Form 1023 EZ Streamlined Reinstatement Instructions National PTA Pta

What is the Form 1023 EZ Streamlined Reinstatement?

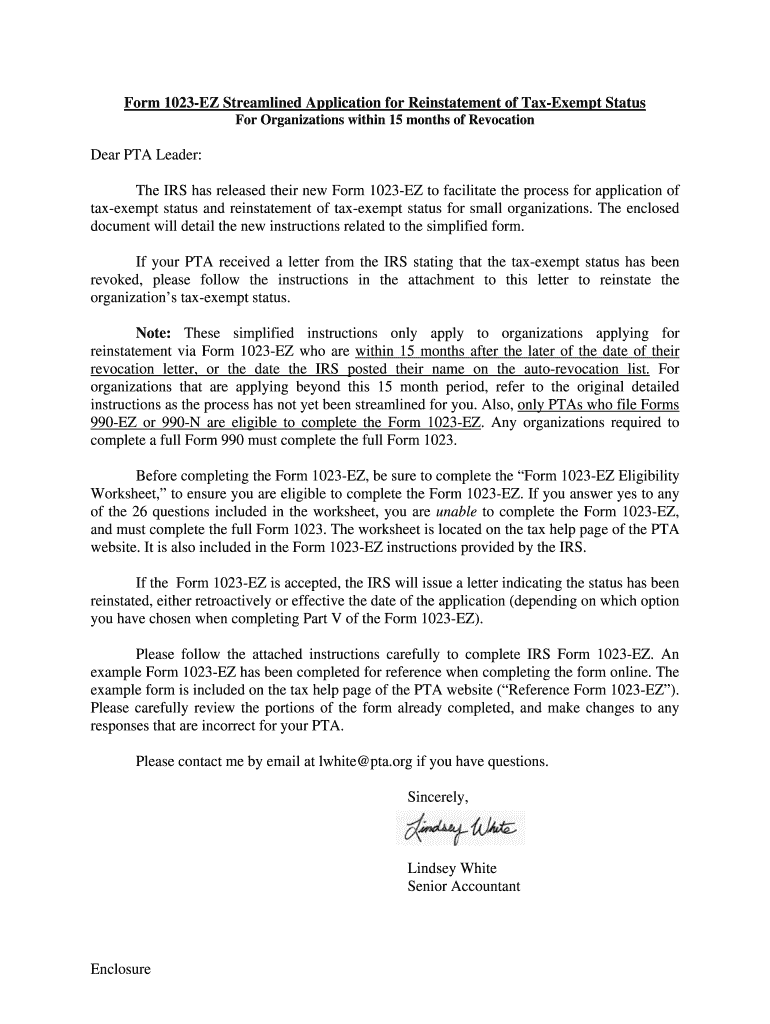

The Form 1023 EZ Streamlined Reinstatement is a simplified application process for organizations seeking to regain their tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is specifically designed for smaller organizations that meet certain eligibility criteria, allowing them to apply for reinstatement in a more efficient manner. The streamlined process is beneficial for organizations that have had their tax-exempt status revoked due to failure to file required annual returns for three consecutive years.

Steps to Complete the Form 1023 EZ Streamlined Reinstatement

Completing the Form 1023 EZ Streamlined Reinstatement involves several important steps. First, ensure that your organization qualifies for the streamlined process by meeting the eligibility criteria. Next, gather the required information, including the organization’s mission statement, a description of its activities, and financial data. Fill out the form accurately, paying attention to each section to avoid errors. Finally, submit the completed form along with any required attachments, ensuring that all documents are current and relevant.

Required Documents for Form 1023 EZ Streamlined Reinstatement

When applying for reinstatement using the Form 1023 EZ, specific documents are necessary to support your application. These typically include:

- A copy of the organization’s governing documents, such as bylaws or articles of incorporation.

- Financial statements for the past three years, if applicable.

- A detailed description of the organization’s activities and programs.

- Any correspondence from the IRS regarding the revocation of tax-exempt status.

Ensuring that all required documents are included will facilitate a smoother review process by the IRS.

Legal Use of the Form 1023 EZ Streamlined Reinstatement

The Form 1023 EZ Streamlined Reinstatement is legally recognized by the IRS as a valid means for organizations to regain their tax-exempt status. It is essential to complete the form accurately and submit it within the designated time frame to comply with IRS regulations. Failure to adhere to these guidelines may result in further complications or delays in reinstatement.

IRS Guidelines for Form 1023 EZ Streamlined Reinstatement

The IRS provides specific guidelines for completing the Form 1023 EZ Streamlined Reinstatement. Organizations must ensure that they are eligible for the streamlined process, which is generally limited to those with gross receipts of less than $50,000 in the past three years. Additionally, organizations must not have assets exceeding $250,000. Familiarizing yourself with these guidelines is crucial for a successful application.

Filing Deadlines for Form 1023 EZ Streamlined Reinstatement

Timely submission of the Form 1023 EZ is critical for organizations seeking reinstatement. The IRS allows organizations to apply for reinstatement within fifteen months of the revocation date. If the application is submitted within this timeframe, the organization may be granted retroactive reinstatement, restoring its tax-exempt status to the date of revocation. It is important to keep track of filing deadlines to avoid losing eligibility.

Quick guide on how to complete form 1023 ez streamlined reinstatement instructions national pta pta

Discover the simplest method to complete and endorse your Form 1023 EZ Streamlined Reinstatement Instructions National PTA Pta

Are you still spending time creating your official documents on paper instead of doing it online? airSlate SignNow offers a superior approach to fill out and endorse your Form 1023 EZ Streamlined Reinstatement Instructions National PTA Pta and other forms for public services. Our advanced electronic signature solution provides you with all the tools necessary to handle documents swiftly and in compliance with formal regulations - robust PDF editing, management, protection, signing, and sharing capabilities are all available within an easy-to-use interface.

Only a few steps are required to fill out and endorse your Form 1023 EZ Streamlined Reinstatement Instructions National PTA Pta:

- Upload the editable template to the editor using the Get Form key.

- Verify what information you need to include in your Form 1023 EZ Streamlined Reinstatement Instructions National PTA Pta.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Cover fields that are no longer relevant.

- Select Sign to generate a legally binding electronic signature using any method you prefer.

- Insert the Date alongside your signature and complete your task with the Done button.

Store your finalized Form 1023 EZ Streamlined Reinstatement Instructions National PTA Pta in the Documents section of your profile, download it, or export it to your chosen cloud storage. Our service also provides flexible file sharing options. There is no need to print your forms when you need to submit them to the appropriate public office - you can send them via email, fax, or request a USPS “snail mail” delivery directly from your account. Experience it today!

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1023 ez streamlined reinstatement instructions national pta pta

How to create an eSignature for your Form 1023 Ez Streamlined Reinstatement Instructions National Pta Pta online

How to generate an eSignature for your Form 1023 Ez Streamlined Reinstatement Instructions National Pta Pta in Chrome

How to generate an eSignature for signing the Form 1023 Ez Streamlined Reinstatement Instructions National Pta Pta in Gmail

How to make an eSignature for the Form 1023 Ez Streamlined Reinstatement Instructions National Pta Pta from your mobile device

How to generate an eSignature for the Form 1023 Ez Streamlined Reinstatement Instructions National Pta Pta on iOS devices

How to make an eSignature for the Form 1023 Ez Streamlined Reinstatement Instructions National Pta Pta on Android OS

People also ask

-

What is a sample completed 1023 ez form?

A sample completed 1023 ez form is a simplified version of the IRS Form 1023, used by small charities to apply for tax-exempt status. It provides an example of how to fill out the form accurately, helping organizations understand required sections and documentation.

-

How can airSlate SignNow help with preparing a sample completed 1023 ez form?

airSlate SignNow simplifies the process of preparing a sample completed 1023 ez form by allowing users to easily fill out, edit, and sign documents digitally. This streamlines collaboration and ensures that all necessary information is captured correctly.

-

Is there a cost associated with using airSlate SignNow for the 1023 ez form?

Yes, while airSlate SignNow offers a free trial, there are subscription plans designed to fit various business needs. Each plan provides access to advanced features that can be especially beneficial when managing a sample completed 1023 ez form.

-

What features does airSlate SignNow offer for managing the sample completed 1023 ez form?

airSlate SignNow offers robust features like document sharing, eSigning, and template creation that can enhance how you manage a sample completed 1023 ez form. These tools ensure that the form is completed accurately and allows for easy updates when necessary.

-

Can I integrate airSlate SignNow with other applications for better document management?

Absolutely! airSlate SignNow offers integrations with various applications, including CRMs and cloud storage services. This allows users to access, sign, and store their sample completed 1023 ez forms seamlessly across different platforms.

-

What are the benefits of using airSlate SignNow for the 1023 ez form?

Using airSlate SignNow provides numerous benefits, including time-saving efficiencies, secure document handling, and a user-friendly interface. These advantages make it easier to prepare and submit a complete sample completed 1023 ez form without unnecessary delays.

-

How do I ensure my sample completed 1023 ez form is compliant with IRS regulations?

To ensure compliance, it's essential to refer to the IRS instructions while filling out the sample completed 1023 ez form. Using airSlate SignNow helps by keeping your documents organized and allowing for easy access to the latest legal guidelines.

Get more for Form 1023 EZ Streamlined Reinstatement Instructions National PTA Pta

- Corrective deed nj form

- Cbrf medication administration training form

- Sermon evaluation form 448385624

- Cic forms

- Delta sigma theta interview point system form

- State of colorado birth certificate worksheet form

- County of hanover virginia application for high mileage discount tax form

- Form 14234 rev 8 compliance assurance process cap application

Find out other Form 1023 EZ Streamlined Reinstatement Instructions National PTA Pta

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast