letter for any errors or omissions before finalization.

- Obtaining the Signature: The CPA must sign the letter to validate its authenticity.

Legal use of the letter of accreditation

The letter of accreditation is legally binding and serves as a critical document in investment transactions. It is essential for individuals to ensure that their letter complies with the regulations set forth by the SEC and other governing bodies. This compliance helps protect both the investor and the issuer from legal complications. Investors should retain a copy of the letter for their records and present it to investment firms as required. Additionally, the letter should be updated periodically, especially if there are significant changes in the investor's financial status.

How to obtain the letter of accreditation

Obtaining a letter of accreditation typically involves engaging a qualified CPA or financial advisor. The steps to secure this letter include:

- Identify a Qualified Professional: Choose a CPA or financial advisor experienced in preparing accreditation letters.

- Schedule a Consultation: Discuss your financial situation and the requirements for accreditation.

- Provide Necessary Documentation: Supply the advisor with all relevant financial documents for review.

- Receive the Letter: Once the advisor confirms your accredited status, they will issue the letter.

Examples of using the letter of accreditation

The letter of accreditation can be used in various scenarios where investment opportunities are presented. Common examples include:

- Participating in private equity investments, where only accredited investors are allowed.

- Investing in hedge funds, which often require proof of accredited status for entry.

- Engaging in real estate syndications that cater exclusively to accredited investors.

Quick guide on how to complete accredited investor representation letter

Effortlessly Prepare ACCREDITED INVESTOR REPRESENTATION LETTER on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without hassles. Manage ACCREDITED INVESTOR REPRESENTATION LETTER across any platform utilizing airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The Easiest Method to Alter and eSign ACCREDITED INVESTOR REPRESENTATION LETTER Effortlessly

- Locate ACCREDITED INVESTOR REPRESENTATION LETTER and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or black out sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and eSign ACCREDITED INVESTOR REPRESENTATION LETTER while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the accredited investor representation letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CPA accredited investor letter?

A CPA accredited investor letter is a document issued by a certified public accountant verifying an individual's status as an accredited investor. This letter confirms that the investor meets the income or net worth criteria set by the SEC, which is essential for participation in private investment opportunities.

-

How can airSlate SignNow help me create a CPA accredited investor letter?

With airSlate SignNow, you can easily create and customize your CPA accredited investor letter using templates and intuitive editing tools. Our platform simplifies the document creation process, ensuring that your letter complies with legal requirements and can be sent for eSignature in minutes.

-

What are the benefits of using airSlate SignNow for CPA accredited investor letters?

Using airSlate SignNow for your CPA accredited investor letter streamlines your workflow, saves time, and reduces errors. You can easily track the status of your document, automate reminders for signatures, and securely store your letters, all while ensuring compliance with regulatory standards.

-

Is there a fee for creating a CPA accredited investor letter with airSlate SignNow?

Yes, airSlate SignNow offers multiple pricing plans that allow you to create CPA accredited investor letters. Our plans are designed to be cost-effective, enabling you to choose the option that best fits your needs, whether you're a startup or an established firm.

-

Can I integrate airSlate SignNow with other tools to manage CPA accredited investor letters?

Absolutely! airSlate SignNow offers seamless integrations with popular business tools such as CRM systems, cloud storage services, and productivity apps. This allows you to manage your CPA accredited investor letters efficiently alongside your other documents and workflows.

-

How secure is my CPA accredited investor letter when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you create and store your CPA accredited investor letters on our platform, you benefit from industry-leading encryption protocols and secure data storage. This ensures that your sensitive information is protected from unauthorized access.

-

How long does it take to get a CPA accredited investor letter signed?

With airSlate SignNow, getting your CPA accredited investor letter signed is quick and efficient. The eSigning process can typically be completed within minutes, depending on the availability of your signers, allowing you to expedite your investment opportunities.

Get more for ACCREDITED INVESTOR REPRESENTATION LETTER

Find out other ACCREDITED INVESTOR REPRESENTATION LETTER

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy