A 1 Comp Sales Comparable Sales Analysis Form

What is the A 1 Comp Sales Comparable Sales Analysis Form

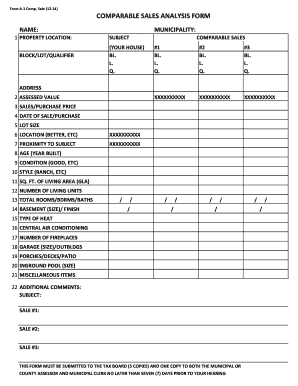

The A 1 Comp Sales Comparable Sales Analysis Form is a specialized document used primarily in real estate transactions. This form assists in evaluating property values by comparing similar properties that have recently sold in the same area. It provides a structured approach for real estate professionals and appraisers to analyze market trends and establish fair market value based on comparable sales. The form typically includes sections for property details, sale prices of comparable properties, and adjustments based on differences in features and conditions.

How to use the A 1 Comp Sales Comparable Sales Analysis Form

Using the A 1 Comp Sales Comparable Sales Analysis Form involves several key steps. First, gather data on recently sold properties that are similar to the subject property. This data should include sale prices, property characteristics, and any relevant market conditions. Next, fill out the form by entering the details of the subject property and the comparable sales. Make adjustments for differences in features, such as square footage, number of bedrooms, and property condition. Finally, analyze the adjusted values to arrive at a fair market value for the property in question.

Steps to complete the A 1 Comp Sales Comparable Sales Analysis Form

Completing the A 1 Comp Sales Comparable Sales Analysis Form requires a systematic approach:

- Identify the subject property and gather its details, including location, size, and unique features.

- Research comparable sales in the area, focusing on properties that share similar characteristics and have sold recently.

- Input the data for the subject property and each comparable sale into the form.

- Make necessary adjustments to the sale prices of the comparable properties based on differences in features and market conditions.

- Calculate the adjusted values and summarize your findings to determine the fair market value.

Legal use of the A 1 Comp Sales Comparable Sales Analysis Form

The A 1 Comp Sales Comparable Sales Analysis Form is legally recognized when completed accurately and in compliance with local real estate regulations. It is essential to ensure that all information is truthful and substantiated by data. This form may be used in various legal contexts, such as property appraisals, disputes, or negotiations. To maintain its legal standing, it is advisable to keep records of all data sources used in the analysis and to ensure that the form is signed by the relevant parties when necessary.

Key elements of the A 1 Comp Sales Comparable Sales Analysis Form

Key elements of the A 1 Comp Sales Comparable Sales Analysis Form include:

- Property Information: Details about the subject property, including address, size, and features.

- Comparable Sales Data: Information on similar properties that have sold, including sale prices and dates.

- Adjustments: A section for making adjustments to the sale prices based on differences between the subject property and comparables.

- Final Valuation: A summary section that provides the estimated fair market value based on the analysis.

Examples of using the A 1 Comp Sales Comparable Sales Analysis Form

Examples of using the A 1 Comp Sales Comparable Sales Analysis Form can be found in various real estate scenarios. For instance, a real estate agent may use the form to help a seller set an appropriate listing price by analyzing recent sales of similar homes in the neighborhood. Alternatively, a buyer may request a comparable sales analysis to ensure they are making a fair offer on a property. In both cases, the form serves as a valuable tool for informed decision-making in real estate transactions.

Quick guide on how to complete a 1 comp sales comparable sales analysis form

Easily Prepare A 1 Comp Sales Comparable Sales Analysis Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Manage A 1 Comp Sales Comparable Sales Analysis Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

Easily Modify and Electronically Sign A 1 Comp Sales Comparable Sales Analysis Form

- Locate A 1 Comp Sales Comparable Sales Analysis Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to submit your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign A 1 Comp Sales Comparable Sales Analysis Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a 1 comp sales comparable sales analysis form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the A 1 Comp Sales Comparable Sales Analysis Form?

The A 1 Comp Sales Comparable Sales Analysis Form is a robust tool designed to assist professionals in evaluating property values through a comprehensive analysis of comparable sales. It simplifies the process of gathering and assessing data, making it essential for real estate agents and appraisers. With this form, you can streamline your valuation efforts and enhance your decision-making.

-

How does airSlate SignNow facilitate the completion of the A 1 Comp Sales Comparable Sales Analysis Form?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out, send, and eSign the A 1 Comp Sales Comparable Sales Analysis Form. The platform’s intuitive interface ensures that even users with minimal technical knowledge can complete forms efficiently. This streamlining enhances productivity and reduces the time spent on paperwork.

-

What are the pricing options for using the A 1 Comp Sales Comparable Sales Analysis Form with airSlate SignNow?

airSlate SignNow provides various pricing tiers to accommodate different business needs when using the A 1 Comp Sales Comparable Sales Analysis Form. The pricing is competitive and provides access to essential features without breaking the bank. You can choose a plan that best suits your volume of transactions and level of required functionalities.

-

What features does airSlate SignNow offer for the A 1 Comp Sales Comparable Sales Analysis Form?

Key features of airSlate SignNow for the A 1 Comp Sales Comparable Sales Analysis Form include eSignature capabilities, document templates, and automated workflows. These tools enhance your document management experience, allowing you to easily collaborate with clients and stakeholders. The platform also provides secure storage and access, ensuring your data remains protected.

-

How can the A 1 Comp Sales Comparable Sales Analysis Form benefit my business?

Utilizing the A 1 Comp Sales Comparable Sales Analysis Form can greatly benefit your business by improving efficiency and accuracy in property valuation. This form allows for systematic data analysis, leading to better-informed decisions and faster transaction times. The ease of use also helps in enhancing customer satisfaction through timely document processing.

-

Can the A 1 Comp Sales Comparable Sales Analysis Form be integrated with other software?

Yes, airSlate SignNow allows for seamless integration with various software solutions, including CRMs and property management systems, while utilizing the A 1 Comp Sales Comparable Sales Analysis Form. This interconnectivity optimizes your workflow by enabling data exchange between platforms. As a result, you can enhance your overall business processes and maintain consistency in your data usage.

-

Is training required to use the A 1 Comp Sales Comparable Sales Analysis Form in airSlate SignNow?

No extensive training is required to use the A 1 Comp Sales Comparable Sales Analysis Form within airSlate SignNow, thanks to its intuitive design. Users can quickly learn how to navigate the platform and utilize its features effectively. Comprehensive support documentation and customer service are also available to help you get started.

Get more for A 1 Comp Sales Comparable Sales Analysis Form

- Nc inventory form

- Maintenance repair request form

- Nc lease form

- Nc cancellation contract form

- North carolina amendment of residential lease form

- Notice beneficiaries will form

- North dakota letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by form

- North dakota notice of lease for recording form

Find out other A 1 Comp Sales Comparable Sales Analysis Form

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF