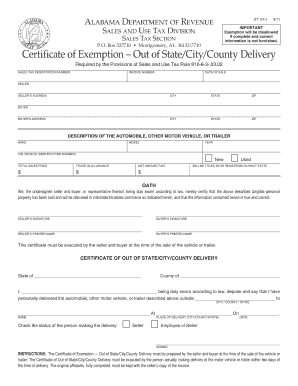

Certificate of Exemption Out of StateCityCounty Delivery Revenue Alabama Form

What is the Alabama exemption certificate?

The Alabama exemption certificate is a document that allows certain buyers to make tax-exempt purchases in the state of Alabama. This certificate is primarily used by organizations that qualify for tax exemptions, such as non-profit entities, government agencies, and certain educational institutions. By presenting this certificate at the time of purchase, the buyer can avoid paying sales tax on eligible items, which can lead to significant savings for organizations that frequently make purchases for their operations.

How to use the Alabama exemption certificate

Using the Alabama exemption certificate is a straightforward process. First, ensure that your organization qualifies for tax-exempt status under Alabama law. Once confirmed, complete the exemption certificate accurately, providing all necessary details, including the buyer's name, address, and the reason for the exemption. When making a purchase, present the completed certificate to the seller. It is essential to retain a copy for your records, as sellers may require proof of the exemption for their documentation.

Steps to complete the Alabama exemption certificate

Completing the Alabama exemption certificate involves several key steps:

- Gather necessary information: Collect your organization’s details, including name, address, and tax identification number.

- Fill out the certificate: Accurately complete all fields on the exemption certificate, ensuring that the information is correct and up-to-date.

- Specify the reason for exemption: Clearly state the reason for your tax-exempt status, such as being a non-profit organization or a government entity.

- Sign and date: Ensure that an authorized representative of your organization signs and dates the certificate.

- Keep a copy: Retain a copy of the completed certificate for your records and provide the original to the seller at the time of purchase.

Eligibility criteria for the Alabama exemption certificate

To be eligible for the Alabama exemption certificate, an organization must meet specific criteria set forth by the state. Generally, eligible entities include:

- Non-profit organizations: Entities that operate for charitable, educational, or religious purposes.

- Government agencies: Federal, state, and local government entities that require tax exemption for their purchases.

- Educational institutions: Schools and universities recognized by the state that qualify for tax-exempt status.

It is crucial for organizations to verify their eligibility before applying for and using the exemption certificate to ensure compliance with state regulations.

Legal use of the Alabama exemption certificate

The legal use of the Alabama exemption certificate is governed by Alabama state law. Organizations must ensure that they are using the certificate in accordance with the law to avoid potential penalties. Misuse of the exemption certificate, such as using it for personal purchases or for items that do not qualify for exemption, can lead to legal repercussions, including fines and back taxes owed. It is advisable for organizations to regularly review their tax-exempt status and the applicable laws to maintain compliance.

Quick guide on how to complete certificate of exemption out of statecitycounty delivery revenue alabama

Finish Certificate Of Exemption Out Of StateCityCounty Delivery Revenue Alabama seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents quickly and without complications. Handle Certificate Of Exemption Out Of StateCityCounty Delivery Revenue Alabama on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to change and eSign Certificate Of Exemption Out Of StateCityCounty Delivery Revenue Alabama without any hassle

- Find Certificate Of Exemption Out Of StateCityCounty Delivery Revenue Alabama and select Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as an ordinary wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Alter and eSign Certificate Of Exemption Out Of StateCityCounty Delivery Revenue Alabama and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of exemption out of statecitycounty delivery revenue alabama

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Alabama exemption certificate?

An Alabama exemption certificate is a document issued by the state that allows businesses to purchase goods or services without paying sales tax. This certificate is essential for qualifying organizations to ensure they comply with local tax laws while saving on costs.

-

How can airSlate SignNow help me manage my Alabama exemption certificate?

airSlate SignNow provides a streamlined solution for managing and eSigning documents, including your Alabama exemption certificate. With our user-friendly platform, you can securely store, access, and share your exemption certificate with relevant parties efficiently.

-

Is there a cost associated with using airSlate SignNow for the Alabama exemption certificate?

airSlate SignNow offers a cost-effective pricing structure that ensures businesses can access essential document management tools, including the handling of Alabama exemption certificates. Our plans are designed to fit various budgets without compromising on quality and features.

-

What features does airSlate SignNow offer for managing Alabama exemption certificates?

Our platform includes features like secure eSigning, template creation, and document tracking, all crucial for managing your Alabama exemption certificate efficiently. These tools help ensure that your exemptions are processed swiftly, saving you time and reducing administrative burden.

-

Can I integrate airSlate SignNow with other applications to manage my Alabama exemption certificate?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage Alabama exemption certificates efficiently. This ensures that your certificate management process is synchronized with your existing workflows for a smoother experience.

-

What are the benefits of using airSlate SignNow for my Alabama exemption certificate?

Using airSlate SignNow for your Alabama exemption certificate provides numerous benefits, including increased efficiency, cost savings, and improved compliance. Our solution simplifies the process of eSigning and managing documents, allowing you to focus more on your core business activities.

-

How secure is airSlate SignNow for handling Alabama exemption certificates?

Security is a top priority at airSlate SignNow. We implement advanced encryption and robust security protocols to ensure that your Alabama exemption certificate and all related documents are protected against unauthorized access and bsignNowes.

Get more for Certificate Of Exemption Out Of StateCityCounty Delivery Revenue Alabama

- Closing statement form 481373162

- North carolina criminal summons failure to return rental property with written purchase option form

- North carolina consent agreement and order to modify child support order form

- North carolina judgment for absolute divorce before the clerk form

- North carolina small estate affidavit for collection of personal property of decedent intestate testate form

- North carolina notices resolutions simple stock ledger and certificate form

- Lead disclosure form

- Change name minor form

Find out other Certificate Of Exemption Out Of StateCityCounty Delivery Revenue Alabama

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure