County of Hanover, Virginia Application for High Mileage Discount Tax 2024

Understanding the Hanover County High Mileage Discount Tax Application

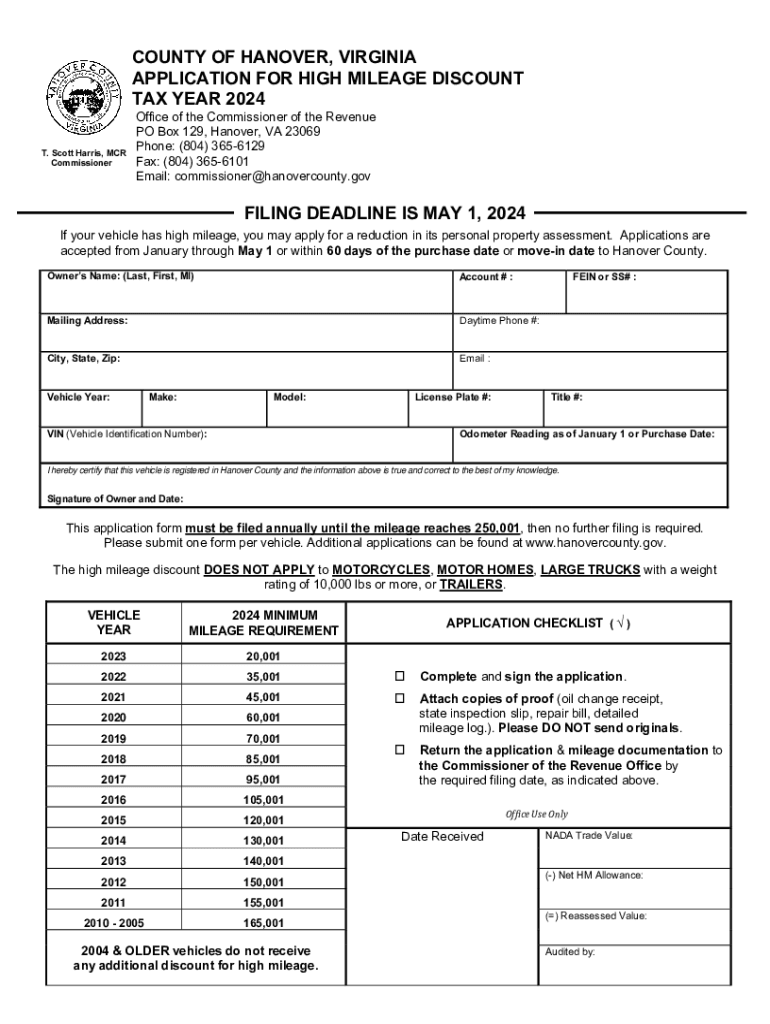

The Hanover County High Mileage Discount Tax application is designed for residents who own vehicles with high mileage. This application allows taxpayers to apply for a discount on their vehicle tax based on the mileage reported. In Hanover County, the high mileage discount is determined using the NADA high mileage tables, which provide a standardized method for assessing vehicle value based on mileage. Understanding this application is crucial for residents seeking to reduce their tax burden.

Steps to Complete the Hanover County High Mileage Discount Tax Application

Completing the Hanover County High Mileage Discount Tax application involves several key steps:

- Gather necessary documentation, including proof of mileage, vehicle registration, and any previous tax assessments.

- Obtain the application form from the Hanover County website or local tax office.

- Fill out the application form accurately, ensuring that all information is complete and correct.

- Submit the application by the designated deadline, either online, by mail, or in person at the local tax office.

Following these steps carefully can help ensure that your application is processed smoothly and efficiently.

Eligibility Criteria for the Hanover County High Mileage Discount Tax

To qualify for the Hanover County High Mileage Discount Tax, applicants must meet specific eligibility criteria. These criteria typically include:

- Ownership of a vehicle that has been registered in Hanover County.

- Submission of the application form within the specified timeframe.

- Provision of accurate mileage documentation that meets the standards set by the county.

It is essential for applicants to review these criteria thoroughly to ensure they qualify for the discount.

Required Documents for the Hanover County High Mileage Discount Tax Application

When applying for the Hanover County High Mileage Discount Tax, certain documents are required to support your application. These documents may include:

- Proof of vehicle ownership, such as a title or registration.

- Documentation of mileage, which can include odometer readings or service records.

- A completed application form, ensuring all sections are filled out accurately.

Having these documents ready can expedite the application process and help avoid delays.

Form Submission Methods for the Hanover County High Mileage Discount Tax

The Hanover County High Mileage Discount Tax application can be submitted through various methods to accommodate different preferences. The submission options include:

- Online submission via the Hanover County tax office website.

- Mailing the completed application to the designated tax office address.

- In-person submission at the local tax office during business hours.

Choosing the most convenient method for submission can help ensure that your application is received on time.

Important Filing Deadlines for the Hanover County High Mileage Discount Tax

To successfully apply for the Hanover County High Mileage Discount Tax, it is vital to be aware of important filing deadlines. Typically, applications must be submitted by a specific date each year, which is often aligned with the local tax assessment schedule. Missing these deadlines can result in the inability to receive the discount for that tax year. It is advisable to check with the Hanover County tax office for the exact dates and any updates to the filing schedule.

Create this form in 5 minutes or less

Find and fill out the correct county of hanover virginia application for high mileage discount tax

Create this form in 5 minutes!

How to create an eSignature for the county of hanover virginia application for high mileage discount tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hanover County high mileage form?

The Hanover County high mileage form is a document used to report high mileage expenses for reimbursement or tax purposes. It simplifies the process of tracking and submitting mileage claims, ensuring accuracy and compliance with local regulations.

-

How can airSlate SignNow help with the Hanover County high mileage form?

airSlate SignNow streamlines the process of completing and signing the Hanover County high mileage form. With our easy-to-use platform, you can fill out the form digitally, eSign it, and send it directly to the relevant authorities, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the Hanover County high mileage form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and provide access to features that simplify the completion of the Hanover County high mileage form and other documents.

-

What features does airSlate SignNow offer for the Hanover County high mileage form?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking. These features enhance the efficiency of managing the Hanover County high mileage form, making it easier to submit and monitor your mileage claims.

-

Can I integrate airSlate SignNow with other applications for the Hanover County high mileage form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your workflow for the Hanover County high mileage form with tools you already use. This integration enhances productivity and ensures a smooth document management process.

-

What are the benefits of using airSlate SignNow for the Hanover County high mileage form?

Using airSlate SignNow for the Hanover County high mileage form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our platform ensures that your mileage claims are processed quickly and securely, giving you peace of mind.

-

Is it easy to use airSlate SignNow for the Hanover County high mileage form?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users to easily navigate through the process of completing and signing the Hanover County high mileage form, making it accessible for everyone.

Get more for County Of Hanover, Virginia Application For High Mileage Discount Tax

- Gas safety certificate template form

- Certification regarding lobbying fillable form

- Abc data sheets pdf form

- Sehteq reimbursement form

- Bible college application form pdf

- Fan cart physics gizmo answer key activity b form

- Agriculture class 10 worksheet form

- Membership proposal form wenatchee rotary club po box 1723

Find out other County Of Hanover, Virginia Application For High Mileage Discount Tax

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form